As filed with the Securities and Exchange Commission on November 1, 2021.

Registration Statement No. 333-259358

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________

Amendment No. 3

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________________

HEARTBEAM, INC.

(Exact name of Registrant as specified in its charter)

__________________________

|

Delaware |

541714 |

47-4881450 |

||||||

|

(State or other jurisdiction of |

(Primary Standard Industrial |

(I.R.S. Employer |

__________________________

Chief Executive Officer

2118 Walsh Avenue, Suite 210

Santa Clara, CA 95050

Telephone: 408-899-4443

(Address and telephone number of principal executive offices)

__________________________

Corporation Trust Center

1209 Orange Street

Wilmington New Castle County, De 19801

Telephone: (866) 539-8692

(Name, address and telephone number of agent for service)

__________________________

Copies to:

|

Joseph M. Lucosky, Esq. |

Ralph V. De Martino, Esq. Cavas Pavri, Esq. Schiff Hardin LLP 901 K Street NW Suite 700 Washington, DC 20001 Telephone: (202) 778-6400 Facsimile: (202) 778-6460 |

__________________________

Approximate Date of Commencement of Proposed Sale to the Public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|||

|

Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

|||

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act ☐

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered |

Proposed |

Amount of |

|||||

|

Units, each consisting of one Common Stock, par value $.0001 per share, and one Warrant to purchase Common Stock(2) |

$ |

20,556,250 |

$ |

1,905.56 |

|

||

|

Common Stock included as part of the Units(3) |

|

|

(4 |

) |

|||

|

Warrants to purchase Common Stock included as part of the Units(3) |

|

|

(4 |

) |

|||

|

Common Stock issuable upon exercise of the Warrants(3) |

$ |

20,556,250 |

$ |

1,905.56 |

|

||

|

Representative’s warrant(3) |

|

|

|

|

|

||

|

Common stock underlying Representative’s warrant |

$ |

1,438,938 |

|

|

|

||

|

Total |

$ |

42,551,438 |

$ |

3,811.12 |

|

||

____________

(1) Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price of the securities registered hereunder to be sold by the registrant.

(2) Includes Units consisting of Common Stock and Warrants which may be issued on exercise of a 30-day option granted to the Underwriters to cover over-allotments, if any.

(3) Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional securities as may be issuable to prevent dilution resulting from stock splits, stock dividends or similar transactions.

(4) No separate registration fee required pursuant to Rule 457(g) under the Securities Act.

(5) Filing fee has been previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 1, 2021

PRELIMINARY PROSPECTUS

HeartBeam, Inc.

2,750,000 Units

This is an initial public offering of units of securities (the “Units) of HeartBeam, Inc (the “Company” or “HeartBeam”). Each Unit consists of (a) one share of our Common Stock (“Common Stock”) and (b) Warrant (the “Warrants”) to purchase one share of our Common Stock at an exercise price equal to $ % of initial public offering price per Unit. The shares of our Common Stock and the Warrants are immediately separable and will be issued separately but will be purchased together in this offering. We anticipate that the initial public offering price per Unit will be between $5.50 and $6.50 per Unit.

We will not issue fractional shares in connection with the exercise of Warrants. Each warrant will become exercisable upon completion of this offering and will expire five (5) years from the date of issuance.

We have granted The Benchmark Company LLC (“Benchmark”), the lead underwriter of this offering, a 30-day option to purchase up to an additional 412,500 shares of Common Stock and/or Warrants to purchase Common Stock to cover over-allotments, if any.

Prior to this offering, there has been no public market for our Common Stock or Warrants. We have applied to have our Common Stock and Warrants listed on the NASDAQ Capital Market, or NASDAQ, under the symbol “BEAT” and “BEATW”, respectively. The Common Stock and Warrants comprising the Units will begin separate trading immediately upon issuance of the Units.

Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the risks and uncertainties described under the heading “Risk Factors” beginning on page 13 of this prospectus before making a decision to purchase our securities.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

|

Per Unit |

Total |

|||||

|

Public offering price(1) |

$ |

$ |

||||

|

Underwriting discounts and commissions |

$ |

$ |

||||

|

Proceeds to HeartBeam, Inc. before expenses |

$ |

$ |

||||

____________

(1) Consists of $ attributable to the Common Stock and $0.01 attributable to the Warrant included in the Unit.

The Company has granted a 30-day option to the representative of the underwriters to purchase up to an additional 412,500 shares of Common Stock and/or Warrants to purchase Common Stock to cover over-allotments, if any.

For a description of the other compensation to be received by the underwriters, please see “Underwriting” beginning on page 77.

The underwriters expect to deliver the Units to purchasers in the offering on or about , 2021.

Book-Running Manager

THE BENCHMARK COMPANY

The date of this prospectus is , 2021.

ABOUT THIS PROSPECTUS

In this prospectus, unless the context suggests otherwise, references to “the Company,” “HeartBeam”, “we,” “us,” and “our” refer to HeartBeam, Inc.

This prospectus describes the specific details regarding this offering, the terms and conditions of the Units being offered hereby and the risks of investing in the Company’s Units. You should read this prospectus and the additional information about the Company described in the section entitled “Where You Can Find More Information” before making your investment decision.

Neither the Company, nor any of its officers, directors, agents, representatives or underwriters, make any representation to you about the legality of an investment in the Company’s Units. You should not interpret the contents of this prospectus to be legal, business, investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before investing in the Company’s securities.

ADDITIONAL INFORMATION

You should rely only on the information contained in this prospectus and in any accompanying prospectus supplement. No one has been authorized to provide you with different or additional information. The shares of Units are not being offered in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front of such documents.

TRADEMARKS AND TRADE NAMES

This prospectus includes trademarks that are protected under applicable intellectual property laws and are the Company’s property. This prospectus also contains trademarks, service marks, trade names and/or copyrights of other companies, which are the property of its owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that the Company will not assert, to the fullest extent under applicable law, its rights or the right of the applicable licensor to these trademarks and trade names.

INDUSTRY AND MARKET DATA

Unless otherwise indicated, information contained in this prospectus concerning the Company’s industry and the markets in which it operates, including market position and market opportunity, is based on information from management’s estimates, as well as from industry publications and research, surveys and studies conducted by third parties. The third-party sources from which the Company has obtained information generally state that the information contained therein has been obtained from sources believed to be reliable, but the Company cannot assure you that this information is accurate or complete. The Company has not independently verified any of the data from third-party sources nor has it verified the underlying economic assumptions relied upon by those third parties. Similarly, internal company surveys, industry forecasts and market research, which the Company believes to be reliable, based upon management’s knowledge of the industry, have not been verified by any independent sources. The Company’s internal surveys are based on data it has collected over the past several years, which it believes to be reliable. Management estimates are derived from publicly available information, its knowledge of the industry, and assumptions based on such information and knowledge, which management believes to be reasonable and appropriate. However, assumptions and estimates of the Company’s future performance, and the future performance of its industry, are subject to numerous known and unknown risks and uncertainties, including those described under the heading “Risk Factors” in this prospectus and those described elsewhere in this prospectus, and the other documents the Company files with the Securities and Exchange Commission, or SEC, from time to time. These and other important factors could result in its estimates and assumptions being materially different from future results. You should read the information contained in this prospectus completely and with the understanding that future results may be materially different and worse from what the Company expects. See the information included under the heading “Forward-Looking Statements.”

i

The following summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you. You should read this entire prospectus carefully, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Company’s historical financial statements and related notes included elsewhere in this prospectus. In this prospectus, unless otherwise noted, the terms “the Company,” “HeartBeam” “we,” “us,” and “our” refer to HeartBeam, Inc.

Overview

Company Overview

We are a medical technology company primarily focusing on telemedicine solutions that enable the detection and monitoring of cardiac disease outside a healthcare facility setting. Our aim is to deliver innovative, remote diagnostic and monitoring technologies that can be used for patients anywhere, with initial offerings for ambulatory and emergency room use. Our products require FDA clearance and have not been cleared for marketing (hereinafter “Product” or “Products”.) We believe our Products and services will benefit many stakeholders, including patients, healthcare providers, and healthcare payors. Our initial focus is providing diagnostic data to help physicians with care management of patients with cardiovascular disease. There are two major markets for our initial Products: remote patient monitoring and the hospital Emergency Room (ER). First, we are developing our telehealth Product to address the rapidly growing field of remote patient monitoring. Our telehealth Product is comprised of a credit card sized ECG machine and a powerful cloud-based diagnostic software expert system. We believe that we are uniquely positioned to play a central role in remote monitoring of high-risk coronary artery disease patients, because the studies performed so far have shown that our ischemia detection system is highly accurate. Our powerful ischemia detection system is unlike other ambulatory cardiac monitors currently on the market which focus on arrhythmia detection. Secondly, we are applying our platform technology to create a software tool for detecting heart attacks in the ER environment. This software tool is designed to enable emergency physicians to more accurately and quickly diagnose heart attacks than currently available. Market release of this Product will precede that of the telehealth Product.

To date, we have developed working prototypes for both our telehealth Product and our ER Product. The ER Product is currently undergoing additional engineering work that we believe will make it ready for FDA 510(k) clearance submission. Both Products have been validated in three medical studies, which were designed by Harvard Medical School faculty. Peer reviewed publications that describe the studies and results are in preparation. One peer reviewed medical publication submission is planned for November 2021 and another for January 2022. These two publications will describe results of our two key studies: HIDES and B Score. In early 2022 we plan to publish results of a study on performance of our ER Product in the real-life environment of an ER. In July 2021 we submitted a technology abstract for presentation at the IEEE EMBS 2021 Conference; it was accepted. The abstract describes the technology foundation of our ER Product

The custom software and hardware of our Products, we believe, are classified as Class II medical devices by the FDA. Class II medical devices are those for which general controls alone are insufficient to provide reasonable assurance of safety and effectiveness and there is sufficient information to establish special controls. Special controls can include performance standards, post-market surveillance, patient histories and FDA guidance documents. Premarket review and clearance by the FDA for these devices is generally accomplished through the 510(k) or 510(k) de-novo premarket notification process.

HeartBeam has three issued U.S. patents, seven pending U.S. patent applications (two pending provisional applications and five are utility applications). Two of the pending utility applications have been published, all of the remaining five pending cases are unpublished.

Market Overview

Chronic diseases are the number one burden on the healthcare system, driving up costs each year, and cardiovascular illnesses are one of the top contributors. Regulators, payors and providers are focused on shifting the diagnosis and management of these conditions to drive better outcomes at lower cost. Connected medical solutions are expanding rapidly and are projected to reach $155 billion by 2026, a compound annual growth rate (CAGR) of 17%. These solutions are socio-technical models for healthcare management and delivery using technology to provide healthcare services remotely and aim to maximize healthcare resources and provide increased, flexible opportunities for consumers to engage with clinicians and better self-manage their care, using readily available consumer technologies

1

to deliver patient care outside of the hospital or doctor’s office. The types of companies that make up this market include Accenture, IBM, SAP, GE Healthcare, Oracle, Microsoft, Airstrip Technology, Medtronic, Allscripts, Boston Scientific, Athenahealth, Cerner, Philips, Agamatrix, Qualcomm, and AliveCor.

The market for remote patient monitoring (RPM), is projected to reach $31.3 billion by 2023. In 2019, 1,800 hospitals in the US were using mobile applications to improve risk management and quality of care. The number in 2020 was likely larger as the onset of the COVID-19 pandemic greatly accelerated use and acceptance of telehealth by both patients and healthcare providers.

Cardiovascular disease is the number one cost to the healthcare system and is estimated to be responsible for 1 in every 6 healthcare dollars spent in the US. As cardiovascular disease is the leading cause of death worldwide, early detection, diagnosis, and management of chronic cardiac conditions are necessary to relieve the increasing burden on the healthcare infrastructure. Diagnostic tests such as Electrocardiograms (ECGs) are used to detect, diagnose and track numerous cardiovascular conditions. With advances in mobile communications, diagnostic monitoring of cardiac conditions is increasingly occurring outside the hospital.

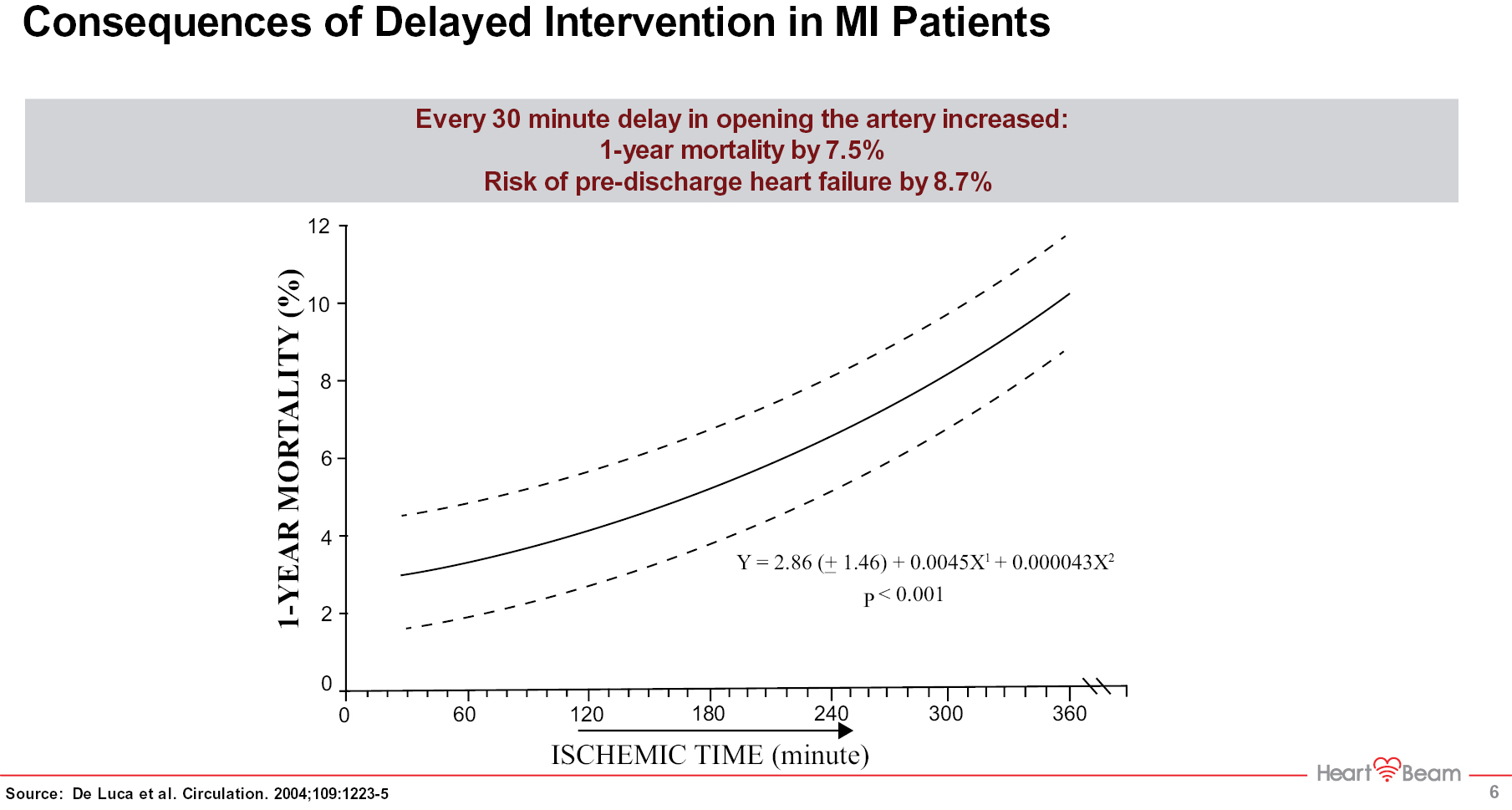

Our initial telemedicine technology Product will address the heart attack detection market as well as the market to monitor coronary artery disease (CAD) patients who are typically at high risk for a heart attack. Currently there are no products on the market that are user friendly, easy to carry, and always with the patient in order to provide physicians and patients with timely and highly accurate information about potential Acute Coronary Syndrome (ACS) and Myocardial Infarction (MI) events. A tool that is always with the patient, that decreases time to intervention, and that decreases the number of unnecessary ER visits by chest pain patients would have a significant effect on saving lives and healthcare dollars. We believe our technology will address this problem and will provide a convenient, cost-effective, integrated telehealth solution, including software and hardware for physicians and their patients. There are approximately 18 million people in the US who are considered at high risk for a heart attack, including 8 million who already have had prior intervention for MI’s and are therefore considered to be at extreme risk.

In the US, mobile cardiac tests are primarily conducted through outsourced Independent Diagnostic Testing Facilities (IDTFs) or as part of a Remote Patient Monitoring (RPM) system. Reimbursement rates vary depending on the use case and generally are based on the value a technology offers to patients and healthcare providers. Actual reimbursed pricing is set by the Centers for Medicare & Medicaid Services (CMS). Reimbursement rates for private insurers typically provide for similar or better reimbursement rates when compared to those set by the Government for Medicare and Medicaid.

In the ER environment, early and accurate diagnosis of a chest pain patient who is potentially having a heart attack is of immense importance. Guidelines state that every chest pain patient in an ER must receive an ECG within 10 minutes of presentation. The accuracy of these initial ECGs is only approximately 75%. The need for increased ECG accuracy in detecting a heart attack in the ER is well defined, and an improved solution could result in saved lives and healthcare dollars. We are currently developing a version of our ER Product that will meet all requirements for FDA 510(k) clearance submission. We believe this Product will offer a marked increase in the accuracy of heart attack detection in ERs. There are approximately 5,000 ER departments in the US.

Products and Technology

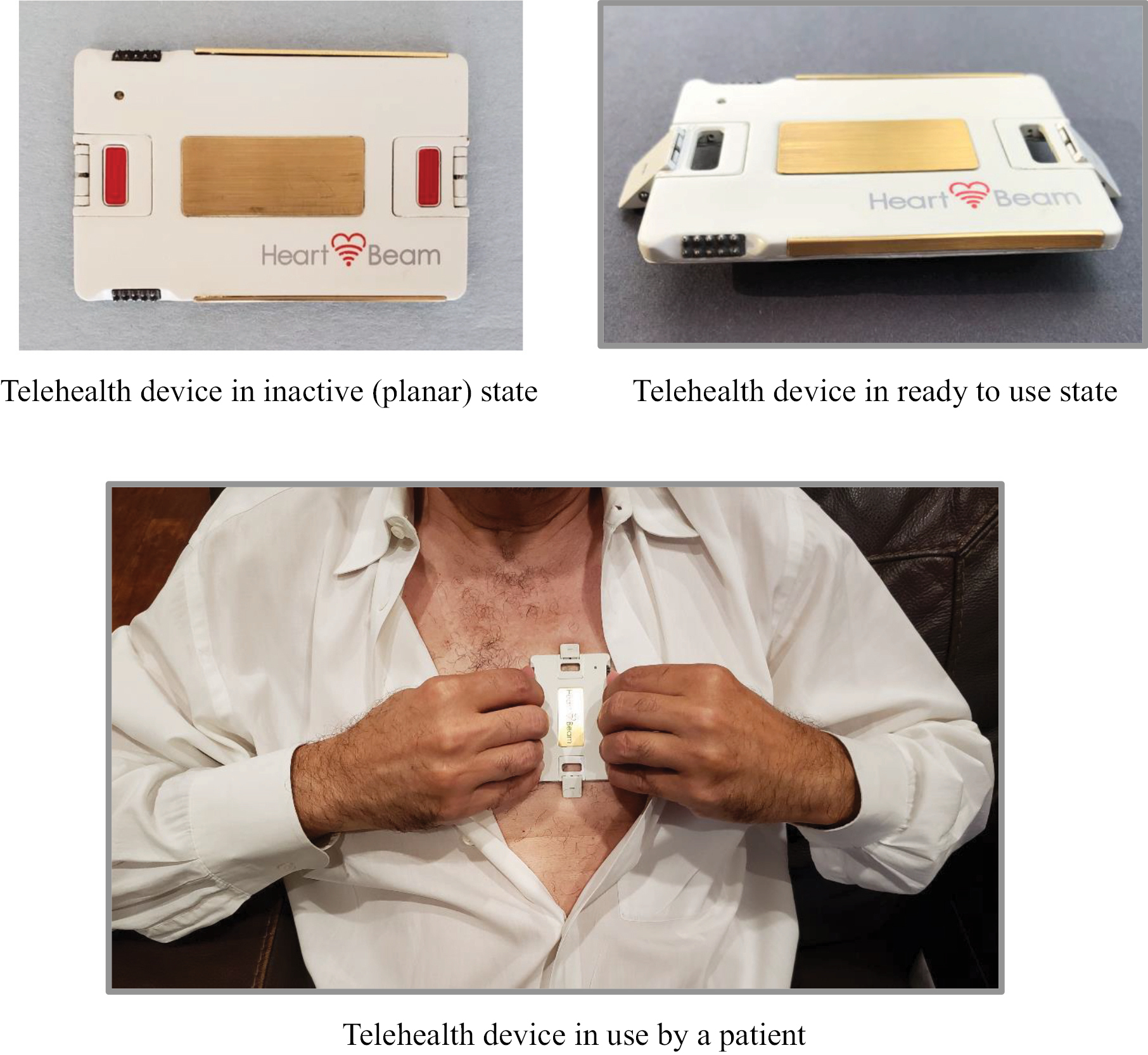

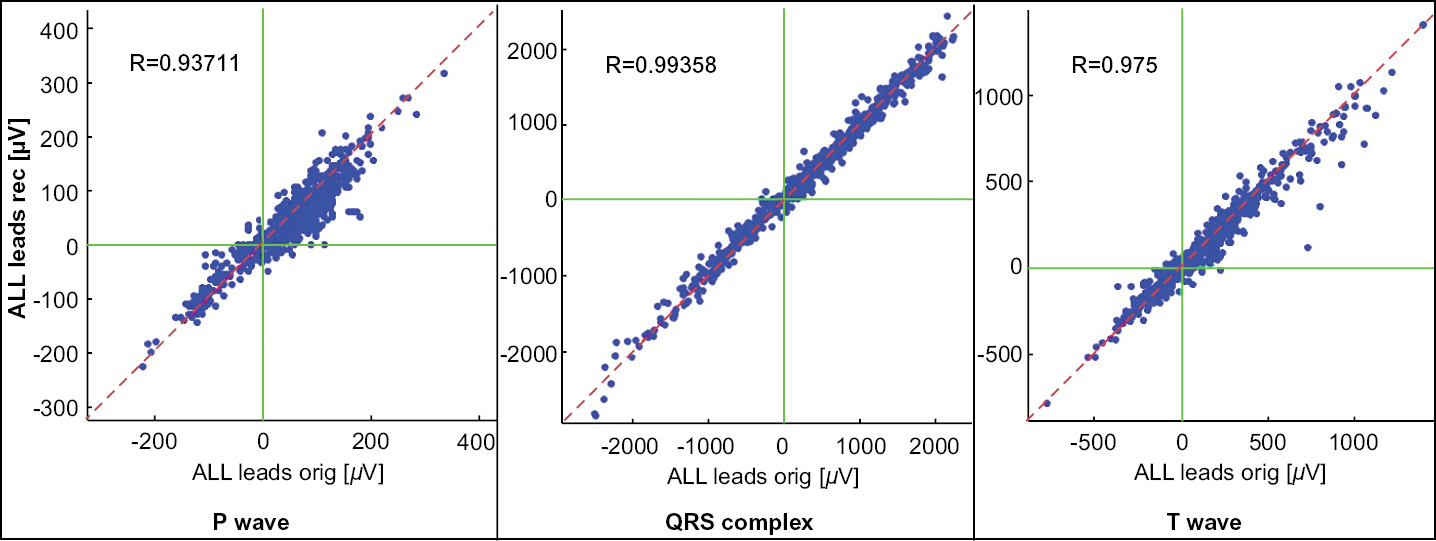

The foundation of our novel technology is the concept of vectorcardiography (VCG), a technology that has long been seen as superior to ECGs in detecting MIs, but is no longer used clinically because of the difficulty experienced by physicians interpreting the output. We solved the crucial problem of recording three orthogonal (x, y and z) projections of the heart vector with a device that is sized like a credit card. The thickness of our credit card sized ECG signal collection device is about 1/8 inch (3 mm) and it weighs about 1 ounce (28 grams). The core technology consists of a series of patented inventions and associated algorithms. In addition to using VCG to get a more complete 3D characterization of cardiac activity, we use the concept of a baseline. Our MI marker is a differential marker that measures the change in cardiac parameters between an asymptomatic (baseline) recording and the symptomatic recording. It is personalized for every patient as every patient has a unique baseline. Our increase in diagnostic performance in detecting MIs, when compared to a panel of cardiologists, is attributed to a richer cardiac information set offered by VCG and the fact that our MI marker compares the baseline and symptomatic recordings and does that in the 3D space of VCG.

2

This novel technology has resulted in two key Products to date: a telehealth Product for high-risk cardiovascular patients and a powerful cloud-based diagnostic expert and MI detection system for ERs.

Our telehealth ECG collection device is the size of a credit card and records cardiac signals with integrated electrodes rather than wires or self-adhesive electrodes. Unlike a standard 12-lead ECG machine that records signals in empirically determined locations on a human body, our approach is focused on recording three projections of the heart vector. The successful recording of the projections of the heart vector enables the synthesis of a 12-lead signal set as well internal algorithmic diagnostic work in the space of 3D heart vectors.

There are obvious ease of use advantages when comparing our handheld device that fits in a wallet and can be instantly self-applied versus the current 12-lead ECG machine that requires a trained professional to apply. In addition, there are diagnostic performance advantages, including, based on our initial study, increased accuracy in diagnosing MIs. The system is used by patients at home or elsewhere, with help from their physicians, to assess whether their chest pain is truly the result of an MI.

Our telehealth system will be a prescription-only mobile health system intended for individuals with known or suspected heart disease, especially coronary artery disease (CAD). It helps guide physicians in choosing the best course of action for their patients who experience chest pain outside of a medical facility. Our system will bring a medical grade ECG to patients and will enable them to receive a plan of action from a physician in a timely manner. At the time of onboarding and at regularly scheduled time intervals, patients record a baseline 30 second cardiac reading using our device. When a patient experiences symptoms, such as irregular heartbeats or chest pain, the patient can simply open the smartphone app and press the credit card sized device against the chest to collect signals that can be converted to a 12-lead ECG. This derived 12-lead ECG is sent to the physician overlayed with the patient’s derived baseline ECG recording. In addition, the patient provides input on their symptoms that are sent, along with the ECG data, to the cloud for interpretation by a physician. A cloud-based algorithm processes the signals and displays the symptom description and patient history to a physician to analyze and prescribe an action plan. From start to finish, the process takes just a few minutes.

The telehealth system consists of:

1. A credit card sized cardiac electrical signal collection device. The device captures cardiac signals that represent x, y and z projections of the heart vector and transmits them via Bluetooth connection to a smartphone. It is always with the patient as it easily fits in a wallet. It is easy to use as all that is required of the patient is that the device be pressed against the chest.

2. A smartphone application that receives the cardiac signals from the HeartBeam signal collection device. The app has several functions: guiding the patient through the signal collection, asking about symptoms, displaying the status of the data collection, and notifying the patient of the plan of action as determined by a physician. In addition, the app will contain HIPAA-compliant video conferencing or text capabilities for the healthcare provider to communicate directly with the patient.

3. A cloud-based software system that serves three basic functions: (1) Performing a final check of the ECG signal quality, (2) Synthesizing a 12-lead ECG from the measured (recorded) 3 vector leads, and (3) Preparing a summary report for the physician. In order to facilitate a more accurate physician interpretation of the data, the software overlays the patient’s synthesized baseline 12 lead ECG waveform on the synthesized 12 lead ECG waveform from the current event. To ensure high signal quality, the system checks for noise levels in the recorded signals. Those signals that can be effectively filtered are accepted and those that have a noise level above an empirically established threshold are rejected. If a recorded signal is rejected, the user is asked to repeat the recording.

4. A web-based physician portal, which displays all of the relevant information for the physician to analyze: patient history, symptoms, baseline and current readings, synthesized 12 lead ECG, and recorded 3 vector leads. The HeartBeam physician portal assists physicians with their diagnostic interpretation by providing both the baseline 12-lead synthesized ECG and the 12-lead synthesized ECG that is under evaluation.

The market release of our telehealth Product will be in two generations. The generation 1 product will have a limited feature set and will offer to the physician a pair of baseline and symptomatic ECGs and a symptoms report. This product is an excellent match for existing CPT remote patient monitoring reimbursement codes. The generation 2 product will

3

feature our proprietary MI marker as well as our diagnostic suggestion in addition to all features of Generation 1 product. Since Generation 2 will offer much increased medical value, we will seek a unique reimbursement code for this product.

The same core technology is used in the ER Product. In this application, the increased accuracy of detecting MIs by the ECG is of utmost importance. An ECG is the first diagnostic test a chest pain patient receives in the ER and it has a major impact on the patient’s subsequent clinical path. The ER Product has no hardware and introduces minimal change to the standard of care chest pain diagnostic path. It uses a baseline standard 12-lead ECG from the patient’s Electronic Medical Record (EMR) and the chest pain ECG that is being evaluated. It converts both of them to a VCG representation and utilizes our proprietary 3D VCG differential marker. An initial clinical study indicates that the ER software Product offers considerable improvement in the accuracy of MI detection compared to a panel of experienced cardiologists interpreting a standard 12 lead ECG. The importance of increased accuracy of the first ECG interpretation for a chest pain patient presenting to an ER is significant, potentially leading to faster intervention or avoiding unnecessary activation of the cardiac catheterization lab.

Market Opportunity

ECGs are key diagnostic tests utilized in the diagnosis and monitoring of cardiovascular disease, the number one cause of death worldwide. In the US in 2016, there were 121.5 million adults living with cardiovascular disease and 18.3 million adults with diagnosed coronary artery disease. The market size is increasing, due to an aging population and lifestyle choices.

Every 40 seconds someone in the US has a heart attack, or myocardial infarction (MI). Unfortunately, there is no way for patients to tell whether the symptoms they are experiencing are due to an MI, or some other more benign condition such as indigestion. As a result, patients often ignore symptoms and delay seeking care, which leads to worse outcomes and increased mortality. On the other hand, many patients who go to the Emergency Room with chest pain are not experiencing an MI. Chest pain is the second most common reason for an ER visit, yet fewer than 20% of chest pain ER visits result in a diagnosis of a life-threatening condition. These unnecessary ER visits lead to well over $10 billion in unnecessary healthcare expenditures.

Most ECGs are conducted in a healthcare facility setting using a 12-lead ECG machine, the gold standard. ECGs taken outside of healthcare facilities are expected to grow more quickly than in-hospital ECGs. Monitoring cardiac patients outside of a hospital is a fast growing trend, as it is less expensive and provides a better patient experience. However, while ambulatory cardiac monitoring devices are often much easier for patients to use, they have fewer leads than the gold standard and therefore cannot offer as comprehensive a picture of cardiac health.

While a standard 12-lead ECG readout is of great medical value, it is simply impractical to have a machine next to patients when they experience symptoms outside the clinical setting, since recording the event requires attaching multiple electrodes to the patient’s body with professional assistance. While existing technologies use predominantly single lead ECG devices to monitor arrhythmias, these technologies do not provide information to the physician on the presence of life threatening conditions of ACS or heart attacks.

We believe our telehealth technology addresses these market needs and has several key attributes that make it a good fit for these patients. Our telehealth Product is generally used when symptoms occur and offers the potential for lifelong patient usage. The device is always near the patient and ready to be used for recording a cardiac event. It enables real-time cardiac data transmission during a telemedicine visit. It offers a recorded 3 vector lead set of signals and a 12-lead derived ECG set of signals. Physicians will typically prescribe our solution to chronic cardiovascular patients for long term monitoring, thereby enabling prolonged data collection and delivering a more complete picture for diagnosis. This will also enable the use of artificial intelligence on our future database that will have a unique set of longitudinal 12-lead ECGs for patients.

Market Strategy

Our goal is to establish our products as key solutions for cardiology practices and hospital ERs. Our efforts to enter the market involve establishing clinical evidence and demonstrating the cost-effectiveness of adopting our products. For both the telehealth and the ER Products, the initial geographic market is the United States.

4

We believe that both the telehealth and ER Products will be subject to the US FDA’s 510(k) review process. We are in the process of preparing regulatory submissions for our ER Product and Generation 1 telehealth Product.

For the telehealth Product, the primary customers are cardiology practices and the cardiology departments of hospitals. Healthcare insurers are another important customer, as they will benefit from the reduced costs to the healthcare system. We are working to develop new clinical studies and publish results of completed clinical studies and plan to demonstrate real world cost-effectiveness of the use of the solution.

A key element of our strategy is obtaining reimbursement for the telehealth Product. This strategy has two stages in full alignment with our Generation 1 and Generation 2 telehealth product introduction plans. In the short term, we expect that physicians will use existing Remote Patient Monitoring (RPM) reimbursement codes. We believe that our Generation 1 telehealth Product will be a compelling offering among RPM technologies, as it will be uniquely positioned to assess ACS and heart attacks among high-risk cardiac patients. In the longer term, we will conduct additional clinical trials that demonstrate the clinical efficacy and cost effectiveness of our next generation, full featured Generation 2 Product and will work to secure a new CPT code and reimbursement specific to Generation 2 telehealth solution.

RPM codes pay practices for providing covered services. The main RPM codes relevant for our Generation 1 telehealth Product are:

• CPT 99453: Remote monitoring of physiologic parameter(s), initial; set-up and patient education on use of equipment

• CPT 99454: Remote monitoring of physiologic parameter(s), initial; device(s) supply with daily recording(s) or programmed alert(s) transmission, each 30 days

• CPT 99457: Remote physiologic monitoring treatment management services, clinical staff/physician/ other qualified health care professional time in a calendar month requiring interactive communication with the patient/caregiver during the month; initial 20 minutes

• CPT 99458: Remote physiologic monitoring treatment management services, clinical staff/physician/ other qualified health care professional time in a calendar month requiring interactive communication with the patient/caregiver during the month; additional 20 minutes

CPT 99453 is paid one-time per patient, with the average CMS payment rate of $21. The technical code CPT 99454 and the professional code CPT 99457 are paid monthly, with a combined average CMS payment rate of $119. Private payers may pay at different amounts.

Practices will bill payers for monthly services related to the core HeartBeam telehealth Product, potentially bundled with a third-party blood pressure measurement device. Under this model, the company will negotiate with payers for a per patient per month fee for the ongoing HeartBeam telehealth service, which also will include an amortized charge for the cost of the device.

We will explore other business models. For example, hospitals face CMS penalties if their 30-day readmission rates for patients who are discharged after an MI exceed certain thresholds. These CMS penalties are levied on all hospital CMS payments, so the impact can be significant. Our telehealth Product can be a tool to help hospitals manage these patients after discharge. We will explore models in which hospitals pay for the device and for the initial 30 days of service. In addition, we will explore models for value-based care, in which the use of the telehealth Product reduces overall costs.

We expect to develop a direct sales force for our telehealth Product and to target large hospitals and integrated practices. These are sophisticated customers, and we will use technical presentations, peer reviewed clinical data, and demonstration projects to achieve penetration of this market. We will continue to expand our medical advisory board, will conduct clinical trials with leading cardiologists to increase the body of evidence, and will establish reference sites among these customers.

5

Our long-term strategy is to generate sufficient evidence of clinical efficacy and cost-effectiveness to generate reimbursement coverage and payment specifically for the HeartBeam telehealth Generation 2 solution. We expect to be able to demonstrate significant clinical benefits for patients and savings to the health care system, justifying reimbursement levels well in excess of the amount paid through the RPM pathway.

For the telehealth Product, our primary marketing strategy will focus on the medical community with continued validation of clinical efficacy and cost-effectiveness and the establishment of reference sites. We will also create educational materials and provide other support to help educate our customers’ patients.

For the ER Product, the primary customers are acute care facilities. As with the telehealth Product, we will publish clinical studies on the effectiveness of the Product. In addition, we will develop financial models demonstrating the cost-effectiveness of the approach and will establish reference sites who are using the Product. We do not expect to obtain specific reimbursement for the ER Product but intend to demonstrate that the purchase of the software would result in clinical and economic benefits and potentially reduced malpractice legal exposure for ER provider institutions.

We will establish a direct sales network with relationships and experience selling to ERs. In addition, we will identify leading Emergency Physicians to conduct clinical studies and generate real-world experience with the Product.

Clinical Data

HeartBeam has performed three clinical studies to assess performance of our technologies.

In the first study (HeartBeam Ischemia Detection Study — HIDES), we collected electrical signal data on patients whose coronary arteries were occluded during a Percutaneous Coronary Intervention (PCI), using simultaneously a traditional 12-lead ECG and our vector signal based device. Our VCG-based signal interpretation system had significantly (21%) higher accuracy in detecting ischemia as more fully discussed in the Business Section.

In a second study (B Score), the HeartBeam diagnostic engine, using ECG, symptoms, and history, matched the diagnostic performance of expert cardiologists in detecting the presence of MIs in patients presenting to an ER with chest pain. This result indicates that the quality of the diagnostic advice produced by our expert system will be extremely valuable to the physician who is assessing the condition of a patient in a telehealth environment.

The third study, ISPEC, which assessed the false positive rate for non-symptomatic patients, is relevant in a telehealth situation. It is important that the system have a low false positive rate when patients are conducting baseline recordings, which are required on at least a monthly basis. The study yielded no false positives.

All three studies are being prepared for peer-reviewed publication.

Intellectual Property

Our innovations are protected with a strong patent portfolio. For a limited number of aspects of our proprietary technology, we rely on trade secret protection. It is our view that the combination of these two methods of intellectual property protection maximizes our chances for success.

HeartBeam has three issued U.S. utility patents, five pending U.S. utility patent applications and two pending provisional applications.

Research and Development

The primary objective of our research and development program is to provide innovative, user friendly solutions with high medical value. To date, we have been highly successful in developing our initial products. The emphasis has been on developing a user-friendly solution that is always with the patient and that provides assistance to physicians in diagnosing heart attacks in chest pain patients.

Our Research and Development team is largely based in Belgrade, Serbia. We have assembled a highly capable team currently consisting of seven PhD level contributors who are credited with developing our key inventions and patents. The diverse group includes two nuclear physicists, three signal processing specialists, and two biomedical engineers.

6

We plan to utilize this team in the future and expect that the key members of this team will transition to full time employees. Future research and development efforts will focus on the application of signal processing and artificial intelligence to address a range of cardiac conditions.

Future Products

Our core technology — the heart vector approach adopted and invented by our scientific team — is a platform technology that can provide diagnostic solutions to a variety of cardiovascular patients. Our plans call for expanding solutions that diagnose all major cardiac conditions that are diagnosed by ECGs.

Our future plans include the development of a 12-lead capable patch ECG monitor that will provide advantages over existing single-lead ECG patch products such as the Zio-XT from iRhythm Technologies, Inc. Our approach will offer a 12-lead ECG with a patch that is very similar, in dimensions and look and feel, to the currently available single lead ECG patches. We believe providing standard of care 12-lead ECG capabilities will have significant diagnostic advantages over a single lead patch.

While our initial telehealth Product is powered by a software expert system that serves as a diagnostic aid to a physician, we will develop an AI based diagnostic system that will supplement our diagnostic expert system.

Summary of Risk Factors

Our business and our ability to execute our business strategy are subject to a number of risks of which you should be aware of before you decide to buy our Units. In particular, you should carefully consider following risks, which are discussed more fully in “Risk Factors” beginning on page 13 of this prospectus:

• We have a limited operating history upon which investors can evaluate our future prospects.

• Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

• We have no revenues and we cannot predict when we will achieve first revenues and be sustained.

• We may never complete the development and commercialization of products that we are currently developing and future development of new generations of any of our other proposed products.

• We may not meet our product development and commercialization milestones.

• Our business is dependent upon physicians utilizing and prescribing our solution; if we fail to engage physicians to utilize our solution, our revenues may never materialize or may not meet our projections.

• We are subject to extensive governmental regulations relating to the manufacturing, labeling and marketing of our products.

• If we are not able to both obtain and maintain adequate levels of third-party reimbursement for our products, it would have a material adverse effect on our business.

• Changes in reimbursement practices of third-party payers could affect the demand for our products and services and our revenue levels.

• We may experience difficulty in obtaining reimbursement for our services from commercial payors that consider our technology to be experimental and investigational, which would adversely affect our revenue and operating results.

• Reimbursement by Medicare is highly regulated and subject to change; our failure to comply with applicable regulations, could decrease our expected revenue and may subject us to penalties or have an adverse impact on our business.

• Consolidation of commercial payors could result in payors eliminating coverage of mobile cardiac monitoring solutions or reducing reimbursement rates.

• Product defects could adversely affect the results of our operations.

7

• Interruptions or delays in telecommunications systems or in the data services provided to us by cellular communication providers or the loss of our wireless or data services could impair the delivery of our cardiac monitoring services.

• Interruptions in computing and data management cloud systems could impair the delivery of our cardiac monitoring services.

• We could be exposed to significant liability claims if we are unable to obtain insurance at acceptable costs and adequate levels or otherwise protect ourselves against potential product liability claims.

• We require additional capital to support our present business plan and our anticipated business growth, and such capital may not be available on acceptable terms, or at all, which would adversely affect our ability to operate.

• We cannot predict our future capital needs and we may not be able to secure additional financing.

• The results of our research and development efforts are uncertain and there can be no assurance of the commercial success of our products.

• If we fail to retain certain of our key personnel and attract and retain additional qualified personnel, we might not be able to pursue our growth strategy.

• We will not be profitable unless we can demonstrate that our products can be manufactured at low prices.

• Our dependence on a limited number of suppliers may prevent us from delivering our devices on a timely basis.

• Natural disasters and other events beyond our control could materially adversely affect us.

• The COVID-19 pandemic may negatively affect our operations.

• The industry in which we operate is highly competitive and subject to rapid technological change. If our competitors are better able to develop and market products that are safer, more effective, less costly, easier to use, or are otherwise more attractive, we may be unable to compete effectively with other companies.

• We face competition from other medical device companies that focus on similar markets.

• Unsuccessful clinical trials or procedures relating to products under development could have a material adverse effect on our prospects.

• Intellectual property litigation and infringement claims could cause us to incur significant expenses or prevent us from selling certain of our products.

• If we are unable to protect the confidentiality of our trade secrets, our business and competitive position would be harmed.

• If we are unable to protect our proprietary rights, or if we infringe on the proprietary rights of others, our competitiveness and business prospects may be materially damaged.

• Dependence on our proprietary rights and failing to protect such rights or to be successful in litigation related to such rights may result in our payment of significant monetary damages or impact offerings in our product portfolios.

• Enforcement of federal and state laws regarding privacy and security of patient information may adversely affect our business, financial condition or operations.

• We may become subject, directly or indirectly, to federal and state health care fraud and abuse laws and regulations and if we are unable to fully comply with such laws, the Company could face substantial penalties.

• We may be subject to federal and state false claims laws which impose substantial penalties.

• The price of our Common Stock and Warrants may be subject to wide fluctuations.

8

• The offering price of the Units may not be indicative of the value of our assets or the price at which shares can be resold. The offering price of the Units may not be an indication of our actual value.

• If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline.

• We may, in the future, issue additional shares of Common Stock, which would reduce investors’ percent of ownership and dilute our share value

• Our need for future financing may result in the issuance of additional securities which will cause investors to experience dilution.

• If our shares become subject to the penny stock rules, it would become more difficult to trade our shares.

• Liability of directors for breach of duty is limited under Delaware law.

• We do not anticipate paying any cash dividends on our Common Stock in the foreseeable future and, as such, capital appreciation, if any, of our Common Stock will be your sole source of gain for the foreseeable future.

• We are an “emerging growth company,” and any decision on our part to comply with certain reduced disclosure requirements applicable to emerging growth companies could make our Common Stock less attractive to investors.

• As a result of our becoming a public company, we will become subject to additional reporting and corporate governance requirements that will require additional management time, resources and expense.

• We have identified weaknesses in our internal controls, and we cannot provide assurances that these weaknesses will be effectively remediated or that additional material weaknesses will not occur in the future.

• Future sales of a substantial number of our Common Stock by our existing shareholders could cause our stock price to decline.

• Future sales and issuances of our Common Stock or rights to purchase Common Stock, including pursuant to our equity incentive plans and outstanding warrants could result in additional dilution of the percentage ownership of our stockholders and could cause our stock price to fall.

• The Company will have broad discretion in the use of the net proceeds from this offering and may fail to apply these proceeds effectively.

• There is no assurance that an active and liquid trading market in our Common Stock and Warrants will develop.

• There is no guarantee that we will successfully have our Common Stock or Warrants listed on the Nasdaq Capital Market. Even if our Common Stock and Warrants are accepted for listing on the Nasdaq Capital Market, upon our satisfaction of the exchange’s initial listing criteria, the exchange may subsequently delist our Common Stock and Warrants if we fail to comply with ongoing listing standards.

• You will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the future.

Corporate History and Information

HeartBeam was incorporated as a C corporation under the laws of the State of Delaware on June 11, 2015. We do not own any subsidiaries.

9

THE OFFERING

|

Securities offered by us |

Units at $ per Unit, each Unit consisting of: • One share of Common Stock; and • Warrant to purchase Common Stock. The Warrants may only be exercised with an exercise price of $ (which will not be less than % of the public offering price of one Unit) per whole Common Stock. The Warrants are exercisable upon completion of this offering and will expire five (5) years from the date of issuance. The Common Stock and the Warrants comprising the Units are immediately separable upon issuance and will be issued separately in this offering. |

|

|

Shares of Common Stock outstanding |

|

|

|

Shares of Common Stock to be |

|

|

|

Number of Warrants outstanding before this offering |

|

|

|

Number of Warrants outstanding after this offering |

|

|

|

Over-allotment option |

The Company has granted the underwriters an over-allotment option. This option, which is exercisable for up to 30 days after the date of this prospectus, permits the underwriters to purchase a maximum of 412,500 additional shares of Common Stock (15% of the shares sold in this offering) and/or Warrants to purchase Common Stock from us to cover over-allotments, if any. |

|

|

Use of Proceeds |

We estimate that the net proceeds from this offering will be approximately $14,695,000, or approximately $16,997,000 if the underwriters exercise their over-allotment option in full, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. The Company intends to use the net proceeds from this offering general working capital and other corporate purposes. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

|

|

Description of Warrant |

The exercise price of the Warrants is $ per share (with an exercise price no less than % of the public offering price of one Unit). Each Warrant is exercisable for one share of our Common Stock, subject to adjustment in the event of stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our Common Stock as described herein. Each Warrant is exercisable upon completion of this offering and will expire five (5) years from the date of issuance. The terms of the Warrants will be governed by a warrant agreement, dated as of the effective date of this offering, between us and Vstock Transfer, as the Warrant Agent. This prospectus also relates to the offering of the Common Stock issuable upon exercise of the Warrants. For more information regarding the Warrants, you should carefully read the section titled “Description of Securities — Warrants” in this prospectus. |

10

|

Representative’s Warrant |

The registration statement of which this prospectus is a part also registers warrants (the “Representative’s Warrants”) to purchase up to 221,375 shares of Common Stock (7% of the number of Common Stock sold in this offering (including any Common Stock and/or Warrants sold pursuant to the over-allotment option) to be issued the underwriters, as a portion of the underwriting compensation payable in connection with this offering, as well as the Common Stock issuable upon the exercise of the Representative’s Warrants. Please see “Underwriting — Representative’s Warrants” for a description of these warrants. |

|

|

Dividend Policy |

The Company has never declared any cash dividends on its Common Stock. The Company currently intends to use all available funds and any future earnings for use in financing the growth of its business and does not anticipate paying any cash dividends for the foreseeable future. See “Dividend Policy.” |

|

|

Trading Symbol |

We have applied to list our Common Stock and Warrants on the Nasdaq Capital Market upon our satisfaction of the exchange’s initial listing criteria. Upon approval to list our Common Stock and Warrants we anticipate that the Common Stock and Warrants, will be listed on the Nasdaq Capital Market under the symbol “BEAT” and “BEATW”, respectively. No assurance can be given that our application will be approved. |

|

|

Risk Factors |

You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 13 of this prospectus before deciding whether or not to invest in the Company’s Units. |

|

|

Lock-up |

We and our directors, officers and principal stockholders have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our Common Stock or securities convertible into Common Stock for a period of six months after the date of this prospectus. See “Underwriting” section on page 77. |

____________

(1) The number of shares of Common Stock outstanding is based on shares of Common Stock issued and outstanding as of September 30, 2021 and excludes the following:

• 792,912 shares of Common Stock issuable upon the exercise of outstanding stock options having a weighted average exercise price of $1.11 per share;

• 422,549 shares of Common Stock issuable upon the exercise of outstanding warrants having a weighted average exercise price of $0.11 per share;

• 1,449,574 shares of Common Stock issuable upon conversion of the convertible debt;

• 584,848 shares of Common Stock reserved for future issuance under the Company’s 2015 Equity Incentive Plan (the “2015 Plan”);

Except as otherwise indicated herein, all information in this prospectus reflects or assumes:

• no exercise of the outstanding options described above;

• no exercise of the underwriters’ option to purchase up to an additional 412,500 shares of Common Stock to cover over-allotments, if any;

• excludes shares of Common Stock underlying the Warrants issued as part of the Units; and

• excludes shares of Common Stock underlying the Warrants to be issued to the underwriters in connection with this offering.

• a 1 for 2.75 reverse stock split of our issued and outstanding shares of common stock, which was effected on September 27, 2021 (all share and per share amounts in this prospectus have been presented on a retrospective basis to reflect the reverse stock split).

11

The following summary financial and operating data set forth below should be read in conjunction with the Company’s financial statements, the notes thereto and the other information contained in this prospectus. The summary statement of operations data for the three and six months ended June 30, 2021 and 2020 and the years ended December 31, 2020 and 2019 have been derived from the Company’s audited financial statements appearing elsewhere in this prospectus. The historical results presented below are not necessarily indicative of financial results to be achieved in future periods. The financial statements have been prepared and presented in accordance with generally accepted accounting principles in the United States. You should read this data together with the information under the captions “Capitalization” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results are not necessarily indicative of our future results or any other period. The summary financial data included in this section are not intended to replace the financial statements and the related notes included elsewhere in this prospectus. Share amounts, per share data, share prices, exercise prices and conversion rates have been retroactively adjusted to reflect the 1-for-2.75 reverse stock split of or common effected on September 27, 2021.

|

For the |

For the |

For the |

||||||||||||||||||||||

|

Statement of operations data: |

2021 |

2020 |

2021 |

2020 |

2020 |

2019 |

||||||||||||||||||

|

(In thousands, except share and per share data) |

||||||||||||||||||||||||

|

Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

General and administrative |

$ |

312 |

|

$ |

133 |

|

$ |

446 |

|

$ |

227 |

|

$ |

655 |

|

$ |

253 |

|

||||||

|

Research and development |

|

25 |

|

|

21 |

|

|

54 |

|

|

28 |

|

|

133 |

|

|

41 |

|

||||||

|

Total Operating Expenses |

|

337 |

|

|

154 |

|

|

500 |

|

|

255 |

|

|

788 |

|

|

294 |

|

||||||

|

Loss From Operations |

|

(337 |

) |

|

(154 |

) |

|

(500 |

) |

|

(255 |

) |

|

(788 |

) |

|

(294 |

) |

||||||

|

Net Loss |

$ |

(945 |

) |

$ |

(229 |

) |

$ |

(1,155 |

) |

$ |

(402 |

) |

$ |

(1,068 |

) |

$ |

(536 |

) |

||||||

|

Net loss per share, basic and diluted |

|

(0.26 |

) |

|

(0.06 |

) |

|

(0.31 |

) |

|

(0.11 |

) |

|

(0.29 |

) |

|

(0.16 |

) |

||||||

|

Weighted average common shares outstanding |

|

3,699,762 |

|

|

3,638,315 |

|

|

3,706,550 |

|

|

3,646,159 |

|

|

3,645,945 |

|

|

3,411,104 |

|

||||||

|

Unaudited pro forma net loss per share: |

|

|

|

|

||||||||

|

Pro-forma net loss(1) |

$ |

(414 |

) |

$ |

(624 |

) |

||||||

|

Pro forma net loss per share, basic and diluted |

|

(0.05 |

) |

|

(0.08 |

) |

||||||

|

Shares used to calculate pro forma net loss per common share, basic and diluted |

|

7,713,321 |

|

|

7,720,109 |

|

|

Balance sheet data: |

As of |

Pro Forma |

||||||

|

(In thousands) |

||||||||

|

Cash |

$ |

465 |

|

$ |

15,160 |

|

||

|

Total assets |

$ |

521 |

|

$ |

15,216 |

|

||

|

Convertible notes, net |

$ |

4,194 |

|

$ |

— |

|

||

|

Total liabilities |

$ |

4,785 |

|

$ |

591 |

|

||

|

Accumulated deficit |

$ |

(5,951 |

) |

$ |

(5,951 |

) |

||

|

Total Stockholders’ (Deficit) Equity |

$ |

(4,264 |

) |

$ |

14,625 |

|

||

____________

(1) On a pro forma basis the net loss decreased by $531,000 due to the exclusion of the convertible note amortization during the three and six months ended June 30, 2021.

(2) The pro forma balance sheet data reflects the items described in footnotes (1) above and gives effect to our receipt of estimated net proceeds $14.7 million from the sale of Common Stock that we are offering at an assumed initial public offering price of $5.34 per share, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. It also assumes that the convertible notes are automatically converted at $4.20/share ($6.00 * 70%).

(3) The pro forma as adjusted data is illustrative only and will be adjusted based on the actual initial public offering price and other terms of this offering determined at pricing.

A $1.00 increase (decrease) in the anticipated initial public offering price of $6.00 per share, would increase (decrease) each of cash, total assets and total stockholders’ equity by approximately $2.6 million, assuming the number of Units offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable. In addition, the convertible notes of $5.3 million gross would convert at a price that is $0.70 different than the initial conversion price of $ 4.20 per share for a public offering price of $ 6.00. It would be $ 4.90 (increase of $1.00) to $ 3.50 (decrease of $1.00).

12

Investing in our Units involves a high degree of risk. Prospective investors should carefully consider the risks described below, together with all of the other information included or referred to in this prospectus, before purchasing our Units. There are numerous and varied risks that may prevent the Company from achieving its goals. If any of these risks actually occurs, the Company’s business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our Common Stock and Warrants could decline and investors could lose all or part of their investment.

Risks Related to Our Business

We have a limited operating history upon which investors can evaluate our future prospects.

We have a limited operating history upon which an evaluation of our business plan or performance and prospects can be made. The business and prospects of the Company must be considered in the light of the potential problems, delays, uncertainties and complications encountered in connection with a newly established business and new industry. The risks include, but are not limited to, the possibility that we will not be able to develop functional and scalable products and services, or that although functional and scalable, our products and services will not be economical to market; that our competitors hold proprietary rights that preclude us from marketing such products; that our competitors market a superior or equivalent product; that we are not able to upgrade and enhance our technologies and products to accommodate new features and expanded service offerings; or the failure to receive necessary regulatory clearances for our products. To successfully introduce and market our products at a profit, we must establish brand name recognition and competitive advantages for our products. There are no assurances that we can successfully address these challenges and if unsuccessful, we and our business, financial condition and operating results could be materially and adversely affected.

The current and future expense levels of our business are based largely on estimates of planned operations and future revenues rather than experience. It is difficult to accurately forecast future revenues because our business is new and our market has not been developed. If our forecasts prove incorrect, the business, operating results and financial condition of the Company may be materially and adversely affected. Moreover, we may be unable to adjust our spending in a timely manner to compensate for any unanticipated reduction in revenues. As a result, any significant reduction in planned or actual revenues may immediately and adversely affect our business, financial condition and operating results.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

As described in Note 2 of our accompanying audited financial statements, our auditors have issued a going concern opinion on our December 31, 2020 financial statements, expressing substantial doubt that we can continue as an ongoing business for the next twelve months after issuance of their report based on our current development plans and our operating requirements and us having suffered recurring losses from operations and having a net capital deficiency. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. If we cannot raise the necessary capital to continue as a viable entity, we could experience a material adverse effect on our business and our stockholders may lose some or all of their investment in us.

We can provide no assurances that any additional sources of financing will be available to us on favorable terms, if at all. Our forecast of the period of time through which our current financial resources will be adequate to support our operations and the costs to support our general and administrative, selling and marketing and research and development activities are forward-looking statements and involve risks and uncertainties.

If we do not succeed in raising additional funds on acceptable terms, we may be unable to complete planned clinical trials or obtain 510(k) clearance of our initial products from the FDA and other regulatory authorities. In addition, we could be forced to delay, discontinue or curtail product development, forego sales and marketing efforts, and forego potential attractive business opportunities. Unless we secure additional financing, we will be unable to fund completion of our initial products and pursue 510(k) clearance from the FDA.

13

We will also need to raise additional capital to expand our business to meet our long-term business objectives. We have no revenues and we cannot predict when we will achieve first revenues and sustained profitability.

We have no revenues and cannot definitely predict when we will achieve revenues and profitability. We do not anticipate generating significant revenues until we successfully develop, achieve regulatory clearance, commercialize and sell our proposed products, of which we can give no assurance. We are unable to determine when we will generate significant revenues from the sale of any such products.

We cannot predict when we will achieve profitability, if ever. Our inability to become profitable may force us to curtail or temporarily discontinue our research and development programs and our day-to-day operations. Furthermore, there can be no assurance that profitability, if achieved, can be sustained on an ongoing basis.

We may never complete the development and commercialization of products that we are currently developing and future development of new generations of any of our other proposed products.

We have no assurance of success as to the completion and of the commercial launch of our products or the completion and development of any new generations of products that are currently under development or other proposed or contemplated products, for any of our target markets. We continue to seek to improve our technologies while we are developing them so that they result in commercially viable products. Failure to improve on any of our technologies could delay or prevent their successful development for our target markets.

Developing any technology into a marketable product is a risky, time consuming and expensive process. You should anticipate that we will encounter setbacks, discrepancies requiring time consuming and costly redesigns and changes, and that there is the possibility of outright failure.

We may not meet our product development and commercialization milestones.

We have established milestones, based upon our expectations regarding our technologies, which we use to assess our progress toward developing our products. These milestones relate to technology development and design improvements as well as dates for achieving development goals. If our products exhibit technical defects or are unable to meet cost or performance goals, our commercialization schedule could be delayed and potential purchasers of our initial commercial products may decline to purchase such products or may opt to pursue alternative products.

We may also experience shortages of the components used in our devices. The contract manufacturing operations that we will use could be disrupted by fire, earthquake or other natural disaster, a labor-related disruption, failure in supply or other logistical channels, electrical outages or other reasons. If there were a disruption to manufacturing facilities, we would be unable to manufacture devices until these manufacturing capabilities are restored or alternative manufacturing facilities are engaged.

Generally, we have met our milestone schedules when making technological advances in our product. We can give no assurance that our development and commercialization schedule will continue to be met as we further develop products currently under development or any of our other future products.

Our business is dependent upon physicians utilizing and prescribing our solution; if we fail to engage physicians to utilize our solution, our revenues may never materialize or may not meet our projections.

The success of our cardiac diagnosis and monitoring business is dependent upon physicians prescribing and utilizing our solution. The utilization of our solution by physicians for use in the prescription of cardiac monitoring is directly influenced by a number of factors, including:

• the ability of the physicians with whom we work to obtain sufficient reimbursement and be paid in a timely manner for the professional services they provide in connection with the use of our monitoring solutions;

• establishing ourselves as a cardiac monitoring technology company by publishing peer reviewed publications showing efficacy of our solutions,

• our ability to educate physicians regarding the benefits of our cardiac monitoring solutions over alternative diagnostic monitoring solutions,

• our demonstrating that our proposed products are reliable and supported by us in the field;

14

• supplying and servicing sufficient quantities of products directly or through marketing alliances; and

• pricing our devices and technology service fees in a medical device industry that is becoming increasingly price sensitive.

If we are unable to drive physician utilization, our revenues may never materialize or may not meet our projections.

We are subject to extensive governmental regulations relating to the manufacturing, labeling and marketing of our products.

Our medical technology products and operations are subject to regulation by the FDA, and other foreign and local governmental authorities. These agencies enforce laws and regulations that govern the development, testing, manufacturing, labeling, advertising, marketing and distribution, and market surveillance of our medical products.

Under the United States Federal Food, Drug, and Cosmetic Act, medical devices are classified into one of three classes — Class I, Class II or Class III — depending on the degree of risk associated with each medical device and the extent of control needed to ensure safety and effectiveness. We believe that our products currently under development and planned products will be Class II medical devices. Class II medical devices are subject to additional controls, including full applicability of the Quality System Regulations, and requirements for 510(k) pre-market notification.

The FDA may disagree with the classification of a new Class II medical device and require the manufacturer of that device to apply for approval as a Class III medical device. In the event that the FDA determines that our Class II medical Products should be classified as Class III medical devices, we could be precluded from marketing the devices for clinical use within the United States for a period of time, the length of which depends on the specific change in the classification. Reclassification of our Class II medical Products as Class III medical devices could significantly increase our regulatory costs, including the timing and expense associated with required clinical trials and other costs.

In addition to regulations in the United States, we will be subject to a variety of foreign regulations governing clinical trials and commercial sales and distribution of our products in foreign countries. Whether or not we obtain FDA approval for a product, we must obtain approval of a product by the comparable regulatory authorities of foreign countries before we can commence clinical trials or marketing of the product in those countries. The approval process varies from country to country, and the time may be longer or shorter than that required for FDA approval. The requirements governing the conduct of clinical trials, product licensing, pricing and reimbursement vary greatly from country to country.

The policies of the FDA and foreign regulatory authorities may change and additional government regulations may be enacted which could prevent or delay regulatory approval of our products and could also increase the cost of regulatory compliance. We cannot predict the likelihood, nature or extent of adverse governmental regulation that might arise from future legislative or administrative action, either in the United States or abroad.

The FDA and non-U.S. regulatory authorities require that our products be manufactured according to rigorous standards. These regulatory requirements may significantly increase our production costs and may even prevent us from making our products in quantities sufficient to meet market demand. If we change our approved manufacturing process, the FDA may need to review the process before it may be used. Failure to comply with applicable regulatory requirements discussed could subject us to enforcement actions, including warning letters, fines, injunctions and civil penalties, recall or seizure of our products, operating restrictions, partial suspension or total shutdown of our production, and even criminal prosecution.

Federal, state and non-U.S. regulations regarding the manufacture and sale of medical devices are subject to future changes. The complexity, timeframes and costs associated with obtaining marketing clearances are unknown. Although we cannot predict the impact, if any, these changes might have on our business, the impact could be material.