As filed with the Securities and Exchange Commission on February 10, 2023.

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________

HEARTBEAM, INC.

(Exact name of Registrant as specified in its charter)

____________________

|

Delaware |

541714 |

47-4881450 |

||

|

(State or other jurisdiction of |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer |

____________________

2118 Walsh Avenue, Suite 210

Santa Clara, CA 95050

Telephone: 408-899-4443

(Address and telephone number of principal executive offices)

____________________

Branislav Vajdic

Chief Executive Officer

HeartBeam, Inc.

2118 Walsh Avenue, Suite 210

Santa Clara, CA 95050

Telephone: 408-899-4443

(Name, address and telephone number of agent for service)

____________________

Copies to:

|

Joseph M. Lucosky, Esq. |

Andrew D. Hudders, Esq, Carl Vandemark, Esq. Golenbock Eiseman Assor Bell & Peskoe, LLP 711 Third Avenue — 17th Floor New York, New York 10017 (212) 907-7300 |

____________________

Approximate Date of Commencement of Proposed Sale to the Public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|||

|

Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

|||

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act ☐

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 10, 2023

PRELIMINARY PROSPECTUS

HeartBeam, Inc.

Shares of Common Stock

We are offering up to shares of common stock, par value .0001 (the “Common Stock”) of HeartBeam, Inc. (the “Company” or “HeartBeam”) at a public offering price of $ per share. This is a “best efforts”. This offering will terminate on ________, 2023 unless we decide to terminate the offering prior to that date. We will have one closing for all the securities purchased in this offering.

Public Ventures, LLC (the “placement agent”) is the placement agent we have engaged to conduct this offering on a commercially reasonable “best efforts” offering basis, with no minimum amount. The placement agent may engage sub-placement agents to assist in the placement of the shares of Common Stock offered hereby. The placement agent is not purchasing or selling any shares of Common Stock offered by this prospectus, but it has agreed to use its commercially reasonable best efforts to find eligible purchasers for the shares of Common Stock offered hereby. While the offering is ongoing, investors may submit subscription agreements to the placement agent. Any funds paid by investors pursuant to the subscription agreements will be paid to and held in escrow pursuant to an escrow agreement with Delaware Trust Company, which will act as escrow agent, until the closing date of this offering. Subscriptions are irrevocable, and subscribers cannot withdraw their funds during the offering period. See “Plan of Distribution” for more details about the offering, the process of subscriptions, subscription agreements and the escrow arrangements.

Our Common Stock and warrants are currently listed on the NASDAQ, under the symbol “BEAT” and “BEATW”, respectively.

Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the risks and uncertainties described under the heading “Risk Factors” beginning on page 13 of this prospectus before making a decision to purchase our securities.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

|

Per Share |

Total |

|||||

|

Public offering price |

$ |

$ |

||||

|

Placement Agent fees |

$ |

$ |

||||

|

Proceeds to HeartBeam, Inc. before expenses |

$ |

$ |

||||

For a description of the other compensation to be received by the placement agent, please see “Plan of Distribution” beginning on page 24.

The delivery of the securities offered hereby is expected to be made on or about the termination date of the offering, which will be , 2023, subject to satisfaction of certain customary closing conditions.

PUBLIC VENTURES, LLC

The date of this prospectus , 2023.

ABOUT THIS PROSPECTUS

In this prospectus, unless the context suggests otherwise, references to “the Company,” “HeartBeam”, “we,” “us,” and “our” refer to HeartBeam, Inc.

This prospectus describes the specific details regarding this offering, the terms and conditions of the Shares being offered hereby and the risks of investing in the Company’s Common Stock. You should read this prospectus and the additional information about the Company described in the section entitled “Where You Can Find More Information” before making your investment decision.

Neither the Company, nor any of its officers, directors, agents, representatives or placement agents, make any representation to you about the legality of an investment in the Company’s Common Stock. You should not interpret the contents of this prospectus to be legal, business, investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before investing in the Company’s securities.

ADDITIONAL INFORMATION

You should rely only on the information contained in this prospectus and in any accompanying prospectus supplement. No one has been authorized to provide you with different or additional information. The shares of Common Stock are not being offered in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front of such documents.

TRADEMARKS AND TRADE NAMES

This prospectus includes trademarks that are protected under applicable intellectual property laws and are the Company’s property. This prospectus also contains trademarks, service marks, trade names and/or copyrights of other companies, which are the property of its owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that the Company will not assert, to the fullest extent under applicable law, its rights or the right of the applicable licensor to these trademarks and trade names.

INDUSTRY AND MARKET DATA

Unless otherwise indicated, information contained in this prospectus concerning the Company’s industry and the markets in which it operates, including market position and market opportunity, is based on information from management’s estimates, as well as from industry publications and research, surveys and studies conducted by third parties. The third-party sources from which the Company has obtained information generally state that the information contained therein has been obtained from sources believed to be reliable, but the Company cannot assure you that this information is accurate or complete. The Company has not independently verified any of the data from third-party sources nor has it verified the underlying economic assumptions relied upon by those third parties. Similarly, internal company surveys, industry forecasts and market research, which the Company believes to be reliable, based upon management’s knowledge of the industry, have not been verified by any independent sources. The Company’s internal surveys are based on data it has collected over the past several years, which it believes to be reliable. Management estimates are derived from publicly available information, its knowledge of the industry, and assumptions based on such information and knowledge, which management believes to be reasonable and appropriate. However, assumptions and estimates of the Company’s future performance, and the future performance of its industry, are subject to numerous known and unknown risks and uncertainties, including those described under the heading “Risk Factors” in this prospectus and those described elsewhere in this prospectus, and the other documents the Company files with the Securities and Exchange Commission, or SEC, from time to time. These and other important factors could result in its estimates and assumptions being materially different from future results. You should read the information contained in this prospectus completely and with the understanding that future results may be materially different and worse from what the Company expects. See the information included under the heading “Forward-Looking Statements.”

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. These forward-looking statements contain information about our expectations, beliefs or intentions regarding our product development and commercialization efforts, business, financial condition, results of operations, strategies or prospects, and other similar matters. These forward-looking statements are based on management’s current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. These statements may be identified by words such as “expects,” “plans,” “projects,” “will,” “may,” “anticipates,” “believes,” “should,” “intends,” “estimates,” and other words of similar meaning.

These statements relate to future events or our future operational or financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under the section titled “Risk Factors” and elsewhere in this prospectus, in any related prospectus supplement and in any related free writing prospectus.

Any forward-looking statement in this prospectus, in any related prospectus supplement and in any related free writing prospectus reflects our current view with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our business, results of operations, industry and future growth. Given these uncertainties, you should not place undue reliance on these forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this prospectus, any related prospectus supplement and any related free writing prospectus and the documents that we reference herein and therein and have filed as exhibits hereto and thereto completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

This prospectus, any related prospectus supplement and any related free writing prospectus also contain or may contain estimates, projections and other information concerning our industry, our business and the markets for our products, including data regarding the estimated size of those markets and their projected growth rates. Information that is based on estimates, forecasts, projections or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. Unless otherwise expressly stated, we obtained these industry, business, market and other data from reports, research surveys, studies and similar data prepared by third parties, industry and general publications, government data and similar sources. In some cases, we do not expressly refer to the sources from which these data are derived.

|

Page No. |

||

|

1 |

||

|

13 |

||

|

20 |

||

|

21 |

||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

22 |

|

|

24 |

||

|

28 |

||

|

30 |

||

|

30 |

||

|

30 |

||

|

31 |

i

The following summary highlights information contained elsewhere in this prospectus or incorporated by reference in this prospectus. This summary may not contain all of the information that may be important to you. You should read this entire prospectus carefully, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Company’s historical financial statements and related notes included elsewhere in this prospectus. In this prospectus, unless otherwise noted, the terms “the Company,” “HeartBeam” “we,” “us,” and “our” refer to HeartBeam, Inc.

Overview

Corporate History and Information

HeartBeam was incorporated as a C corporation under the laws of the State of Delaware on June 11, 2015. We do not own any subsidiaries.

Company Overview

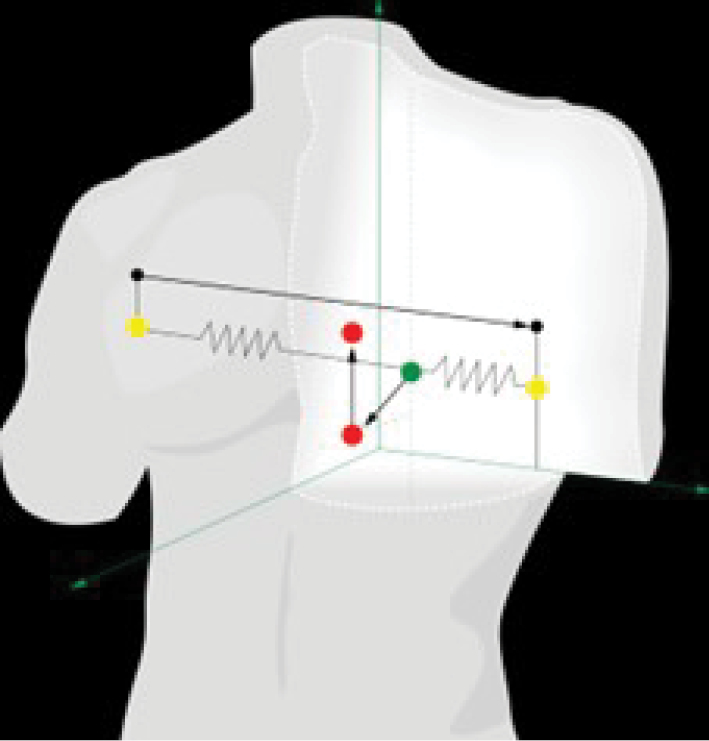

We are a medical technology company primarily focusing on developing and commercializing higher resolution ambulatory Electrocardiogram (“ECG”) solutions that enable the detection and monitoring of cardiac disease outside a healthcare facility setting. Our ability to develop higher resolution ECG solutions is achieved through the development of our proprietary and patented Vector Electrocardiography (“VECG”) technology platform. Our vector electrocardiography technology is capable of developing three-dimensional (3D) images of cardiac electrical activity by displaying the spatial locations of ECG waveforms that has demonstrated in early studies to deliver equal or superior diagnostic capability than traditional hospital based ECG systems.

3D projections of cardiac vectors

Our aim is to deliver innovative, remote patient monitoring (“RPM”) technologies that can be used for patients anywhere, especially where critical cardiac care decisions need to be made on a more timely basis. Our products (hereinafter “Product” or “Products”) require Food and Drug Administration (“FDA”) clearance and have not been cleared for marketing.

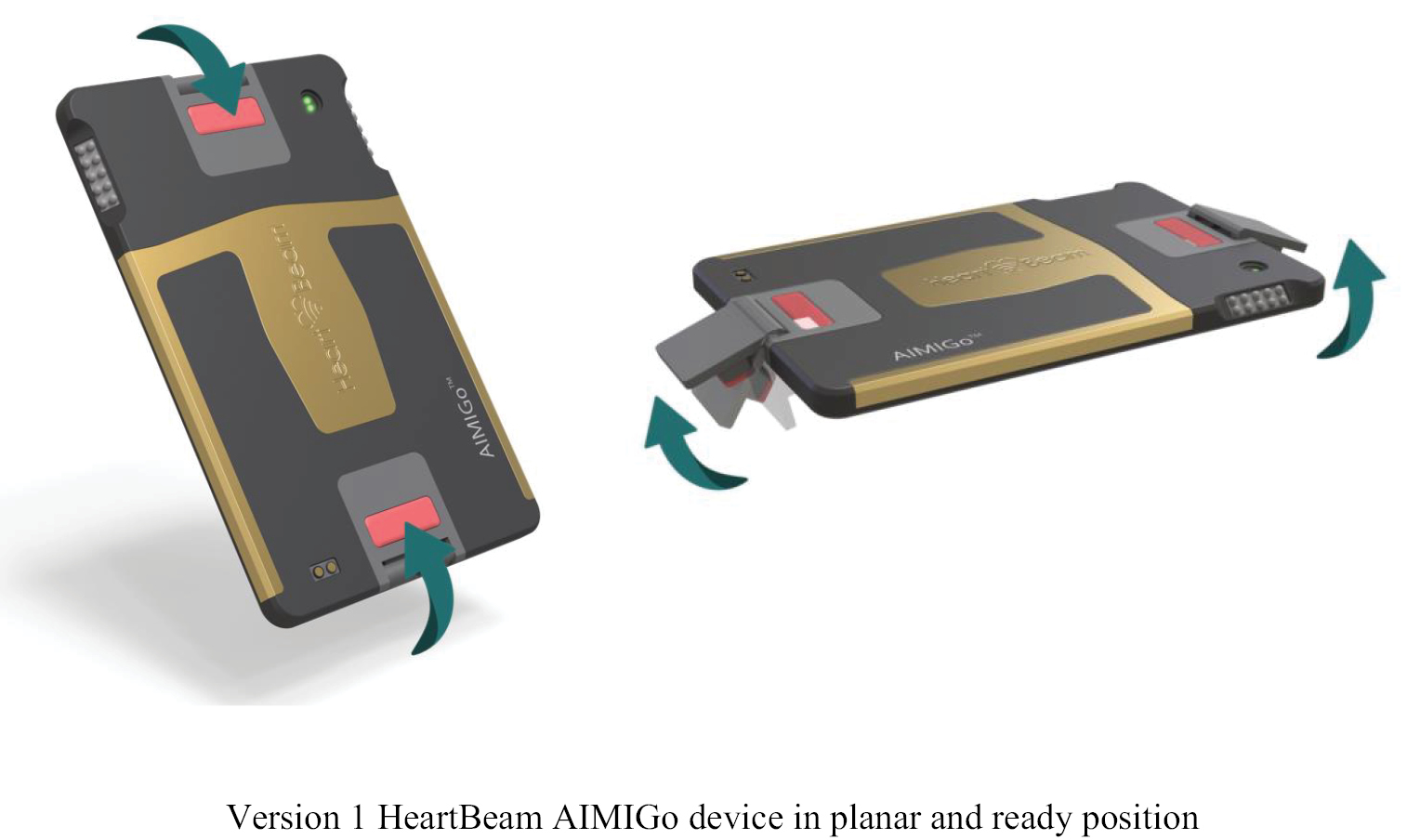

We believe our Products and services will benefit many stakeholders, including patients, healthcare providers, and healthcare payors. We are developing Generation 1 of our telehealth product (“HeartBeam AIMIGoTM”), to address the rapidly growing field of RPM. HeartBeam AIMIGo is comprised of a credit card sized electrocardiogram device and other powerful cloud-based diagnostic expert software systems. We believe that we are uniquely positioned to play a central role in remote monitoring of high-risk coronary artery disease patients, because the initial studies have shown that our ischemia detection system may be more accurate than existing RPM solutions.

1

We are also applying our software platform to create a tool for detecting heart attacks in the Emergency Department (“ED”) environment using standard 12-lead ECG recordings. The software tool, (“HeartBeam AIMITM”) is designed to enable emergency physicians to more accurately and quickly diagnose heart attacks than currently available tools. Market clearance of this Product will precede that of HeartBeam AIMIGo.

To date, we have developed working prototypes for both HeartBeam AIMIGo and HeartBeam AIMI. HeartBeam AIMI has been submitted for FDA 510(k) clearance and we have received questions from the FDA within the statutory 30-day review deadline, discussed the questions via teleconference with the FDA review team and provided written responses addressing the questions to the primary reviewer.

The custom software and hardware of our Products, we believe, are classified as Class II medical devices by the FDA, running on an FDA approved Class I registered software platform. Class II medical devices are those for which general controls alone are insufficient to provide reasonable assurance of safety and effectiveness and there is sufficient information to establish special controls. Special controls can include performance standards, post-market surveillance, patient histories and FDA guidance documents. Premarket review and clearance by the FDA for these devices is generally accomplished through the 510(k) or 510(k) de-novo premarket notification process.

Recent Developments not Incorporated by Reference

In September 2022, we were granted two patents;

• We were granted a patent for a 12-lead ECG patch monitor intended for detection of acute coronary syndrome (“ACS”) and cardiac arrhythmias by the United States Patent and Trademark Office. The innovation builds on our growing intellectual property portfolio enabling synthesized 12-lead ECG diagnostics outside of a medical setting.

• We were also granted a patent that enables generation of a synthesized 12-lead ECG by the HeartBeam AIMIGo credit card-sized device by the United States Patent and Trademark Office. The innovation opens the pathway for a patient to record a set of signals using HeartBeam AIMIGo device outside of a medical setting with a diagnostic synthesized 12-lead ECG immediately transmitted to a physician for review and diagnosis. Unlike single-lead ECG products currently in the marketplace, such as other credit card sized devices or smartwatches, our technology is intended to quickly and accurately help a physician identify a heart attack (“Myocardial Infarction” or “MI”) in addition to arrythmias.

2

In October 2022, we announced the expansion of our product pipeline with smartwatch connectivity enablement for 24/7 heart monitoring capability. The product pipeline advancement allows for the addition of arrhythmia detection capabilities to address the multibillion-dollar global market for atrial fibrillation and other arrhythmia monitoring. This capability builds on our recently issued patents. This broader product portfolio enables the following:

• Introducing a 3-lead 3D vector electrocardiogram credit card-sized device, the HeartBeam AIMIGo 3L, that records the X,Y,Z cardiac activity and displays the signals for clinician review, providing the regulatory foundation for subsequent products in our product portfolio. The 510(k) submission to the FDA is planned for Q1 2023.

• Leveraging recently issued patents to incorporate both synthesized baseline and symptomatic 12-lead signals for enhanced diagnostic accuracy as well as the addition of atrial fibrillation detection capability in the HeartBeam AIMIGo 12L tool for planned FDA 510(k) submission in 2023.

• Broadening of the product portfolio to enable smartwatch connectivity to our platform in future products as an optional monitoring solution for the clinician and the patient.

In October 2022, we announced the appointment of Peter J. Fitzgerald, MD, Ph. D, as Chief Medical Officer. Dr. Fitzgerald is the Director of the Center for Cardiovascular Technology and Director of the Cardiovascular Core Analysis Laboratory at Stanford University Medical School. In addition to his world-renowned expertise in interventional cardiology, Dr. Fitzgerald is an accomplished inventor, entrepreneur, and investment fund founder.

In November 2022, we announced that our patent for a 12-lead ECG smartwatch-based monitor intended for detection of heart attacks and complex cardiac arrhythmias was allowed by the United States Patent and Trademark Office. The innovation builds on our growing intellectual property portfolio enabling 12-lead ECG diagnostics outside of a medical setting.

Market Overview

Chronic diseases are the number one burden on the healthcare system, driving up costs each year, and cardiovascular illnesses are one of the top contributors. Regulators, payors and providers are focused on shifting the diagnosis and management of these conditions to drive better outcomes at lower cost. Connected medical solutions are expanding rapidly and are projected to reach $155 billion by 2026, a compound annual growth rate (“CAGR”) of 17%. These solutions are socio-technical models for healthcare management and delivery using technology to provide healthcare services remotely and aim to maximize healthcare resources and provide increased, flexible capabilities for patients to engage with clinicians and better self-manage their care, using readily available consumer-facing technologies to deliver patient care outside of the hospital or doctor’s office.

The market for RPM is projected to reach $31.3 billion by 2023. In 2019, 1,800 hospitals in the US were using mobile applications to improve risk management and quality of care. The number in 2020 was likely larger as the onset of the COVID-19 pandemic greatly accelerated use and acceptance of telehealth by both patients and healthcare providers.

Cardiovascular disease is the number one cost to the healthcare system and is estimated to be responsible for 1 in every 6 healthcare dollars spent in the US. As cardiovascular disease is the leading cause of death worldwide, early detection, diagnosis, and management of chronic cardiac conditions are necessary to relieve the increasing burden on the healthcare infrastructure. Diagnostic tests such as ECGs are used to detect, diagnose and track numerous cardiovascular conditions. With advances in mobile communications, diagnostic monitoring of cardiac conditions is increasingly occurring outside the hospital.

Our initial telemedicine technology Product will address the heart attack detection market as well as the market to monitor coronary artery disease (“CAD”) patients who are typically at high risk for a heart attack. Currently there are no products on the market that are user friendly, easy to carry, and always with the patient in order to provide physicians and patients with timely and highly accurate information about potential ACS and MI events. A tool that is always with the patient, that decreases time to intervention, and that decreases the number of unnecessary ED visits by chest pain patients would have a significant effect on saving lives and healthcare dollars. We believe our technology will address this problem and will provide a convenient, cost-effective, integrated telehealth solution, including software and hardware for physicians and their patients. There are approximately 20 million people in the US who are considered at high risk for a heart attack, including 8 million who already have had prior intervention for MI’s and are therefore considered to be at extreme risk.

3

In the US, mobile cardiac tests are primarily conducted through outsourced Independent Diagnostic Testing Facilities (“IDTFs”) or as part of an RPM system. Reimbursement rates vary depending on the use case and generally are based on the value a technology offers to patients and healthcare providers. Actual reimbursed pricing is set by the Centers for Medicare & Medicaid Services (“CMS”). Reimbursement rates for private insurers typically provide for similar or higher reimbursement rates when compared to those set by the government for Medicare and Medicaid.

In the ED environment, early and accurate diagnosis of a chest pain patient who is potentially having a heart attack is of immense importance. Guidelines state that every chest pain patient in an ED must receive an ECG within 10 minutes of presentation. The accuracy of these initial ECGs, interpreted by physicians, is only approximately 75%. The need for increased ECG accuracy in detecting a heart attack in the ED is well defined, and an improved solution could result in saved lives and healthcare dollars. A 510(k) for our ED Product HeartBeam AIMI, was submitted for review on August 15, 2022 to the FDA. We believe this Product will offer an increase in the accuracy of heart attack detection in EDs. There are approximately 5,000 Emergency Departments in the US.

Products and Technology

The foundation of our novel technology is the concept of VECG, a technology that has long been seen as superior to ECGs in detecting MIs but is no longer used clinically because of the difficulty experienced by physicians interpreting the output. We solved the crucial problem of recording three orthogonal (x, y and z) projections of the heart vector with a device that is sized like a credit card. The thickness of our credit card sized ECG signal collection device is about 1/8 inch (3 mm), and it weighs about 1 ounce (28 grams). The core technology consists of a series of patented inventions and associated algorithms. In addition to using VECG to get a more complete 3D characterization of cardiac activity, we use the concept of a baseline. Our MI marker is a differential marker that measures the change in cardiac parameters between an asymptomatic (baseline) recording and the symptomatic recording. It is personalized for every patient as every patient has a unique baseline. Our increase in diagnostic performance in detecting MIs, when compared to a panel of cardiologists, is attributed to a richer cardiac information set offered by VECG and the fact that our MI marker compares the baseline and symptomatic recordings and does that in the 3D space of VECG.

This novel technology has resulted in two key Products to date: a telehealth Product for high-risk cardiovascular patients (HeartBeam AIMIGo) and a powerful cloud-based ECG interpretation and MI suggestion expert system for EDs (HeartBeam AIMI). Our telehealth ECG collection device is the size of a credit card and records cardiac signals with integrated electrodes rather than wires or self-adhesive electrodes. Unlike a standard 12-lead ECG machine that records signals in empirically determined locations on a human body, our approach is focused on recording three projections of the heart vector. The successful recording of the projections of the heart vector enables the synthesis, via a patented method, of a 12-lead signal set and internal algorithmic diagnostic work in the space of 3D heart vectors.

There are obvious ease of use advantages when comparing our handheld device that fits in a wallet and can be instantly self-applied versus the current 12-lead ECG machine that requires a trained professional to apply. In addition, there are diagnostic performance advantages, including, based on our initial study, increased accuracy in diagnosing MIs. The system is used by patients at home or elsewhere, and collected data is sent to a physician to assess whether the patient’s chest pain is truly the result of an MI.

Our telehealth HeartBeam AIMIGo system will be a prescription-only mobile health system intended for individuals with known or suspected heart disease, especially CAD. It helps guide physicians in choosing the best course of action for their patients who experience chest pain outside of a medical facility. HeartBeam AIMIGo will bring a medical grade ECG to patients and will enable them to receive a plan of action from a physician in a timely manner. At the time of onboarding and at regularly scheduled time intervals, patients record a baseline 30 second cardiac reading using our device. When a patient experiences symptoms, such as irregular heartbeats or chest pain, the patient can simply open the smartphone application and press the credit card sized device against the chest to collect signals that can be converted to a synthesized 12-lead ECG. This synthesized 12-lead ECG is sent to the physician overlayed with the patient’s synthesized baseline ECG recording. In addition, the patient provides input on their symptoms that is sent, along with the ECG data, to the cloud for interpretation by a physician. A cloud-based algorithm processes the signals and displays the symptom description and patient history to a physician to analyze and prescribe an action plan. From start to finish, the process takes just a few minutes.

4

The telehealth HeartBeam AIMIGo system consists of a number of capabilities that will be productized in an incremental fashion. These are:

1. A credit card sized cardiac electrical signal collection device. The device captures cardiac signals that represent x, y and z projections of the heart vector and transmits them via Bluetooth connection to a smartphone. It is always with the patient as it easily fits in a wallet. It is easy to use as all that is required of the patient is that the device be pressed against the chest.

2. A smartphone application that receives the cardiac signals from the HeartBeam signal collection device. The application has several functions: guiding the patient through the signal collection, asking about symptoms, displaying the status of the data collection including real time signal quality check, and notifying the patient of the plan of action as determined by a physician. In addition, the application will contain HIPAA-compliant video conferencing or text capabilities for the healthcare provider to communicate directly with the patient.

3. A cloud-based software system that serves four basic functions: (1) Performing a final check of the ECG signal quality, (2) Synthesizing a 12-lead ECG from the measured (recorded) 3 vector leads, (3) Creating a diagnostic suggestion based on 3D VECG interpretation, risk factors and symptoms and (4) Preparing a summary report for the physician. These software functions will be introduced to the HeartBeam AIMIGo product in a sequential manner. In order to facilitate a more accurate physician interpretation of the data, the software overlays the patient’s synthesized baseline 12 lead ECG waveform on the synthesized 12 lead ECG waveform from the current event. To ensure high signal quality, the system checks for noise levels in the recorded signals. Those signals that can be effectively filtered are accepted and those that have a noise level above an empirically established threshold are rejected. If a recorded signal is rejected, the user is asked to repeat the recording.

4. A web-based physician portal capable of displaying the relevant information for the physician to analyze: diagnostic suggestion, patient history, symptoms, baseline and current readings, synthesized 12-lead ECG, and recorded 3 vector leads. Our physician portal assists physicians with their diagnostic interpretation by providing both the baseline 12-lead synthesized ECG and the 12-lead synthesized ECG that is under evaluation.

The market release of our telehealth Product will be in multiple generations.

The generation 1 Product will have a limited feature set and introduce a 3-lead 3D VECG credit card-sized device, the HeartBeam AIMIGo 3L, that records the X,Y,Z cardiac activity and displays the signals for clinician review, providing the regulatory foundation for subsequent products in our product portfolio. The 510(k) submission to the FDA is planned for Q1 2023.

The generation 2 Product will offer to the physician a pair of baseline and symptomatic 12-lead ECGs, both synthesized from 3-lead 3D VECG signals recorded by the HeartBeam AIMIGo device, and a symptoms report. It leverages recently issued patents for a personalized system for synthesizing 12-lead ECG waveforms. The generation 2 Product is planned to offer an automated atrial fibrillation detection algorithm. The 510(k) submission to the FDA is planned for the third quarter of 2023.

The generation 3 Product plans call for inclusion of our proprietary ECG interpretation MI marker. The generation 4 may include our overall MI diagnostic suggestion in addition to all features of the earlier generation Products.

The same core technology built into the telehealth Product (HeartBeam AIMIGo) is used in the ED Product (HeartBeam AIMI). In this application, the increased accuracy of detecting MIs by the ECG is of utmost importance. An ECG is the first diagnostic test a chest pain patient receives in the ED and it has a major impact on the patient’s subsequent clinical path. The ED Product has no hardware and introduces minimal change to the standard of care chest pain diagnostic path. It uses a baseline standard 12-lead ECG from the patient’s Electronic Medical Record (“EMR”) and the chest pain ECG that is being evaluated. It converts the two ECGs to a VECG representation and utilizes our proprietary 3D VECG differential marker to generate an ECG interpretation suggestion to be used by the ED physician. The importance of increased accuracy of the first ECG interpretation for a chest pain patient presenting to an ED is significant, potentially leading to faster intervention or avoiding unnecessary activation of the cardiac catheterization lab.

5

Market Opportunity

ECGs are key diagnostic tests utilized in the diagnosis and monitoring of cardiovascular disease, the number one cause of death worldwide. In the US in 2016, there were approximately 120 million adults living with cardiovascular disease and approximately 20 million adults with diagnosed coronary artery disease. The prevalence of these cardiac conditions and thus the market size is increasing, due to an aging population and lifestyle choices.

Every 40 seconds someone in the US has a heart attack, or MI. Unfortunately, there is no way for patients to tell whether the symptoms they are experiencing are due to an MI, or some other more benign condition such as indigestion. As a result, patients often ignore symptoms and delay seeking care, which leads to worse outcomes and increased mortality. On the other hand, many patients who go to the ED with chest pain are not experiencing an MI. Chest pain is the second most common reason for an ED visit, yet fewer than 20% of chest pain ED visits result in a diagnosis of a life-threatening condition. These unnecessary ED visits lead to well over $10 billion in unnecessary healthcare expenditures.

Most ECGs are conducted in a healthcare facility setting using a 12-lead ECG machine, the gold standard. ECGs taken outside of healthcare facilities are expected to grow more quickly than in-hospital ECGs. Monitoring cardiac patients outside of a hospital is a fast-growing trend, as it is less expensive and provides a better patient experience. However, while ambulatory cardiac monitoring devices are often much easier for patients to use, they have fewer leads than the gold standard and therefore cannot offer as comprehensive a picture of cardiac health.

While a standard 12-lead ECG readout is of great medical value, it is simply impractical to have a standard 12-lead machine next to patients when they experience symptoms outside the clinical setting, since recording the event requires attaching multiple electrodes to the patient’s body with professional assistance. While existing technologies use predominantly single lead ECG devices to monitor arrhythmias, these technologies do not provide information to the physician on the presence of life-threatening conditions of ACS or heart attacks.

We believe our telehealth technology addresses these market needs and has several key attributes that make it a good fit for these patients. Our telehealth Product is generally used when symptoms occur and offers the potential for lifelong patient usage. The device is practically always near the patient and ready to be used for recording a cardiac event. It enables very nearly real-time cardiac data transmission during a telemedicine visit. It offers a recorded 3 vector lead set of signals and a synthesized 12-lead ECG set of signals. We believe physicians will typically prescribe our solution to chronic cardiovascular patients for long term monitoring, thereby enabling prolonged data collection and delivering a more complete picture for diagnosis. This will also enable the use of artificial intelligence on our future database that will have a unique set of longitudinal synthesized 12-lead ECGs for patients.

Market Strategy

Our goal is to establish our products as key solutions for cardiology practices and hospital EDs. Our efforts to enter the market involve establishing clinical evidence and demonstrating the cost-effectiveness of adopting our products. For both the telehealth (HeartBeam AIMIGo) and the ED Products (HeartBeam AIMI), the initial geographic market is the United States.

We believe that both the telehealth and ED Products will be subject to the US FDA’s 510(k) review process. A 510(k) for our HeartBeam AIMI was submitted to the FDA on August 15, 2022 for review and we are in the process of preparing a 510(k) submission for Heartbeam AIMIGo.

For HeartBeam AIMIGo, the primary customers are cardiology practices and the cardiology departments of hospitals. Healthcare insurers are another important customer, as they will potentially benefit from the reduced costs to the healthcare system. We are working to develop new clinical studies and publish results of completed clinical studies and plan to demonstrate real world cost-effectiveness of the use of the solution.

Our long-term strategy is to generate sufficient evidence of clinical efficacy and cost-effectiveness to generate reimbursement coverage and payment specifically for the HeartBeam telehealth Generation 2 solution. We expect to be able to demonstrate significant clinical benefits for patients and savings to the healthcare system, justifying reimbursement levels well in excess of the amount paid through the RPM pathway.

For the telehealth Product, our primary marketing strategy will focus on the medical community with continued validation of clinical efficacy and cost-effectiveness and the establishment of reference sites. We will also create educational materials and provide other support to help educate our customers’ patients.

6

Clinical Data

HeartBeam has performed three initial clinical studies to assess performance of our technologies.

In the first study (HeartBeam Ischemia Detection Study — HIDES), we simultaneously collected traditional 12-lead ECG and vector X,Y and Z signals on patients whose coronary arteries were occluded during a Percutaneous Coronary Intervention (PCI). Our VECG-based signal interpretation system had significantly (21%) higher accuracy in detecting ischemia.

In a second study (B Score), the HeartBeam diagnostic engine, using ECG, symptoms, and history, matched the diagnostic performance of expert cardiologists in detecting the presence of MIs in patients presenting to an ED with chest pain. This result indicates that the quality of the diagnostic advice produced by our expert system will be extremely valuable to the physician who is assessing the condition of a patient in a telehealth environment.

The third study, ISPEC, which assessed the false positive rate for non-symptomatic patients, is relevant in a telehealth situation. It is important that the system have a low false positive rate when patients are conducting baseline recordings, which are required on at least a monthly basis. The study yielded no false positives.

All three studies are being prepared for peer-reviewed publication.

Intellectual Property

We believe our innovations are protected with our patent portfolio and our goal is to become a leader in the ambulatory VECG sector. For a limited number of aspects of our proprietary technology we rely on trade secret protection. It is our view that the combination of these two methods of intellectual property protection maximizes our chances for success.

The issued and pending U.S. patent applications cover compact VECG systems for remote detection and/or diagnosis of AMI. The pending EU and CN patent applications correspond to the pending and issued US cases. The pending PCT applications cover methods and apparatuses for automatic cardiac diagnosis as well as compact systems including retractable electrodes.

The issued and pending U.S. patent applications cover compact VECG systems for remote detection and/or diagnosis of AMI. The pending EU and CN patent applications correspond to the pending and issued US cases. The pending PCT applications cover methods and apparatuses for automatic cardiac diagnosis as well as compact systems including retractable electrodes.

HeartBeam has six issued U.S. patents (U.S. 10,433,744, U.S. 10,117,592, U.S. 11,071,490, U.S. 11,419,538, U.S. 11,445,963 and U.S. 11,529,085), and six pending U.S applications. Four of the pending applications have been published, the remaining two pending cases are unpublished. Outside of the U.S., HeartBeam has four issued patents in Germany, France, Netherlands and United Kingdom and seven pending applications in Canada, China, the European Union (“EU”), Japan and Australia. HeartBeam has three pending PCT applications. The issued patents are predicted to expire between April 11, 2036 and April 21, 2042.

Research and Development

The primary objective of our research and development program is to provide innovative, user-friendly, ambulatory VECG solutions with high medical value. To date, we have been highly successful in developing our initial products. The emphasis has been on developing a user-friendly solution that is always with the patient and that provides assistance to physicians in diagnosing heart attacks in chest pain patients.

Our Research team is largely based in Belgrade, Serbia as well as in California, USA. We have assembled a highly capable Belgrade team currently consisting of seven PhD level contributors who are credited with developing our key inventions and patents. The diverse group includes:

• Two nuclear physicists.

• Two Biomedical Engineers experienced in developed digital health applications.

• Two highly experienced Healthcare IT development professionals.

• Two Electrical Engineers (M.S.E.E) with strong signal processing and ECG analysis algorithm expertise from the medical device industry.

7

• An Electrical Engineer (M.S.E.E) with exceptional implantable medical device development and power optimization expertise.

• A Software Engineer, (PhD Computer Science), with deep expertise in developing mobile applications for medical devices.

Future research and development efforts will focus on the application of signal processing and artificial intelligence to address a range of cardiac conditions.

In the third quarter of 2022 we added 3 development engineers led by our recently hired Chief Technology Officer Ken Persen. This is an experienced development team that worked together previously and was successful in delivering FDA cleared products.

Future Products

Our core technology — the heart vector approach adopted and invented by our research team — is a platform technology that can provide diagnostic solutions to a variety of cardiovascular patients. Our plans call for expanding solutions that diagnose all major cardiac conditions that are diagnosed by ECGs.

Our future plans include the development of a VECG-based, synthesized 12-lead capable patch ECG monitor that will provide advantages over existing single-lead ECG patch products such as the Zio-XT from iRhythm Technologies, Inc. Our approach will offer a synthesized 12-lead ECG with a patch that is very similar, in dimensions and look and feel, to the currently available single lead ECG patches. We believe providing standard of care 12-lead ECG capabilities will have significant diagnostic advantages over a single lead patch.

We also plan to integrate a synthesized 12-lead ECG smartwatch-based monitor intended for detection of heart attacks and complex cardiac arrhythmias. This invention eliminates the need for a dedicated ECG device while offering a synthesized 12-lead ECG capability enabling heart attack and complex arrhythmia detection.

While our initial telehealth Product is powered by a software expert system that serves as a diagnostic aid to a physician, we will develop an AI based diagnostic system that will supplement our diagnostic expert system.

We are committed to continue advancing the full potential inherent in our synthesized 12-lead 3D VECG technology as demonstrated in recently issued and allowed patents with potentially disruptive market impacts.

Summary of Risk Factors

Our business and our ability to execute our business strategy are subject to a number of risks of which you should be aware of before you decide to buy our Common Stock. In particular, you should carefully consider following risks, which are discussed more fully in “Risk Factors” beginning on page 13 of this prospectus:

• We have a limited operating history upon which investors can evaluate our future prospects.

• We have expressed substantial doubt about our ability to continue as a going concern.

• We have no revenues and we cannot predict when we will achieve first revenues and be sustained.

• We may never complete the development and commercialization of products that we are currently developing and future development of new generations of any of our other proposed products.

• We may not meet our product development and commercialization milestones.

• Our business is dependent upon physicians utilizing and prescribing our solution; if we fail to engage physicians to utilize our solution, our revenues may never materialize or may not meet our projections.

• We are subject to extensive governmental regulations relating to the manufacturing, labeling and marketing of our products.

• If we are not able to both obtain and maintain adequate levels of third-party reimbursement for our products, it would have a material adverse effect on our business.

8

• Changes in reimbursement practices of third-party payers could affect the demand for our products and services and our revenue levels.

• We may experience difficulty in obtaining reimbursement for our services from commercial payors that consider our technology to be experimental and investigational, which would adversely affect our revenue and operating results.

• Reimbursement by Medicare is highly regulated and subject to change; our failure to comply with applicable regulations, could decrease our expected revenue and may subject us to penalties or have an adverse impact on our business.

• Consolidation of commercial payors could result in payors eliminating coverage of mobile cardiac monitoring solutions or reducing reimbursement rates.

• Product defects could adversely affect the results of our operations.

• Interruptions or delays in telecommunications systems or in the data services provided to us by cellular communication providers or the loss of our wireless or data services could impair the delivery of our cardiac monitoring services.

• Interruptions in computing and data management cloud systems could impair the delivery of our cardiac monitoring services.

• We could be exposed to significant liability claims if we are unable to obtain insurance at acceptable costs and adequate levels or otherwise protect ourselves against potential product liability claims.

• We require additional capital to support our present business plan and our anticipated business growth, and such capital may not be available on acceptable terms, or at all, which would adversely affect our ability to operate.

• We cannot predict our future capital needs and we may not be able to secure additional financing.

• The results of our research and development efforts are uncertain and there can be no assurance of the commercial success of our products.

• If we fail to retain certain of our key personnel and attract and retain additional qualified personnel, we might not be able to pursue our growth strategy.

• We will not be profitable unless we can demonstrate that our products can be manufactured at low prices.

• Our dependence on a limited number of suppliers may prevent us from delivering our devices on a timely basis.

• Natural disasters and other events beyond our control could materially adversely affect us.

• COVID-19 pandemic may negatively affect our operations.

• The industry in which we operate is highly competitive and subject to rapid technological change. If our competitors are better able to develop and market products that are safer, more effective, less costly, easier to use, or are otherwise more attractive, we may be unable to compete effectively with other companies.

• We face competition from other medical device companies that focus on similar markets.

• Unsuccessful clinical trials or procedures relating to products under development could have a material adverse effect on our prospects.

• Intellectual property litigation and infringement claims could cause us to incur significant expenses or prevent us from selling certain of our products.

• If we are unable to protect the confidentiality of our trade secrets, our business and competitive position would be harmed.

• If we are unable to protect our proprietary rights, or if we infringe on the proprietary rights of others, our competitiveness and business prospects may be materially damaged.

9

• Dependence on our proprietary rights and failing to protect such rights or to be successful in litigation related to such rights may result in our payment of significant monetary damages or impact offerings in our product portfolios.

• Enforcement of federal and state laws regarding privacy and security of patient information may adversely affect our business, financial condition or operations.

• We may become subject, directly or indirectly, to federal and state health care fraud and abuse laws and regulations and if we are unable to fully comply with such laws, the Company could face substantial penalties.

• We may be subject to federal and state false claims laws which impose substantial penalties.

• The price of our Common Stock may be subject to wide fluctuations.

• The offering price of our Common Stock may not be indicative of the value of our assets or the price at which shares can be resold. The offering price of our Common Stock may not be an indication of our actual value.

• If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline.

• We may, in the future, issue additional shares of Common Stock, which would reduce investors’ percent of ownership and dilute our share value

• Our need for future financing may result in the issuance of additional securities which will cause investors to experience dilution.

• If our shares become subject to the penny stock rules, it would become more difficult to trade our shares.

• Liability of directors for breach of duty is limited under Delaware law.

• We do not anticipate paying any cash dividends on our Common Stock in the foreseeable future and, as such, capital appreciation, if any, of our Common Stock will be your sole source of gain for the foreseeable future.

• We are an “emerging growth company,” and any decision on our part to comply with certain reduced disclosure requirements applicable to emerging growth companies could make our Common Stock less attractive to investors.

• As a result of our becoming a public company, we will become subject to additional reporting and corporate governance requirements that will require additional management time, resources and expense.

• We have identified weaknesses in our internal controls, and we cannot provide assurances that these weaknesses will be effectively remediated or that additional material weaknesses will not occur in the future.

• Future sales of a substantial number of our Common Stock by our existing shareholders could cause our stock price to decline.

• Future sales and issuances of our Common Stock or rights to purchase Common Stock, including pursuant to our equity incentive plans and outstanding warrants could result in additional dilution of the percentage ownership of our stockholders and could cause our stock price to fall.

• The Company will have broad discretion in the use of the net proceeds from this offering and may fail to apply these proceeds effectively.

• There is no assurance that an active and liquid trading market in our Common Stock will develop.

• While our Common Stock is listed on the NASDAQ, the exchange may subsequently delist our Common Stock if we fail to comply with ongoing listing standards.

• You will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the future.

• This is a commercially reasonable “best efforts offering. We may sell fewer than all the securities offered hereby which may not be enough to properly fund the current financial requirements of the Company.

10

THE OFFERING

|

Securities offered by us |

Up to shares of Common Stock at $ per share on a commercially reasonable best efforts basis. |

|

|

Shares of Common Stock outstanding before this offering(1) |

|

|

|

Shares of Common Stock to be outstanding after this offering(1) |

|

|

|

Use of Proceeds |

We estimate that the net proceeds from this offering will be approximately $ , if the full amount of the offering is sold, after deducting the placement agent fees and estimated offering expenses payable by us. We intend to use the net proceeds from this offering general working capital and other corporate purposes. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

|

|

Placement Agent’s Warrant |

The registration statement of which this prospectus is a part also registers warrants (the “Placement Agent’s Warrants”) to purchase up to shares of Common Stock (10% of the number of Common Stock sold in this offering) to be issued to the placement agent or its designees, as a portion of its compensation payable in connection with this offering, including Public Ventures’ and its affiliates’ purchase amount in this offering, as well as the Common Stock issuable upon the exercise of the Placement Agent’s Warrants. Please see “Plan of Distribution — Placement Agent’s Warrants” for a description of these warrants. |

|

|

Dividend Policy |

We have never declared any cash dividends on its Common Stock. We currently intends to use all available funds and any future earnings for use in financing the growth of its business and does not anticipate paying any cash dividends for the foreseeable future. |

|

|

Risk Factors |

You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 13 of this prospectus before deciding whether or not to invest in our Common Stock. |

11

|

_________ (1) The number of shares of Common Stock outstanding is based on shares of Common Stock issued and outstanding as of September 30, 2022 and excludes the following: • 2,101,921 shares of Common Stock issuable upon the exercise of outstanding stock options having a weighted average exercise price of $1.69 per share; • 257,720 shares of Common Stock issuable upon vesting; • 3,908,276 shares of Common Stock issuable upon the exercise of outstanding warrants having a weighted average exercise price of $5.43 per share; • 847,364 shares of Common Stock reserved for future issuance under the Company’s 2022 Equity Incentive Plan (the “2022 Equity Plan”); Except as otherwise indicated herein, all information in this prospectus reflects or assumes: • no exercise of the outstanding options described above; • excludes shares of Common Stock underlying the Placement Agent Warrants to be issued to the placement agent in connection with this offering. |

||

|

Lock-up |

Our officers and directors have agreed to be subject to a lock-up period of 180 days following the closing of this offering. This means that, during the applicable lock-up period, those persons may not offer for sale, contract to sell, sell, distribute, grant any option, right or warrant to purchase, pledge, hypothecate or otherwise dispose of, directly or indirectly, any shares of our common stock or any securities convertible into, or exercisable or exchangeable for, shares of our common stock. Certain limited transfers are permitted during the lock-up period if the transferee agrees to these lock-up restrictions, including the right to sell any shares of common stock received on the exercise of a restricted stock unit. The Company is not subject to any form of lock-up and may enter into other transactions for the sale of securities such as equity support offerings and at-the-market offerings, and we will be permitted to issue stock under certain other transactions and stock options or stock awards to directors, officers and employees under our existing plans. Public Ventures may, in its sole discretion and without notice, waive the terms of any of these lock-up agreements. |

|

12

An investment in our securities involves substantial risks. In addition to other information in this prospectus, you should carefully consider the following risks and the risks described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 under the caption “Item 1A. Risk Factors,” as well as other information and data set forth in this prospectus and the documents incorporated by reference herein, before making an investment decision with respect to our securities. The occurrence of any of the following risks could materially and adversely affect our business, prospects, financial condition, and our results of operations, which could cause you to lose all or a part of your investment in our securities. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. See “Forward-Looking Statements.”

Risks Related To Our Common Stock

The price of our Common Stock may be subject to wide fluctuations.

A consistently active trading market for our Common Stock does not exist and may not develop or be maintained. You may not be able to sell your shares quickly or at the current market price if trading in our stock is not active. You may lose all or a part of your investment. The market price of our Common Stock may be highly volatile and subject to wide fluctuations in response to a variety of factors and risks, many of which are beyond our control. In addition to the risks noted elsewhere in this prospectus, some of the other factors affecting our stock price may include:

• variations in our operating results;

• announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments;

• announcements by third parties of significant claims or proceedings against us;

• future sales of our Common Stock;

• any delay in our regulatory filings for our product and any adverse development or perceived adverse development with respect to the applicable regulatory authority’s review of such filings, including without limitation the FDA’s issuance of a “refusal to file” letter or a request for additional information;

• adverse results or delays in clinical trials;

• our decision to initiate a clinical trial, not to initiate a clinical trial or to terminate an existing clinical trial;

• adverse regulatory decisions, including failure to receive regulatory approval of our product;

• changes in laws or regulations applicable to our products, including but not limited to clinical trial requirements for approvals;

• adverse developments concerning our manufacturers;

• our inability to obtain adequate product supply for any approved product or inability to do so at acceptable prices;

• our inability to establish collaborations if needed;

• additions or departures of key scientific or management personnel;

• introduction of new products or services offered by us or our competitors;

• announcements of significant acquisitions, strategic partnerships, joint ventures or capital commitments by us or our competitors;

• our ability to effectively manage our growth;

• the size and growth of our initial target markets;

13

• our ability to successfully treat additional types of indications or at different stages;

• actual or anticipated variations in quarterly operating results;

• our cash position;

• our failure to meet the estimates and projections of the investment community or that we may otherwise provide to the public;

• publication of research reports about us or our industry, or positive or negative recommendations or withdrawal of research coverage by securities analysts;

• changes in the market valuations of similar companies;

• overall performance of the equity markets;

• sales of our Common Stock by us or our stockholders in the future;

• trading volume of our Common Stock;

• changes in accounting practices;

• ineffectiveness of our internal controls;

• disputes or other developments relating to proprietary rights, including patents, litigation matters and our ability to obtain patent protection for our or our licensee’s technologies;

• significant lawsuits, including patent or stockholder litigation;

• general political and economic conditions; and

• other events or factors, many of which are beyond our control.

The offering price of our Common Stock may not be indicative of the value of our assets or the price at which shares can be resold. The offering price of the Shares may not be an indication of our actual value.

The offering price of per share of our Common Stock was determined based upon negotiations between the Company and the placement agent. Factors taken into consideration include the trading volume of our Common Stock prior to this offering, the historical prices at which our shares of Common Stock have recently traded, the history and prospects of our Company, the stage of development of our business, our business plans for the future and the extent to which they have been implemented, an assessment of our management, general conditions of the securities markets at the time of the offering, and such other factors as were deemed relevant. No assurance can be given that the securities underlying our Common Stock can be resold at the public offering price.

For these reasons, comparing our operating results on a period-to-period basis may not be meaningful, and you should not rely on past results as an indication of future performance. In the past, following periods of volatility in the market price of a public company’s securities, securities class action litigation has often been instituted against the public company. Regardless of its outcome, this type of litigation could result in substantial costs to us and a likely diversion of our management’s attention. You may not receive a positive return on your investment when you sell your shares and you may lose the entire amount of your investment.

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline.

The trading market for our Common Stock will depend in part on the research and reports that securities or industry analysts publish about us or our business. Securities and industry analysts do not currently, and may never, publish research on our Company. If no securities or industry analysts commence coverage of our Company, the trading price for our stock would likely be negatively impacted. In the event securities or industry analysts initiate coverage, if one or more of the analysts who covers us downgrades our stock or publishes inaccurate or unfavorable research about our business, our stock price may decline. If one or more of these analysts ceases coverage of our Company or fails to publish reports on us regularly, demand for our stock could decrease, which might cause our stock price and trading volume to decline.

14

We may, in the future, issue additional shares of Common Stock, Warrants or Preferred Stock, which would reduce investors’ percent of ownership and dilute our share value

Our Certificate of Incorporation authorizes the issuance of 100,000,000 shares of Common Stock and 10,000,000 shares of Preferred Stock. As of September 30, 2022, there are outstanding 8,000,870 shares of Common Stock and zero shares of Preferred Stock.

Our need for future financing may result in the issuance of additional securities which will cause investors to experience dilution.

Our cash requirements may vary from those now planned depending upon numerous factors, including the result of future research and development activities, our ability to estimate future expenses and acceptance of our products in the market.

While the proceeds derived from the sale of the shares in this offering, according to our plans, will be enough to fund commercialization of the ED Product, they will not provide us with sufficient working capital to fund commercialization of our telehealth Product. There are no commitments for future financing of the commercial phase of our telehealth Product and other future products. Though we believe a successful ED Product introduction will be a significant value creation event for us, our securities may be offered to other investors at a price lower than the price per share offered to the investors in the offering, or upon terms which may be deemed more favorable than offered hereunder. In addition, the issuance of securities in this offering as well as any future financing using our securities may dilute an investor’s equity ownership. Moreover, we may issue derivative securities, including options and/or warrants, from time to time, to procure qualified personnel or for other business reasons. The issuance of any such derivative securities, which is at the discretion of our board of directors, may further dilute the equity ownership of our stockholders, including the investors in this offering. No assurance can be given as to our ability to procure additional financing, if required, and on terms deemed favorable to us. To the extent additional capital is required and cannot be raised successfully, we may then have to limit our then current operations and/or may have to curtail certain, if not all, of our business objectives and plans.

If our shares become subject to the penny stock rules, it would become more difficult to trade our shares.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or authorized for quotation on certain automated quotation systems, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. If the price of our Common Stock is less than $5.00, our Common Stock will be deemed a penny stock. The penny stock rules require a broker-dealer, before a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document containing specified information. In addition, the penny stock rules require that before effecting any transaction in a penny stock not otherwise exempt from those rules, a broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive (i) the purchaser’s written acknowledgment of the receipt of a risk disclosure statement; (ii) a written agreement to transactions involving penny stocks; and (iii) a signed and dated copy of a written suitability statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our Common Stock, and therefore shareholders may have difficulty selling their shares.

Liability of directors for breach of duty is limited under Delaware law.

Our certificate of incorporation limits the liability of directors to the maximum extent permitted by Delaware law. Delaware law provides that directors of a corporation will not be personally liable for monetary damages for breach of their fiduciary duties as directors, except for liability for any:

• breach of their duty of loyalty to us or our stockholders;

• act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

• unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the Delaware General Corporation Law; or

• transaction from which the directors derived an improper personal benefit.

15

These limitations of liability do not apply to liabilities arising under the federal or state securities laws and do not affect the availability of equitable remedies such as injunctive relief or rescission.

Our bylaws provide that we will indemnify for our directors and officers to the fullest extent permitted by law, and may indemnify employees and other agents. Our bylaws also provide that we are obligated to advance expenses incurred by a director or officer in advance of the final disposition of any action or proceeding.

Upon completion of this offering, we intend to obtain a policy of directors’ and officers’ liability insurance.

We plan to enter into separate indemnification agreements with our directors and officers. These agreements, among other things, require us to indemnify our directors and officers for any and all expenses (including reasonable attorneys’ fees, retainers, court costs, transcript costs, fees of experts, witness fees, travel expenses, duplicating costs, printing and binding costs, telephone charges, postage, delivery service fees) judgments, fines and amounts paid in settlement actually and reasonably incurred by such directors or officers or on his or her behalf in connection with any action or proceeding arising out of their services as one of our directors or officers, or any of our subsidiaries or any other company or enterprise to which the person provides services at our request provided that such person follows the procedures for determining entitlement to indemnification and advancement of expenses set forth in the indemnification agreement. We believe that these bylaw provisions and indemnification agreements are necessary to attract and retain qualified persons as directors and officers.

The limitation of liability and indemnification provisions in our certificate of incorporation and bylaws may discourage stockholders from bringing a lawsuit against directors for breach of their fiduciary duties. They may also reduce the likelihood of derivative litigation against directors and officers, even though an action, if successful, might provide a benefit to us and our stockholders. Our results of operations and financial condition may be harmed to the extent we pay the costs of settlement and damage awards against directors and officers pursuant to these indemnification provisions.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us, we have been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

At present, there is no pending litigation or proceeding involving any of our directors or officers as to which indemnification is required or permitted, and we are not aware of any threatened litigation or proceeding that may result in a claim for indemnification.

We do not anticipate paying any cash dividends on our Common Stock in the foreseeable future and, as such, capital appreciation, if any, of our Common Stock will be your sole source of gain for the foreseeable future.

We do not anticipate paying any cash dividends on our Common Stock in the foreseeable future. We currently intend to retain all available funds and any future earnings to fund the development and growth of our business. In addition, and any future loan arrangements we enter into may contain, terms prohibiting or limiting the amount of dividends that may be declared or paid on our Common Stock. As a result, capital appreciation, if any, of our Common Stock will be your sole source of gain for the foreseeable future.

Risks Related to this Offering

We are an “emerging growth company,” and any decision on our part to comply with certain reduced disclosure requirements applicable to emerging growth companies could make our Common Stock less attractive to investors.

We are an “emerging growth company” as defined in the JOBS Act, and, for as long as we continue to be an emerging growth company, we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, not being required to comply with any new requirements adopted by the Public Company Accounting Oversight Board (the “PCAOB”), requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer, not being required to comply with any new audit rules adopted by the PCAOB after April 5, 2012 unless the SEC determines otherwise, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements

16

of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We could remain an emerging growth company until the earlier of: (i) the last day of the fiscal year in which we have total annual gross revenues of $1.235 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of our first sale of common equity securities pursuant to an effective registration statement; (iii) the date on which we have issued more than $1.0 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer. We cannot predict if investors will find our Common Stock less attractive if we choose to rely on these exemptions. If some investors find our Common Stock less attractive as a result of any choices to reduce future disclosure, there may be a less active trading market for our Common Stock and our stock price may be more volatile. Further, as a result of these scaled regulatory requirements, our disclosure may be more limited than that of other public companies and you may not have the same protections afforded to shareholders of such companies.

Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards. We have opted for taking advantage of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Jobs Act.

We have identified weaknesses in our internal controls, and we cannot provide assurances that these weaknesses will be effectively remediated or that additional material weaknesses will not occur in the future.

As a public company, we will be subject to the reporting requirements of the Exchange Act, and the Sarbanes-Oxley Act. We expect that the requirements of these rules and regulations will continue to increase our legal, accounting and financial compliance costs, make some activities more difficult, time consuming and costly, and place significant strain on our personnel, systems and resources.