|

Prospectus Supplement |

Filed Pursuant to Rule 424(b)(2) |

|||

|

(to Prospectus dated February 10, 2023) |

Registration No. 333-269520 |

HEARTBEAM, INC.

1,000,000 Shares of Common Stock

|

We are offering and selling to an investor 1,000,000 shares of our Common Stock, par value $0.0001, at an offering price of $1.50 pursuant to this prospectus and the accompanying base prospectus. The sales of the shares of Common Stock will be made in accordance with a Securities Purchase Agreement, dated as of May 2, 2023, as amended, by and between us and the investor named therein (the “Securities Purchase Agreement”). Our common stock and warrants are listed on The NASDAQ Capital Market under the symbol “BEAT” and “BEATW”, respectively. On May 3, 2023, the last reported sale price of our common stock on The NASDAQ Capital Market was $2.31 per share. |

|

Per Share(1) |

Total |

Proceeds, |

|||||||

|

Offering price |

$ |

1.50 |

$ |

1,500,000 |

$ |

1,400,000 |

|||

Investing in our securities involves a high degree of risk, including that the trading price of our common stock has been subject to volatility. See “Risk Factors” beginning on page S-11 of this prospectus supplement, page 9 of the accompanying base prospectus and under similar headings in the documents incorporated by reference into this prospectus supplement and the accompanying base prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is May 4, 2023

|

Page |

||

|

Prospectus Supplement |

||

|

S-ii |

||

|

S-1 |

||

|

S-11 |

||

|

S-12 |

||

|

S-13 |

||

|

S-13 |

||

|

S-13 |

||

|

S-13 |

||

|

S-14 |

||

|

S-14 |

||

|

S-15 |

||

Prospectus

|

ii |

||

|

1 |

||

|

9 |

||

|

10 |

||

|

11 |

||

|

12 |

||

|

16 |

||

|

22 |

||

|

24 |

||

|

25 |

||

|

26 |

||

|

28 |

||

|

28 |

||

|

28 |

||

|

29 |

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying base prospectus are part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or SEC, utilizing a “shelf” registration process. This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information contained in the accompanying base prospectus and the documents incorporated by reference herein. The second part, the accompanying base prospectus, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement and the information contained in the accompanying base prospectus or any document incorporated by reference therein filed prior to the date of this prospectus supplement, you should rely on the information in this prospectus supplement; provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date-for example, a document incorporated by reference in the accompanying base prospectus-the statement in the document having the later date modifies or supersedes the earlier statement.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

You should rely only on the information contained in this prospectus supplement or the accompanying base prospectus or incorporated by reference herein. We have not authorized anyone to provide you with information that is different. The information contained in this prospectus supplement or the accompanying base prospectus, or incorporated by reference herein or therein is accurate only as of the respective dates thereof, regardless of the time of delivery of this prospectus supplement and the accompanying base prospectus or of any sale of our Common Stock. It is important for you to read and consider all information contained in this prospectus supplement and the accompanying base prospectus, including the documents incorporated by reference herein and therein, in making your investment decision. You should also read and consider the information in the documents to which we have referred you in the sections entitled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” in this prospectus supplement and in the accompanying base prospectus, respectively.

We are offering to sell, and seeking offers to buy, the securities offered by this prospectus supplement only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying base prospectus and the offering of the securities offered by this prospectus supplement in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying base prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Common Stock and the distribution of this prospectus supplement and the accompanying base prospectus outside the United States. This prospectus supplement and the accompanying base prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying base prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

When we refer to “BEAT,” “we,” “our,” “us” and the “Company” in this prospectus, we mean HeartBeam, Inc., unless otherwise specified. When we refer to “you,” we mean the holders of the applicable series of securities.

S-ii

The following information below is only a summary of more detailed information included elsewhere in, or incorporated by reference into, this prospectus supplement and the accompanying base prospectus, and should be read together with the information contained or incorporated by reference in other parts of this prospectus supplement and the accompanying base prospectus. This summary highlights selected information about us and this offering. This summary may not contain all of the information that may be important to you. Before making a decision to invest in our securities, you should read carefully all of the information contained in or incorporated by reference into this prospectus supplement and the accompanying base prospectus, including the information set forth under the caption “Risk Factors” in this prospectus supplement and the accompanying base prospectus as well as the documents incorporated herein by reference, which are described under “Where You Can Find More Information; Incorporation by Reference” in this prospectus supplement. Unless otherwise indicated or unless the context requires otherwise, this prospectus includes the accounts of HeartBeam, Inc., a Delaware corporation and its wholly-owned subsidiaries, collectively referred to as “we”, “us”, “our”, “HeartBeam” or the “Company”.

Overview

Overview

Company Overview

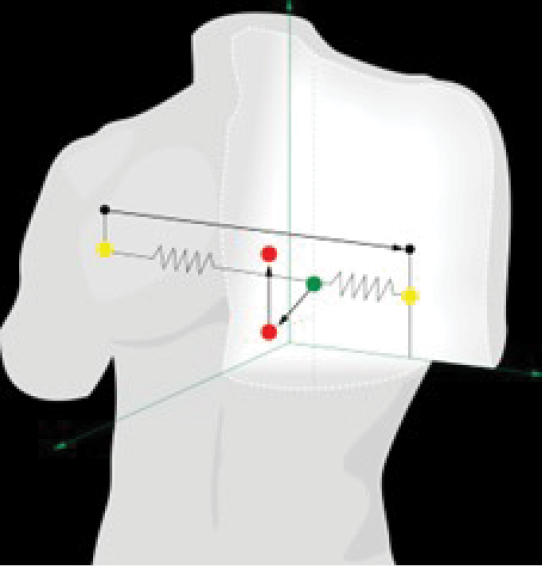

We are a medical technology company primarily focusing on developing and commercializing higher resolution ambulatory Electrocardiogram (“ECG”) solutions that enable the detection and monitoring of cardiac disease both inside and outside a healthcare facility setting. Our ability to develop higher resolution ECG solutions is achieved through the development of our proprietary and patented Vector Electrocardiography (“VECG”) technology platform. Our VECG is capable of developing three-dimensional (“3D”) vector images of cardiac electrical activity by displaying the spatial locations of ECG waveforms that demonstrated in early studies to deliver equal or superior diagnostic capability than traditional hospital-based ECG systems.

Our aim is to deliver innovative, ambulatory cardiac health monitoring technologies that can be used for patients anywhere, especially where critical cardiac care decisions need to be made on a more timely basis. Our products (hereinafter “Product” or “Products”) require Food and Drug Administration (“FDA”) clearance and have not been cleared for marketing.

We believe our Products and services will benefit many stakeholders, including patients, healthcare providers, and healthcare payors. We are developing our telehealth Product (“HeartBeam AIMIGoTM”), to address the rapidly growing telehealth market. HeartBeam AIMIGo is comprised of a credit card sized electrocardiogram device and powerful cloud-based diagnostic expert software systems. We intend to show that our easy to use device (without external electrodes) provides signals equivalent to a standard 12L device, and therefore will have a number of applications for ambulatory use. We believe that we are uniquely positioned to play a central role in cardiac remote monitoring including high-risk coronary artery disease patients, because the initial studies have shown that our ischemia detection system may be more accurate than existing ambulatory monitoring solutions. Coronary artery disease (“CAD”) patients are at increased risk for a heart attack or Myocardial Infarction (“MI”).

S-1

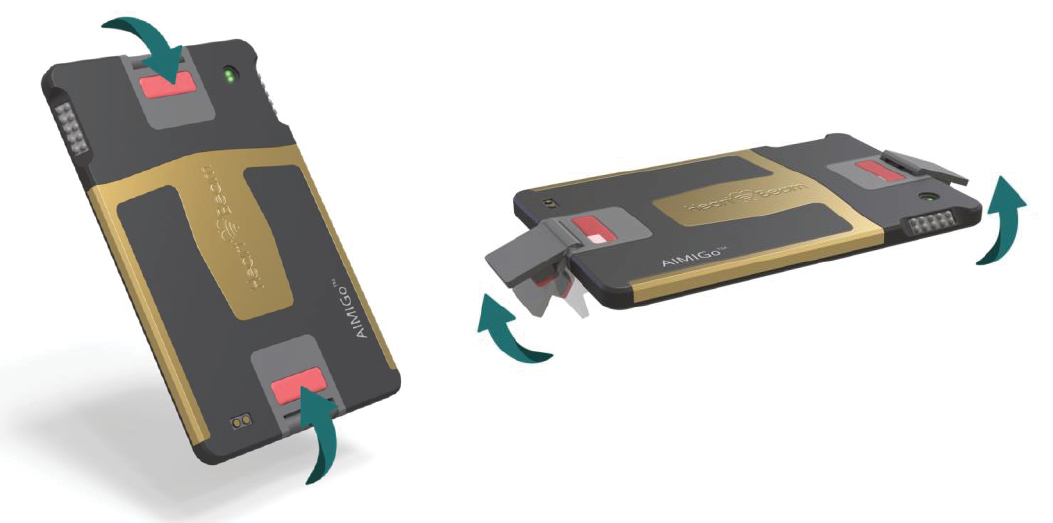

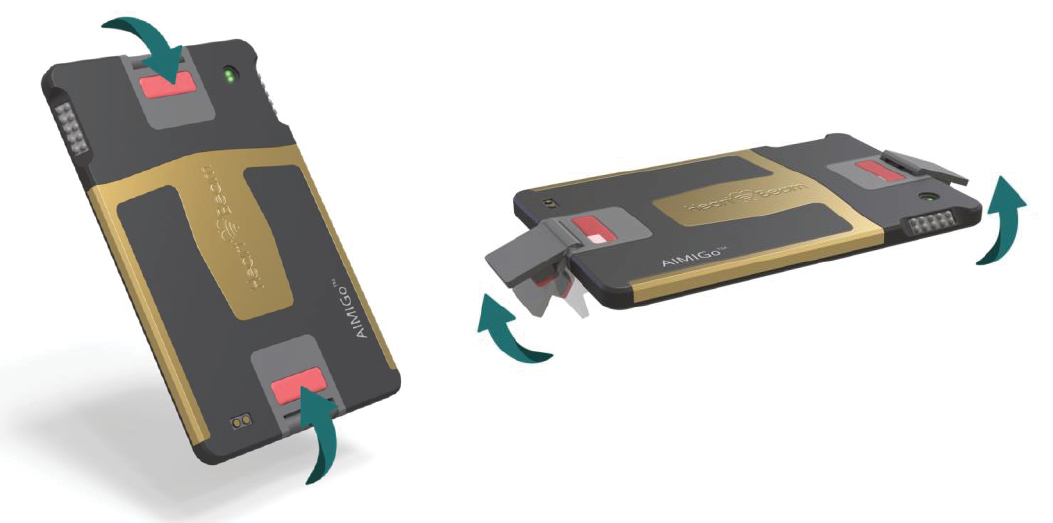

HeartBeam AIMIGo device in planar and ready position

We are also applying our software platform to create a tool for detecting heart attacks in the Emergency Department (“ED”) environment using standard 12-lead ECG recordings. The software tool, (“HeartBeam AIMITM”) is designed to enable emergency physicians diagnose heart attacks more accurately and quickly than currently available tools. Market clearance of this Product is planned to precede HeartBeam AIMIGo.

To date, we have developed working prototypes for both HeartBeam AIMIGo and HeartBeam AIMI. HeartBeam AIMI has been submitted for FDA 510(k) clearance and we have received questions from the FDA within the statutory 30-day review deadline, discussed the questions via teleconference with the FDA review team and provided written responses addressing the questions to the primary reviewer.

The custom software and hardware of our Products, we believe, are classified as Class II medical devices by the FDA, running on an FDA approved Class I registered software platform. Class II medical devices are those for which general controls alone are insufficient to provide reasonable assurance of safety and effectiveness and there is sufficient information to establish special controls. Special controls can include performance standards, post-market surveillance, patient histories and FDA guidance documents. Premarket review and clearance by the FDA for these devices is generally accomplished through the 510(k) or 510(k) de-novo premarket notification process.

HeartBeam has nine issued U.S. patents (U.S. 10,433,744, U.S. 10,117,592, U.S. 11,071,490, U.S. 11,419,538, U.S. 11,445,963, U.S. 11,529,085, U.S. 10,980,433, U.S. 11,412,972 and U.S. 11,234,658), and six pending U.S. applications. Four of the pending applications have been published, the remaining two pending cases are unpublished. Outside of the U.S., HeartBeam has four issued patents in Germany, France, Netherlands and United Kingdom and seven pending applications in Canada, China, the European Union, Japan and Australia. HeartBeam has three pending PCT applications. The issued patents are predicted to expire between April 11, 2036 and April 21, 2042.

Market Overview

Chronic diseases are the number one burden on the healthcare system, driving up costs each year, and cardiovascular illnesses are one of the top contributors. Regulators, payors, and providers are focused on shifting the diagnosis and management of these conditions to drive better outcomes at lower cost. Connected medical solutions are expanding rapidly and are projected to reach $155 billion by 2026, a compound annual growth rate (“CAGR”) of 17%. These solutions are socio-technical models for healthcare management and delivery using technology to provide healthcare services remotely and aim to maximize healthcare resources and provide increased, flexible capabilities for patients to engage with clinicians and better self-manage their care, using readily available consumer-facing technologies to deliver patient care outside the hospital or doctor’s office.

The market for Remote Patient Monitoring (“RPM”) is projected to reach $31.3 billion by 2023. In 2019, 1,800 hospitals in the US were using mobile applications to improve risk management and quality of care. The number in 2020 was likely larger as the onset of the COVID-19 pandemic greatly accelerated use and acceptance of telehealth by both patients and healthcare providers.

S-2

Cardiovascular disease is the number one cost to the healthcare system and is estimated to be responsible for 1 in every 6 healthcare dollars spent in the US. As cardiovascular disease is the leading cause of death worldwide, early detection, diagnosis, and management of chronic cardiac conditions are necessary to relieve the increasing burden on the healthcare infrastructure. Diagnostic tests such as ECGs are used to detect, diagnose, and track numerous cardiovascular conditions. With advances in mobile communications, diagnostic monitoring of cardiac conditions is increasingly occurring outside the hospital.

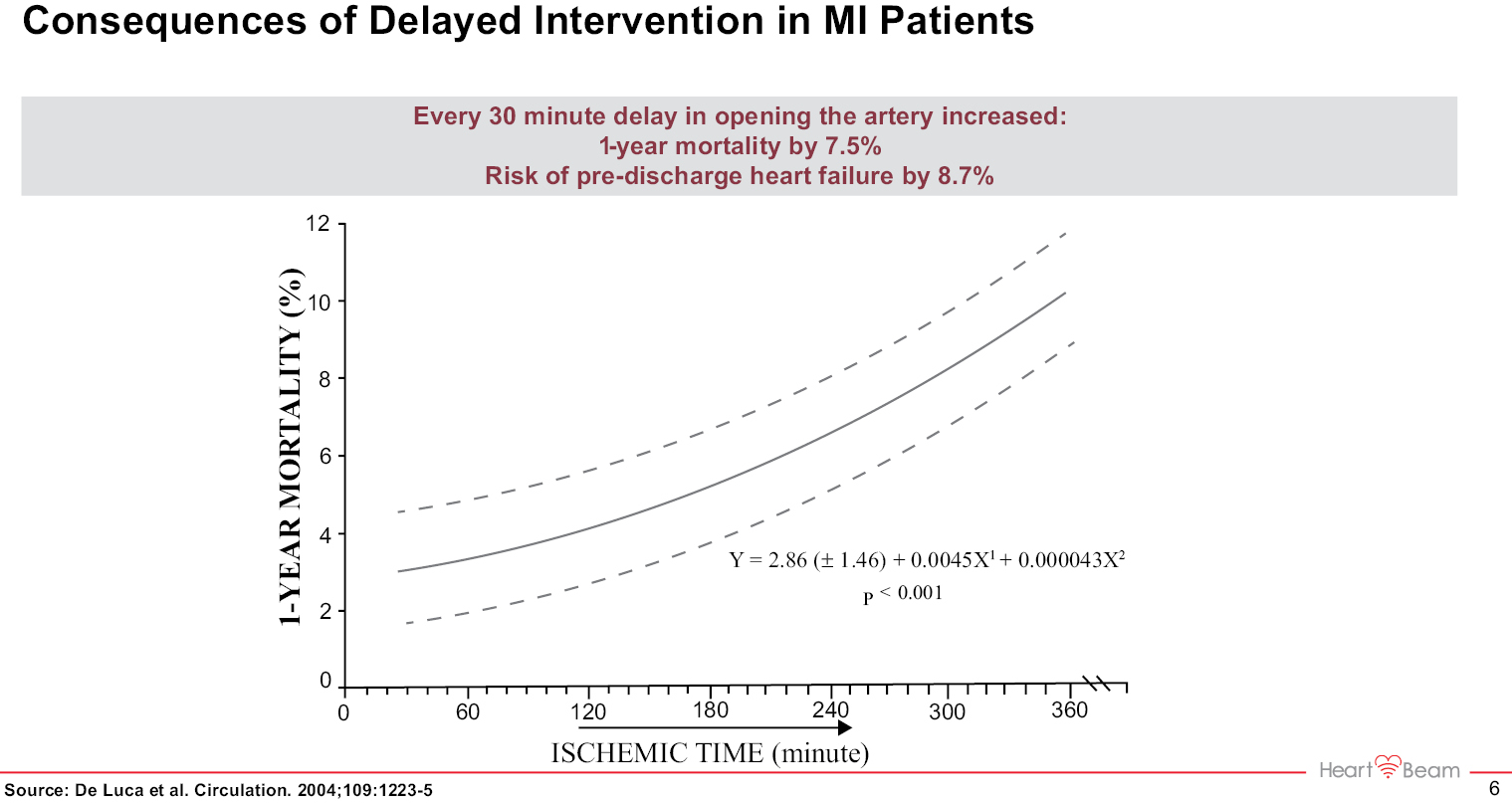

We intend to show that our easy to use device (without external electrodes) provides signals equivalent to a standard 12L device, and therefore will have a number of applications for ambulatory use. Our initial telemedicine technology Product HeartBeam AIMIGo will first address the heart attack detection market as well as the market to monitor CAD patients who are typically at high risk for a heart attack. Additionally, we expect to cater to patients across different risk profiles interested in our cardiac monitoring solutions for different heart conditions. Currently there are no products on the market that are user friendly, easy to carry, and always with the patient to provide physicians and patients with timely and highly accurate information about all heart conditions that could be detected with a 12L ECG, including potential ischemic events. A tool that is always with the patient, that decreases time to intervention, and that decreases the number of unnecessary ED visits by chest pain patients would have a significant effect on saving lives and healthcare dollars. We believe our technology will address this problem and will provide a convenient, cost-effective, integrated telehealth solution, including software and hardware for physicians and their patients. There are approximately 20 million people in the US who are considered at high risk for a heart attack, including 8 million who already have had prior intervention for MI’s and are therefore considered to be at extreme risk.

In the US, mobile cardiac tests are primarily conducted through outsourced Independent Diagnostic Testing Facilities (“IDTFs”) or as part of an RPM/telehealth system. Reimbursement rates vary depending on the use case and generally are based on the value a technology offers to patients and healthcare providers. Actual reimbursed pricing is set by the Centers for Medicare & Medicaid Services (“CMS”). Reimbursement rates for private insurers typically provide for similar or higher reimbursement rates when compared to those set by the government for Medicare and Medicaid.

In the ED environment, early and accurate diagnosis of a chest pain patient who is potentially having a heart attack is of immense importance. Guidelines state that every chest pain patient in an ED must receive an ECG within 10 minutes of presentation. The accuracy of these initial ECGs, interpreted by physicians, is only approximately 75%. The need for increased ECG accuracy in detecting a heart attack in the ED is well defined, and an improved solution could result in saved lives and healthcare dollars. A 510(k) for our ED Product, HeartBeam AIMI, was submitted for review on August 15, 2022 to the FDA. We believe this Product will offer an increase in the accuracy of heart attack detection in EDs. There are approximately 5,000 Emergency Departments in the US.

S-3

Products and Technology

The foundation of our novel technology is the concept of VECG, a technology that has long been seen as superior to ECGs in detecting MIs but is no longer used clinically because of the difficulty experienced by physicians interpreting the output. We solved the crucial problem of recording three orthogonal (x, y and z) projections of the heart vector with a device that is sized like a credit card. The thickness of our credit card sized ECG signal collection device is about 1/8 inch (4 mm), and it weighs about 1 ounce (28 grams). The core technology consists of a series of patented inventions and associated algorithms. In addition to using VECG to get a more complete 3D characterization of cardiac activity, we use the concept of a baseline. Our MI marker is a differential marker that measures the change in cardiac parameters between an asymptomatic (baseline) recording and the symptomatic recording. It is personalized for every patient as every patient has a unique baseline. Our increase in diagnostic performance in detecting MIs, when compared to a panel of cardiologists, is attributed to a richer cardiac information set offered by VECG and the fact that our MI marker compares the baseline and symptomatic recordings and does that in the 3D space of VECG.

This novel technology has resulted in two key Products to date: a telehealth Product for cardiovascular patients (HeartBeam AIMIGo) and a powerful cloud-based ECG interpretation based on a quantitative comparison of the patients 3D VECG baseline and symptomatic recordings for EDs (HeartBeam AIMI). Our telehealth ECG collection device is the size of a credit card and records cardiac signals with integrated electrodes rather than wires or self-adhesive electrodes. Unlike a standard 12-lead ECG machine that records signals in empirically determined locations on a human body, our approach is focused on recording three projections of the heart vector. The successful recording of the projections of the heart vector enables the synthesis, via a patented method, of a 12-lead signal set and internal algorithmic diagnostic work in the space of 3D heart vectors.

There are obvious ease of use advantages when comparing our handheld device that fits in a wallet and can be instantly self-applied versus the current 12-lead ECG machine that requires a trained professional to apply. In addition, there are diagnostic performance advantages, including, based on our initial study, increased accuracy in diagnosing MIs. The system is used by patients at home or elsewhere, and collected data is sent to a physician to assess whether the patient’s chest pain is truly the result of an MI.

Our telehealth HeartBeam AIMIGo system will be a prescription-only mobile health system intended for individuals with known or suspected heart disease, especially CAD. It helps guide physicians in choosing the best course of action for their patients who experience chest pain outside of a medical facility. HeartBeam AIMIGo will bring a medical grade ECG to patients and will enable them to receive a plan of action from a physician in a timely manner. At the time of onboarding and at regularly scheduled time intervals, patients record a baseline 30 second cardiac reading using our device. When a patient experiences symptoms, such as irregular heartbeats or chest pain, the patient can simply open the smartphone application and press the credit card sized device against the chest to collect signals that can be converted to a synthesized 12-lead ECG. This synthesized 12-lead ECG is sent to the physician overlayed with the patient’s synthesized baseline ECG recording. In addition, the patient provides input on their symptoms that is sent, along with the ECG data, to the cloud for interpretation by a physician. A cloud-based algorithm processes the signals and displays the symptom description and patient history to a physician to analyze and prescribe an action plan. From start to finish, the process takes just a few minutes.

The telehealth HeartBeam AIMIGo system consists of a number of capabilities that will be productized in an incremental fashion. These are:

1. A credit card sized cardiac electrical signal collection device. The device captures cardiac signals that represent x, y and z projections of the heart vector and transmits them via Bluetooth connection to a smartphone. It is always with the patient as it easily fits in a wallet. It is easy to use as all that is required of the patient is that the device be pressed against the chest.

2. A smartphone application that receives the cardiac signals from the HeartBeam signal collection device. The application has several functions: guiding the patient through the signal collection, asking about symptoms, displaying the status of the data collection including real time signal quality check, and notifying the patient of the plan of action as determined by a physician. In addition, the application will contain HIPAA-compliant video conferencing or text capabilities for the healthcare provider to communicate directly with the patient.

S-4

3. A cloud-based software system that serves four basic functions: (1) Performing a final check of the ECG signal quality, (2) Synthesizing a 12-lead ECG from the measured (recorded) 3 vector leads, (3) Creating a diagnostic suggestion based on 3D VECG interpretation, risk factors and symptoms and (4) Preparing a summary report for the physician. These software functions will be introduced to the HeartBeam AIMIGo product in a sequential manner. To facilitate a more accurate physician interpretation of the data, the software overlays the patient’s synthesized baseline 12 lead ECG waveform on the synthesized 12 lead ECG waveform from the current event. To ensure high signal quality, the system checks for noise levels in the recorded signals. Those signals that can be effectively filtered are accepted and those that have a noise level above an empirically established threshold are rejected. If a recorded signal is rejected, the user is asked to repeat the recording.

4. A web-based physician portal capable of displaying the following relevant information for the physician to analyze: diagnostic suggestion, patient history, symptoms, baseline and current, synthesized 12-lead ECG, and recorded 3 vector leads. Our physician portal assists physicians with their diagnostic interpretation by providing both the baseline 12-lead synthesized ECG and the 12-lead synthesized ECG that is under evaluation.

5. A dedicated ECG monitoring and reading team of medical professionals to offer 24/7/365 services in order to assist symptomatic patients when making a decision of whether they should go to the Emergency Department. This capability will be developed in-house or outsourced through a contracted third-party organization.

The market release of our telehealth Product will be in multiple versions.

The initial Product will have a limited feature set and introduce a 3-lead 3D VECG credit card-sized device, the HeartBeam AIMIGo 3L, that records the X,Y,Z cardiac activity and displays the signals for clinician review, providing the regulatory foundation for subsequent products in our product portfolio. The 510(k) submission to the FDA is planned for early 2023.

Following this we will offer to the physician a pair of baseline and symptomatic 12-lead ECGs, both synthesized from 3-lead 3D VECG signals recorded by the HeartBeam AIMIGo device, and a symptoms report. It leverages recently issued patents for a personalized system for synthesizing 12-lead ECG waveforms. The 510(k) submission to the FDA is planned for late 2023.

Future versions may include our proprietary ECG interpretation MI marker and our overall MI diagnostic suggestion in addition to all features of the earlier Products and may as well offer an automated atrial fibrillation detection algorithm.

The same core technology built into the telehealth Product HeartBeam AIMIGo is used in the ED Product HeartBeam AIMI. In this application, the increased accuracy of detecting MIs by the ECG is of utmost importance. An ECG is the first diagnostic test a chest pain patient receives in the ED and it has a major impact on the patient’s subsequent clinical path. The ED Product has no hardware and introduces minimal change to the standard of care chest pain diagnostic path. It uses a baseline standard 12-lead ECG from the patient’s Electronic Medical Record (“EMR”) and the standard 12-lead ECG that is being evaluated. It converts the two ECGs to a VECG representation and utilizes our proprietary 3D VECG differential marker to generate an ECG interpretation suggestion to be used by the ED physician. The importance of increased accuracy of the first ECG interpretation for a chest pain patient presenting to an ED is significant, potentially leading to faster intervention or avoiding unnecessary activation of the cardiac catheterization lab.

FDA Regulatory Path

We have defined the FDA 510(k) clearance paths for both Products and have contracted with regulatory consultants to help us clear both products with the FDA.

The initial Product will have a limited feature set and introduce a 3-lead 3D VECG credit card-sized device, the HeartBeam AIMIGo 3L, that records the X, Y, Z cardiac activity and displays the signals for clinician review, providing the regulatory foundation for subsequent products in our product portfolio.

S-5

The 510(k) submission to the FDA is planned for early Q2 2023. We are planning a subsequent 510(k) submission, in Q4 2023, for the Product, which will include the ability to generate synthesized 12L ECG recordings. The submission is planned to contain results of a validation study comparing our synthesized 12-lead ECG recordings to standard 12-lead ECG recordings.

HeartBeam’s ED software product, HeartBeam AIMI, is hosted on LIVMOR’s Class I registered software platform and a predicate device for the cloud-based diagnostic engine for the ED product was identified. The predicate device is widely used as part of a software package produced by a leading ECG machine manufacturer. The predicate device software makes a diagnostic suggestion regarding a potential MI diagnosis. HeartBeam AIMI will also make a diagnostic suggestion to the ED physician. In the HIDES pilot study, we showed improved performance in detecting ischemia over a panel of cardiologists.

For the FDA 510(k) regulatory submission, a retrospective study was performed comparing patients’ baseline and asymptomatic ECG recordings and providing a diagnostic suggestion from the HeartBeam AIMI software. The diagnostic suggestion of the predicate device software, that was already recorded in the patient’s EMR, was compared to the diagnostic suggestion of our Product. The 510(k) regulatory submission for market clearance was filed with the FDA on August 15, 2022.

Market Opportunity

ECGs are key diagnostic tests utilized in the diagnosis and monitoring of cardiovascular disease, the number one cause of death worldwide. In the US in 2016, there were approximately 120 million adults living with cardiovascular disease and approximately 20 million adults with diagnosed coronary artery disease. The prevalence of these cardiac conditions and thus the market size is increasing, due to an aging population and lifestyle choices.

Every 40 seconds someone in the US has a heart attack, or MI. Unfortunately, there is no way for patients to tell whether the symptoms they are experiencing are due to an MI, or some other more benign condition such as indigestion. As a result, patients often ignore symptoms and delay seeking care, which leads to worse outcomes and increased mortality. On the other hand, many patients who go to the ED with chest pain are not experiencing an MI. Chest pain is the second most common reason for an ED visit in patients over 45, yet fewer than 20% of chest pain ED visits result in a diagnosis of a life-threatening condition. These unnecessary ED visits lead to well over $10 billion in unnecessary healthcare expenditures.

Most ECGs are conducted in a healthcare facility setting using a 12-lead ECG machine, the gold standard. ECGs taken outside of healthcare facilities are expected to grow more quickly than in-hospital ECGs. Monitoring cardiac patients outside of a hospital is a fast-growing trend, as it is less expensive and provides a better patient experience. However, while ambulatory cardiac monitoring devices are often much easier for patients to use, they have fewer leads than the gold standard and therefore cannot offer as comprehensive a picture of cardiac health.

While a standard 12-lead ECG readout is of great medical value, it is simply impractical to have a standard 12-lead machine next to patients when they experience symptoms outside the clinical setting, since recording the event requires attaching multiple electrodes to the patient’s body with professional assistance. While existing technologies use predominantly single lead ECG devices to monitor arrhythmias, these technologies do not provide information to the physician on the presence of life-threatening conditions of acute coronary syndrome (“ACS”) or heart attacks.

We believe our telehealth technology addresses these market needs and has several key attributes that make it a good fit for these patients. Our telehealth Product is generally used when symptoms occur and offers the potential for lifelong patient usage. The device is practically always near the patient and ready to be used for recording a cardiac event. It enables very nearly real-time cardiac data transmission during a telemedicine visit. It offers a recorded 3 vector lead set of signals and a synthesized 12-lead ECG set of signals. We believe physicians will typically prescribe our solution to chronic cardiovascular patients for long term monitoring, thereby enabling prolonged data collection and delivering a more complete picture for diagnosis. This will also enable the use of artificial intelligence on our future database that will have a unique set of longitudinal synthesized 12-lead ECGs for patients.

As our VECG platform demonstrates 12-Lead equivalence and clinical & cost-effectiveness advantages, coupled with a patent protected technology, we believe this might open multiple licensing and/or partnering opportunities with players in the ECG, cardiac monitoring patch and smart watch verticals.

S-6

Market Strategy

Our goal is to establish our products as key solutions for cardiology practices and hospital EDs. Our efforts to enter the market involve establishing clinical evidence and demonstrating the cost-effectiveness of adopting our products. For both the telehealth (HeartBeam AIMIGo) and the ED Products (HeartBeam AIMI), the initial geographic market is the United States.

We believe that both the telehealth and ED Products will be subject to the US FDA’s 510(k) review process. A 510(k) for our HeartBeam AIMI was submitted to the FDA on August 15, 2022, for review and we are in the process of preparing a 510(k) submission for HeartBeam AIMIGo.

For HeartBeam AIMIGo, the primary customers are cardiology practices and the cardiology departments of hospitals. Healthcare insurers are another important customer, as they will potentially benefit from the reduced costs to the healthcare system. We are working to develop new clinical studies and publish results of completed clinical studies and plan to demonstrate real world cost-effectiveness of the use of the solution.

Our initial targets for HeartBeam AIMIGo are market segments that see value in an easy-to-use device that can generate synthesized 12L ECG recordings. These will be segments in which payment for the device will be outside of the established reimbursement system. These target segments include concierge practices, hospital-at-home segment and clinical trials. As we establish clinical data on the clinical and cost-effectiveness of HeartBeam AIMIGo, we will target at-risk cardiology practices, including high risk patients being discharged from hospitals after experiencing an MI.

Our long-term strategy is to generate sufficient evidence of clinical efficacy and cost-effectiveness to generate reimbursement coverage and payment specifically for the HeartBeam AIMIGo solution. We expect to be able to demonstrate significant clinical benefits for patients and savings to the healthcare system, justifying appropriate reimbursement levels.

For the telehealth Product, our primary marketing strategy will focus on the medical community with continued validation of clinical efficacy and cost-effectiveness and the establishment of reference sites. We will also create educational materials and provide other support to help educate our customers’ patients.

We will explore other business models. For example, hospitals face CMS penalties if their 30-day readmission rates for patients who are discharged after an MI exceed certain thresholds. These CMS penalties are levied on all hospital CMS payments, so the impact can be significant. Our telehealth Product can be a tool to help hospitals manage these patients after discharge. We will explore models in which hospitals pay for the device and for the initial 30 days of service. In addition, we will explore models for value-based care, in which the use of the telehealth Product reduces overall costs.

We are currently speaking with hospitals in large healthcare systems to educate them about our first two products. These are sophisticated customers, and we plan to use technical presentations, peer reviewed clinical data, and demonstration projects to achieve penetration of this market. We plan to continue to expand our medical advisory board, conduct clinical trials with leading cardiologists to increase the body of evidence, and establish reference sites among these customers.

For the ED Product, the primary customers are acute care facilities. As with the telehealth Product, we plan to publish clinical studies on the effectiveness of the Product. In addition, we plan to develop financial models demonstrating the cost-effectiveness of the approach and establish reference sites who are using the Product. We do not expect to obtain specific reimbursement for the ED Product but intend to demonstrate that the purchase of the software would result in clinical and economic benefits and potentially reduced malpractice legal exposure for ED provider institutions.

We expect our value proposition will be progressively increased as we gradually add additional functionality to our monitoring solutions and drive down the cost of continuous monitoring by increasing scale and automation. We expect our HeartBeam AIMIGo device and AIMI software to gradually incorporate internally developed algorithms with the capabilities of detecting heart conditions that can be exposed via a standard 12-L ECG device. Additionally, as we collect rich longitudinal data sets from our patients, we expect to train AI and ML algorithms that could potentially have predictive capabilities regarding different heart conditions. Over time and with scale we expect our costs to decrease and provide more and better services to our patients by improving our capabilities.

We plan to establish a direct sales network with relationships and experience selling to our target markets.

S-7

Clinical Data

HeartBeam has performed three initial clinical studies to assess performance of our technologies.

In the first study (HeartBeam Ischemia Detection Study — HIDES), we simultaneously collected traditional 12-lead ECG and vector X,Y and Z signals on patients whose coronary arteries were occluded during a Percutaneous Coronary Intervention (PCI). Our VECG-based signal interpretation system had significantly (21%) higher accuracy in detecting ischemia.

In a second study (B Score), the HeartBeam diagnostic engine, using ECG, symptoms, and history, matched the diagnostic performance of expert cardiologists in detecting the presence of MIs in patients presenting to an ED with chest pain. This result indicates that the quality of the diagnostic advice produced by our expert system will be extremely valuable to the physician who is assessing the condition of a patient in a telehealth environment.

The third study, ISPEC, which assessed the false positive rate for non-symptomatic patients, is relevant in a telehealth situation. It is important that the system have a low false positive rate when patients are conducting baseline recordings, which are required on at least a monthly basis. The study yielded no false positives.

All three studies are being prepared for peer-reviewed publication.

Intellectual Property

We believe our intellectual property (“IP”) protects our innovations, and our goal is to become a leader in the ambulatory VECG sector. For some aspects of our proprietary technology, we rely on trade secret protection. It is our view that the combination of these two methods of IP protection maximizes our chances for success.

HeartBeam has nine issued U.S. patents (U.S. 10,433,744, U.S. 10,117,592, U.S. 11,071,490, U.S. 11,419,538, U.S. 11,445,963, U.S. 11,529,085, U.S. 10,980,433, U.S. 11,412,972 and U.S. 11,234,658), and six pending U.S applications. Four of the pending applications have been published, the remaining two pending cases are unpublished. Outside of the U.S., HeartBeam has four issued patents in Germany, France, Netherlands, and United Kingdom and seven pending applications in Canada, China, the European Union (“EU”), Japan and Australia. HeartBeam has three pending PCT applications. The issued patents are predicted to expire between April 11, 2036 and April 21, 2042.

Our issued and pending U.S. patent applications cover compact VECG systems for remote detection and/or diagnosis of acute myocardial infarction (“AMI”). Outside of the U.S., the pending EU, Australian (“AU”), Japanese (“JP”) and Chinese (“CN”) patent applications correspond to the pending and issued US cases. The pending PCT applications cover methods and apparatuses for automatic cardiac diagnosis as well as compact systems including retractable electrodes.

Research and Development

The primary objective of our research and development program is to provide innovative, user-friendly, ambulatory VECG solutions with high medical value. To date, we have been highly successful in developing our initial products. The emphasis has been on developing a user-friendly solution that is always with the patient and assists physicians in diagnosing heart attacks in chest pain patients.

Our Research team is largely based in Belgrade, Serbia as well as in California, USA. We have assembled a highly capable Belgrade team currently consisting of seven PhD level contributors who are credited with developing our key inventions and patents. The diverse group includes:

• Two nuclear physicists.

• Two Biomedical Engineers experienced in developed digital health applications.

• Two highly experienced Healthcare IT development professionals.

• Two Electrical Engineers (M.S.E.E) with strong signal processing and ECG analysis algorithm expertise from the medical device industry.

S-8

• An Electrical Engineer (M.S.E.E) with exceptional implantable medical device development and power optimization expertise.

• A Software Engineer, (PhD Computer Science), with deep expertise in developing mobile applications for medical devices.

Future research and development efforts will focus on the application of signal processing and artificial intelligence to address a range of cardiac conditions.

During 2022 we also added 3 development engineers led by our recently hired Chief Technology Officer Kenneth Persen. This is an experienced development team that worked together previously and was successful in delivering FDA cleared products.

Future Products

Our core technology — the heart vector approach adopted and invented by our research team — is a platform technology that can provide diagnostic solutions to a variety of cardiovascular patients. Our plans call for expanding solutions that diagnose all major cardiac conditions that are diagnosed by ECGs.

Our future plans include the development of a VECG-based, synthesized 12-lead capable patch ECG monitor that will provide advantages over existing single-lead ECG patch products such as the Zio-XT from iRhythm Technologies, Inc. Our approach will offer a synthesized 12-lead ECG with a patch that is very similar, in dimensions and look and feel, to the currently available single lead ECG patches. We believe providing standard of care 12-lead ECG capabilities will have significant diagnostic advantages over a single lead patch.

We also plan to integrate a synthesized 12-lead ECG smartwatch-based monitor intended for detection of heart attacks and complex cardiac arrhythmias. This invention eliminates the need for a dedicated ECG device while offering a synthesized 12-lead ECG capability enabling heart attack and complex arrhythmia detection.

While our initial telehealth Product is powered by a software expert system that serves as a diagnostic aid to a physician, we will develop an AI based diagnostic system that will supplement our diagnostic expert system.

We are committed to continue advancing the full potential inherent in our synthesized 12-lead 3D VECG technology as demonstrated in recently issued and allowed patents with potentially disruptive market impacts.

Corporate Information

HeartBeam was incorporated as a C corporation under the laws of the State of Delaware on June 11, 2015. We do not own any subsidiaries. Our corporate offices are located at 2118 Walsh Avenue, Suite 210, Santa Clara, CA 95050. Our telephone number is (408) 899-4443. The address of our website is https://www.heartbeam/. The inclusion of our website address in this prospectus does not include or incorporate by reference the information on our website into this prospectus.

S-9

OFFERING SUMMARY

This summary highlights certain information about this offering and selected information contained elsewhere in or incorporated by reference into this prospectus supplement. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in securities. For a more complete understanding of our company and this offering, we encourage you to read and consider carefully the more detailed information in this prospectus supplement and the accompanying base prospectus, including the information incorporated by reference into this prospectus supplement and the accompanying base prospectus, and the information referred to under the heading “RISK FACTORS” in this prospectus supplement on page S-11 and on page 9 of the accompanying base prospectus, and in the documents incorporated by reference into this prospectus supplement and the accompanying base prospectus.

|

Issuer |

HeartBeam, Inc. |

|

|

Common stock offered by us |

1,000,000 shares |

|

|

Common stock outstanding prior to the offering(1) |

|

|

|

Common stock to be outstanding after this offering(1) |

|

|

|

Common Stock Trading symbol |

Our Common Stock is traded on Nasdaq Capital Market under the symbol “BEAT”. |

|

|

Use of proceeds |

We intend to use the net proceeds from the offering for working capital and general corporate purposes. See “Use of Proceeds.” |

|

|

Risk factors |

This investment involves a high degree of risk. See “Risk Factors” and other information included or incorporated by reference in this prospectus supplement beginning on page S-11 and the accompanying base prospectus beginning on page 9 for a discussion of certain factors you should carefully consider before deciding to invest in shares of our common stock. |

____________

(1) The number of shares of Common Stock outstanding is based on shares of Common Stock issued and outstanding as of December 31, 2022 plus the 16,666,666 shares of Common Stock issued on May 2, 2023 and excludes the following:

• 2,196,798 shares of Common Stock issuable upon the exercise of outstanding stock options having a weighted average exercise price of $1.76 per share;

• 253,970 shares of Common Stock issuable upon vesting of RSUs;

• 3,908,276 shares of Common Stock issuable upon the exercise of outstanding warrants having a weighted average exercise price of $5.42 per share;

• 747,364 shares of Common Stock reserved for future issuance under the Company’s 2022 Equity Incentive Plan.

Except as otherwise indicated herein, all information in this prospectus reflects or assumes:

• no exercise of the outstanding options described above;

S-10

Investment in any securities offered pursuant to this prospectus and the applicable prospectus supplement involves risks. You should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the risk factors and other information contained in the applicable prospectus supplement before acquiring any of such securities. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

Risks Relating to this Offering

We may allocate the net proceeds from this offering in ways that you or other stockholders may not approve.

We currently intend to use the net proceeds of this offering, if any, for working capital and general corporate purposes, which may include capital expenditures, research and development expenditures, regulatory affairs expenditures, clinical trial expenditures, acquisitions of new technologies and investments, and the financing of possible acquisitions or business expansions. This expected use of the net proceeds from this offering represents our intentions based upon our current plans and business conditions. The amounts and timing of our actual expenditures may vary significantly depending on numerous factors, including the progress of our development efforts, the status of and results from clinical trials, as well as any third-party intellectual property or other assets that we may opportunistically identify and seek to license or acquire or any collaborations that we may enter into with third parties for our product candidates, and any unforeseen cash needs. Because the number and variability of factors that will determine our use of the proceeds from this offering, their ultimate use may vary substantially from their currently intended use. As a result, our management will retain broad discretion over the allocation of the net proceeds from this offering and could spend the proceeds in ways that do not necessarily improve our operating results or enhance the value of our common stock. See “Use of Proceeds.

Sales of our common stock in this offering, or the perception that such sales may occur, could cause a drop in the market price of our common stock.

We may issue and sell shares of our common stock for aggregate gross proceeds of up to $13 million from time to time in connection with this offering. The issuance and sale from time to time of these new shares of common stock, or our ability to issue these new shares of common stock in this offering could have the effect of depressing the market price of our common stock.

We may sell additional shares of our common stock to fund our operations, which sales may occur during or immediately after sales pursuant to this offering are commenced, which would result in dilution to our shareholders.

In order to raise additional funds to support our operations, we may sell additional shares of our common stock, which would result in dilution to all of our shareholders that may adversely impact our business. See “Dilution.” In particular, at any time, including during the pendency of this offering, we may sell additional shares of our common stock, other than pursuant to this offering, in amounts that may be material to us, which may be in amounts that are equal to or greater than the size of this offering, including, without limitation, through underwritten public offerings, privately negotiated transactions, block trades, or any combination of the above, subject, in certain circumstances, to the consent of the Agent. We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing shareholders. The price per share at which we sell additional shares of our common stock or other securities convertible into or exchangeable for our common stock in future transactions may be higher or lower than the price per share in this offering.

S-11

SPECIAL NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve risks and uncertainties, principally in the sections entitled “Risk Factors.” All statements other than statements of historical fact contained in this prospectus, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this prospectus, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, that performance or those results will be achieved. Forward-looking statements are based on information available at the time they are made and/or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from what is expressed in or suggested by the forward-looking statements.

Forward-looking statements speak only as of the date they are made. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

S-12

We currently intend to use the net proceeds from this offering, if any, for working capital and general corporate purposes.

The timing and amount of our actual expenditures will be based on many factors, including cash flows from operations and the anticipated growth of our business. As of the date of this prospectus, we cannot specify with certainty all of the particular uses for the net proceeds to us from this offering. As a result, our management will have broad discretion regarding the timing and application of the net proceeds from this offering. Pending their ultimate use, we intend to invest the net proceeds in short-term, investment-grade, interest-bearing instruments.

MARKET PRICE OF OUR COMMON STOCK

Our common stock is presently listed on The NASDAQ Global Market under the symbol “BEAT”. On May 3 2023, the last reported sale price of our common stock was $2.31.

Holders

As of May 3, 2023 we had 50 registered holders of record of our common stock. A substantially greater number of holders of our common stock are “street name” or beneficial holders, whose shares of record are held through banks, brokers, other financial institutions and registered clearing agencies.

We have never declared or paid cash dividends on our capital stock. We currently intend to retain our future earnings, if any, for use in our business and therefore do not anticipate paying cash dividends in the foreseeable future. Payment of future dividends, if any, will be at the discretion of our board of directors after taking into account various factors, including our financial condition, operating results, current and anticipated cash needs and plans for expansion.

DESCRIPTION OF SECURITIES WE ARE OFFERING

In this offering, we are offering a 1,000,000 maximum of shares of our Common at public offering price of $1.50 per share.

The material terms and provisions of our Common Stock are described under the caption “Description of Capital Stock” starting on page 12 of the accompanying base prospectus.

Transfer Agent

The transfer agent and registrar for our common stock is VStock Transfer, LLC with an address at 18 Lafayette Pl, Woodmere, NY 11598.

S-13

The validity of the shares of common stock offered hereby will be passed upon for us by Lucosky Brookman LLP.

The financial statements as of and for the year ended December 31, 2022 incorporated by reference in this registration statement have been audited by Marcum LLP, an independent registered public accounting firm, as stated in their report (the report on the financial statements contains an explanatory paragraph regarding the Company’s ability to continue as a going concern). Such financial statements are incorporated by reference in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

The financial statements as of and for the year ended December 31, 2021 incorporated by reference in this registration statement have been audited by Friedman LLP, an independent registered public accounting firm, as stated in their report. Such financial statements are incorporated by reference in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

S-14

The SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus modifies or replaces that statement.

We incorporate by reference our documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this prospectus, between the date of this prospectus and the termination of the offering of the securities described in this prospectus. We are not, however, incorporating by reference any documents or portions thereof, whether specifically listed below or filed in the future, that are not deemed “filed” with the SEC, including any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits furnished pursuant to Item 9.01 of Form 8-K.

This prospectus supplement incorporates by reference the documents listed below, other than those documents or the portions of those documents deemed to be furnished and not filed in accordance with SEC rules:

• our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 16, 2023;

• our Current Reports on Form 8-K filed with the SEC on January 24, 2023, February 2, 2023, March 3, 2023, March 8, 2023, March 9, 2023, March 13, 2023, March 24, 2023, and May 3, 2023; and

• our 2022 equity incentive plan on Form S-8 filed with the SEC July 13, 2022;

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering, including all such documents we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may request a free copy of any of the documents incorporated by reference in this prospectus (other than exhibits, unless they are specifically incorporated by reference in the documents) by writing or telephoning us at the following address:

Branislav Vajdic

Chief Executive Officer

2118 Walsh Avenue, Suite 210

Santa Clara, CA 95050

Telephone: 408-899-4443

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus and any accompanying prospectus supplement.

S-15

PROSPECTUS

HeartBeam, Inc.

$100,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

We may offer and sell up to $100,000,000 in the aggregate of the securities identified above from time to time in one or more offerings. This prospectus provides you with a general description of the securities.

Each time we offer and sell securities, we will provide a supplement to this prospectus that contains specific information about the offering and the amounts, prices and terms of the securities. The supplement may also add, update or change information contained in this prospectus with respect to that offering. You should carefully read this prospectus and the applicable prospectus supplement before you invest in any of our securities.

We may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters, dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information. No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of the offering of such securities.

INVESTING IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” ON PAGE 9 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED IN THE APPLICABLE PROSPECTUS SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

Our common stock and warrants are listed on The NASDAQ Capital Market under the symbol “BEAT” and “BEATW”, respectively. On March 7, 2023, the last reported sale price of our common stock on The NASDAQ Capital Market was $3.39 per share.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is February 10, 2023.

TABLE OF CONTENTS

|

Page |

||

|

ii |

||

|

1 |

||

|

9 |

||

|

10 |

||

|

11 |

||

|

12 |

||

|

16 |

||

|

22 |

||

|

24 |

||

|

25 |

||

|

26 |

||

|

28 |

||

|

28 |

||

|

28 |

||

|

29 |

i

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”), using a “shelf” registration process. By using a shelf registration statement, we may sell securities from time to time and in one or more offerings up to a total dollar amount of $100,000,000 as described in this prospectus. Each time that we offer and sell securities, we will provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and sold and the specific terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you should rely on the prospectus supplement. Before purchasing any securities, you should carefully read both this prospectus and the applicable prospectus supplement, together with the additional information described under the headings “Where You Can Find More Information” and “Incorporation by Reference.”

We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

When we refer to “BEAT,” “we,” “our,” “us” and the “Company” in this prospectus, we mean HeartBeam, Inc., unless otherwise specified. When we refer to “you,” we mean the holders of the applicable series of securities.

ii

Corporate History and Information

HeartBeam was incorporated as a C corporation under the laws of the State of Delaware on June 11, 2015. We do not own any subsidiaries.

Company Overview

We are a medical technology company primarily focusing on developing and commercializing higher resolution ambulatory Electrocardiogram (“ECG”) solutions that enable the detection and monitoring of cardiac disease outside a healthcare facility setting. Our ability to develop higher resolution ECG solutions is achieved through the development of our proprietary and patented Vector Electrocardiography (“VECG”) technology platform. Our vector electrocardiography technology is capable of developing three-dimensional (3D) images of cardiac electrical activity by displaying the spatial locations of ECG waveforms that has demonstrated in early studies to deliver equal or superior diagnostic capability than traditional hospital based ECG systems.

3D projections of cardiac vectors

Our aim is to deliver innovative, remote patient monitoring (“RPM”) technologies that can be used for patients anywhere where critical cardiac care decisions can be made on a more timely basis. Our products require Food and Drug Administration (“FDA”) clearance and have not been cleared for marketing (hereinafter “Product” or “Products”.)

We believe our Products and services will benefit many stakeholders, including patients, healthcare providers, and healthcare payors. We are developing Generation 1 of our telehealth product (“HeartBeam AIMIGoTM”) to address the rapidly growing field of RPM. HeartBeam AIMIGo is comprised of a credit card sized electrocardiogram device and a powerful cloud-based diagnostic expert software system. We believe that we are uniquely positioned to play a central role in remote monitoring of high-risk coronary artery disease patients, because the initial studies have shown that our ischemia detection system may be more accurate than existing RPM solutions.

Photographs of version 1 HeartBeam AIMIGo devices in planer and ready to use position.

1

We are also applying our software platform to create a tool for detecting heart attacks in the emergency room environment using traditional ECG devices. The software tool, (“HeartBeam AIMI(TM)”) is designed to enable emergency physicians to more accurately and quickly diagnose heart attacks than currently available. Market release of this Product will precede that of HeartBeam AIMIGo.

To date, we have developed working prototypes for both HeartBeam AIMIGo and HeartBeam AIMI. HeartBeam AIMI has been submitted for FDA 510(k) clearance and we have received questions from the FDA within the statutory 30-day review deadline, discussed the questions via teleconference with the FDA review team and provided written responses addressing the questions to the primary reviewer. We believe we are on track for FDA clearance this quarter.

The custom software and hardware of our Products, we believe, are classified as Class II medical devices by the FDA, running on an FDA approved Class I registered platform. Class II medical devices are those for which general controls alone are insufficient to provide reasonable assurance of safety and effectiveness and there is sufficient information to establish special controls. Special controls can include performance standards, post-market surveillance, patient histories and FDA guidance documents. Premarket review and clearance by the FDA for these devices is generally accomplished through the 510(k) or 510(k) de-novo premarket notification process.

Recent Developments not Incorporated by Reference

In September 2022, we were granted two patents;

• We were granted a 12-lead ECG patch monitor intended for detection of acute coronary syndrome (“ACS”) and cardiac arrhythmia by the United States Patent and Trademark Office. The innovation builds on our growing intellectual property portfolio enabling synthesized 12-lead ECG diagnostics outside of a medical setting.

• We were also granted a patent that enables generation of a synthesized 12-lead ECG by the HeartBeam AIMIGo credit card-sized device by the United States Patent and Trademark Office. The innovation opens the pathway for a patient to record a set of signals using HeartBeam AIMIGo outside of a medical setting with a diagnostic synthesized 12-lead ECG immediately transmitted to a physician for review and diagnosis. Unlike single-lead ECG products currently in the marketplace, such as other credit card sized devices or smartwatches, our technology is intended to quickly and accurately help a physician identify a heart attack (“Myocardial Infarction” or “MI”).

In October 2022, we announced the expansion of our product pipeline with smartwatch connectivity enablement for 24/7 heart monitoring capability. The product pipeline advancement allows for the addition of arrhythmia detection capabilities to address the multibillion-dollar global market for atrial fibrillation and other arrhythmia monitoring. This capability builds on our recently issued patents. This broader product portfolio enables the following:

• Introducing a 3-lead 3D vector electrocardiogram credit card-sized device, the HeartBeam AIMIGo 3L, that records the X,Y,Z cardiac activity and displays the signals for clinician review, providing the regulatory foundation for subsequent products in our product portfolio. The 510(K) submission to the FDA is planned for Q4 2022.

• Leveraging recently issued patents to incorporate both synthesized baseline and symptomatic 12-lead signals for enhanced diagnostic accuracy as well as the addition of atrial fibrillation detection capability in the HeartBeam AIMIGo 12L device for FDA 510(K) submission in Q2 2023.

• Broadening of the product portfolio profile to enable smartwatch connectivity to our platform in future products as an optional monitoring solution for the clinician and the patient.

In October 2022, we announced the appointment of Peter J. Fitzgerald, MD, Ph. D, as Chief Medical Officer. Dr. Fitzgerald is the Director of the Center for Cardiovascular Technology and Director of the Cardiovascular Core Analysis Laboratory at Stanford University Medical School. In addition to his world-renowned expertise in interventional cardiology, Dr. Fitzgerald is an accomplished inventor, entrepreneur, and investment fund founder.

In November 2022, we announced that our patent for a 12-lead ECG smartwatch-based monitor intended for detection of heart attacks and complex cardiac arrhythmias was allowed by the United States Patent and Trademark Office. The innovation builds on our growing intellectual property portfolio enabling 12-lead ECG diagnostics outside of a medical setting.

2

Market Overview

Chronic diseases are the number one burden on the healthcare system, driving up costs each year, and cardiovascular illnesses are one of the top contributors. Regulators, payors and providers are focused on shifting the diagnosis and management of these conditions to drive better outcomes at lower cost. Connected medical solutions are expanding rapidly and are projected to reach $155 billion by 2026, a compound annual growth rate (“CAGR”) of 17%. These solutions are socio-technical models for healthcare management and delivery using technology to provide healthcare services remotely and aim to maximize healthcare resources and provide increased, flexible opportunities for consumers to engage with clinicians and better self-manage their care, using readily available consumer technologies to deliver patient care outside of the hospital or doctor’s office. The types of companies that make up this market include Accenture, IBM, SAP, GE Healthcare, Oracle, Microsoft, Airstrip Technology, Medtronic, Allscripts, Boston Scientific, Athenahealth, Cerner, Philips, Agamatrix, Qualcomm, and AliveCor.

The market for RPM, is projected to reach $31.3 billion by the end of 2023. In 2019, 1,800 hospitals in the US were using mobile applications to improve risk management and quality of care. The number in 2020 was likely larger as the onset of the COVID-19 pandemic greatly accelerated use and acceptance of telehealth by both patients and healthcare providers.

Cardiovascular disease is the number one cost to the healthcare system and is estimated to be responsible for 1 in every 6 healthcare dollars spent in the US. As cardiovascular disease is the leading cause of death worldwide, early detection, diagnosis, and management of chronic cardiac conditions are necessary to relieve the increasing burden on the healthcare infrastructure. Diagnostic tests such as ECGs are used to detect, diagnose and track numerous cardiovascular conditions. With advances in mobile communications, diagnostic monitoring of cardiac conditions is increasingly occurring outside the hospital.

Our initial telemedicine technology Product will address the heart attack detection market as well as the market to monitor coronary artery disease (“CAD”) patients who are typically at high risk for a heart attack. Currently there are no products on the market that are user friendly, easy to carry, and always with the patient in order to provide physicians and patients with timely and highly accurate information about potential ACS and MI events. A tool that is always with the patient, that decreases time to intervention, and that decreases the number of unnecessary ED visits by chest pain patients would have a significant effect on saving lives and healthcare dollars. We believe our technology will address this problem and will provide a convenient, cost-effective, integrated telehealth solution, including software and hardware for physicians and their patients. There are approximately 18 million people in the US who are considered at high risk for a heart attack, including 8 million who already have had prior intervention for MI’s and are therefore considered to be at extreme risk.

In the US, mobile cardiac tests are primarily conducted through outsourced Independent Diagnostic Testing Facilities (“IDTFs”) or as part of an RPM system. Reimbursement rates vary depending on the use case and generally are based on the value a technology offers to patients and healthcare providers. Actual reimbursed pricing is set by the Centers for Medicare & Medicaid Services (“CMS”). Reimbursement rates for private insurers typically provide for similar or better reimbursement rates when compared to those set by the Government for Medicare and Medicaid.

In the ED environment, early and accurate diagnosis of a chest pain patient who is potentially having a heart attack is of immense importance. Guidelines state that every chest pain patient in an ED must receive an ECG within 10 minutes of presentation. The accuracy of these initial ECGs is only approximately 75%. The need for increased ECG accuracy in detecting a heart attack in the ED is well defined, and an improved solution could result in saved lives and healthcare dollars. A 510(K) for our ED Product was submitted for review on August 15, 2022 to the FDA. We believe this Product will offer a marked increase in the accuracy of heart attack detection in EDs. There are approximately 5,000 ED departments in the US.

Products and Technology

The foundation of our novel technology is the concept of VECG, a technology that has long been seen as superior to ECGs in detecting MIs but is no longer used clinically because of the difficulty experienced by physicians interpreting the output. We solved the crucial problem of recording three orthogonal (x, y and z) projections of the heart vector with a device that is sized like a credit card. The thickness of our credit card sized ECG signal collection device is about 1/8 inch (3 mm), and it weighs about 1 ounce (28 grams). The core technology consists of a series of patented inventions and associated algorithms. In addition to using VECG to get a more complete 3D characterization of

3

cardiac activity, we use the concept of a baseline. Our MI marker is a differential marker that measures the change in cardiac parameters between an asymptomatic (baseline) recording and the symptomatic recording. It is personalized for every patient as every patient has a unique baseline. Our increase in diagnostic performance in detecting MIs, when compared to a panel of cardiologists, is attributed to a richer cardiac information set offered by VECG and the fact that our MI marker compares the baseline and symptomatic recordings and does that in the 3D space of VECG.

This novel technology has resulted in two key Products to date: a telehealth Product for high-risk cardiovascular patients (HeartBeam AIMIGo) and a powerful cloud-based diagnostic expert and MI detection system for EDs (HeartBeam AIMI). Our telehealth ECG collection device is the size of a credit card and records cardiac signals with integrated electrodes rather than wires or self-adhesive electrodes. Unlike a standard 12-lead ECG machine that records signals in empirically determined locations on a human body, our approach is focused on recording three projections of the heart vector. The successful recording of the projections of the heart vector enables the synthesis of a 12-lead signal set and internal algorithmic diagnostic work in the space of 3D heart vectors.

There are obvious ease of use advantages when comparing our handheld device that fits in a wallet and can be instantly self-applied versus the current 12-lead ECG machine that requires a trained professional to apply. In addition, there are diagnostic performance advantages, including, based on our initial study, increased accuracy in diagnosing MIs. The system is used by patients at home or elsewhere, with help from their physicians, to assess whether their chest pain is truly the result of an MI.