UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | |

| ☑ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under § 240.14a-12 |

HeartBeam, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the boxes that apply):

| | | | | |

| þ | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

HEARTBEAM, INC.

2118 Walsh Avenue, Suite 210

Santa Clara, CA 95050

(408) 899-4443

Notice of Special Meeting of Shareholders

Dear HeartBeam Shareholders:

It is our pleasure to invite you to attend HeartBeam, Inc.’s 2022 Special Meeting of Stockholders (the “Special Meeting”).

Date: November 14, 2022 (Monday)

Time: 1:00 p.m., Eastern Standard Time

Virtual

Location: You can attend the Special Meeting online, including to vote and/or submit questions, at www.virtualshareholdermeeting.com/BEAT2022SM. See page 1 of the accompanying proxy statement for additional information regarding participation in the virtual meeting.

Items of At the Special Meeting, shareholders will be asked to vote on the following proposals:

Business:

| | | | | | | | |

| 1 | | To approve an amendment to the Company’s Certificate of Incorporation to increase our authorized shares of Common Stock to 100,000,000 shares |

| | |

| 2 | | To approve an amendment to the Company’s Certificate of Incorporation to authorize 10,000,000 shares of “blank check” Preferred Stock. |

| | |

Record Date: You are entitled to notice of the Special Meeting, and can participate and vote at the Special Meeting if you were a

shareholder of record as of the close of business on September 30, 2022.

Voting: Your vote is very important to us. Whether or not you plan to attend the virtual Special Meeting, please ensure your

shares are represented by voting promptly. For instructions on how to vote your shares, please refer to the

instructions included with this proxy statement or on your proxy card or voting instruction form.

| | |

| By order of the Board of Directors, |

|

| /s/ Branislav Vajdic |

| Branislav Vajdic |

| President and Chief Executive Officer |

| Santa Clara, California, [*], 2022 |

| | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MONDAY NOVEMBER 14, 2022:

Our official Notice of Special Meeting of Stockholders and Proxy Statement are available at: www.proxyvote.com |

TABLE OF CONTENTS

HEARTBEAM, INC.

2118 Walsh Avenue, Suite 210

Santa Clara, CA 95050

(408) 899-4443

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 14, 2022

GENERAL

This proxy statement (“Proxy Statement”) is being furnished to the shareholders (the “Shareholders”) of HeartBeam, Inc., a Delaware corporation (the “Company” or "HeartBeam"), in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board”) from the Shareholders for use at the 2022 Special Meeting of Shareholders to be held at 1:00 p.m., Eastern Standard Time, on Monday, November 14, 2022, and any continuations, postponements or adjournments thereof (the “Special Meeting”). The Special Meeting will be held virtually. To participate in the virtual meeting, click on www.virtualshareholdermeeting.com/BEAT2022SM. This Proxy Statement and the accompanying Notice and proxy card are first being mailed to Shareholders on or about [*], 2022.

INFORMATION ABOUT THE MEETING

When and where is the Special Meeting?

The Special Meeting will be held at 1:00 p.m., Eastern Standard Time, on Monday, November 14, 2022. To participate in the virtual meeting, click on ww.virtualshareholdermeeting.com/BEAT2022SM

Why did I receive these materials?

Our Board has provided these proxy materials to you, in connection with our Board’s solicitation of proxies for use at the Special Meeting. As a Shareholder, you are invited to attend the Special Meeting virtually and vote per the virtual meeting instructions or you may vote by proxy on the proposals described in this Proxy Statement.

What is included in the proxy materials?

The proxy materials include:

•this Proxy Statement; and

•the proxy card or voting instruction form

What is being considered at the Special Meeting?

At the Special Meeting, our Shareholders will be acting on the following proposals:

1. To approve an amendment to the Company’s Certificate of Incorporation to increase our authorized shares of Common Stock to 100,000,000 shares.

2. To approve an amendment to the Company’s Certificate of Incorporation to authorize 10,000,000 shares of “blank check” Preferred Stock.

Who is entitled to vote at the Special Meeting?

You may vote at the Special Meeting if you owned shares of the Company's Common Stock (the "Common Stock") as of the close of business on the record date, which is set for September 30, 2022 (the "Record Date"). You are entitled to one vote for each share of Common Stock that you held as of the record date.

How many shares are eligible to be voted at the Special Meeting?

There were 8,000,870 shares of Common Stock issued and outstanding as of the Record Date, each of which entitles the holder thereof to one vote at the Special Meeting.

How do I vote?

You can vote in the following ways:

•by attending the virtual Special Meeting and voting per the virtual meeting instructions;

•over the Internet or by telephone using the instructions on the enclosed proxy card;

•by completing, signing, dating and returning the enclosed proxy card (applicable only to Shareholders of record); or

•by following the instructions on the voting instruction form (applicable only to beneficial holders of shares of Common Stock held in “street name”).

What if I return my proxy card but do not include voting instructions?

Proxies that are signed and returned but do not include voting instructions will be voted in accordance with the Board’s recommendations, which are as follows:

•FOR the approval of the proposed amendment to the Company’s certificate of incorporation to increase the authorized shares of Common Stock to 100,000,000 shares (Proposal 1).

•FOR the approval of the proposed amendment to our certificate of incorporation to authorize 10,000,000 shares of “blank check” Preferred Stock (Proposal 2).

How do I vote if I hold shares registered in “street name”?

If, on the Record Date, your shares were not held in your name, but rather were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and the proxy materials were forwarded to you by that organization. The organization holding your account is considered to be the Shareholder of record for purposes of voting at the Special Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares held in your account. You will receive a voting instruction form from your broker or other agent asking you how your shares should be voted. Please complete the form and return it as provided in the instructions.

You are also invited to attend the virtual Special Meeting. However, since you are not the Shareholder of record, you may not vote your shares at the Special Meeting unless you request and obtain a valid proxy from your broker or other agent. If you want to attend the virtual Special Meeting, you must provide proof of beneficial ownership as of the Record Date, such as your voting instruction card with your control number provided by your broker or other agent, or other similar evidence of ownership. Whether or not you plan to attend the virtual Special Meeting, we urge you to provide voting instructions to your broker or other agent in advance of the Special Meeting to ensure your vote is counted. Your broker or other agent will furnish you with additional information regarding the submission of such voting instructions.

Will my shares be voted if I do not provide my proxy?

If you hold your shares directly in your own name, they will not be voted if you do not provide a proxy or attend the Special Meeting and vote in accordance with the virtual meeting instructions.

If, however, you hold your shares in street name, your shares may be voted under certain circumstances. Brokers and other agents generally have the authority to vote customers’ un-voted shares on certain “routine” matters. Accordingly, brokers and other agents that do not receive voting instructions from beneficial owners may vote on this proposal in their discretion. A “broker non-vote” occurs when the broker or other agent is unable to vote on a proposal because the proposal is non-routine and the beneficial owner does not provide instructions.

Can I change my mind after I return my proxy?

Yes. You may change your vote or revoke your proxy at any time before your proxy is voted at the Special Meeting. If you are a Shareholder of record, you can do this by giving written notice to the corporate secretary, by submitting another proxy with a later date, or by attending the Special Meeting and voting in accordance with the virtual meeting instructions. If you hold your shares in street name, you should consult with your broker or other agent regarding the procedures for changing your voting instructions.

How many votes must be present to hold the Special Meeting?

Your shares are counted as present at the Special Meeting if you attend the meeting and vote in accordance with the virtual meeting instructions or if you properly return a proxy by mail or the other methods described in these materials. In order for us to

conduct business at the Special Meeting, a majority of the shares of Common Stock entitled to vote as of the Record Date must be present in person or by proxy at the Special Meeting. This is referred to as a quorum. In order to ensure that there is a quorum, it may be necessary for certain directors, officers, regular employees and other representatives of the Company to solicit proxies by telephone, facsimile or in person. These persons will receive no extra compensation for their services.

If a quorum is not present, then either the Chairman of the Special Meeting or the Shareholders may adjourn the meeting until a later time. Abstentions and broker non-votes are counted as present or represented for purposes of determining the presence or absence of a quorum.

What vote is required to approve each item of business to be considered at the Special Meeting?

The following describes the voting requirement for each proposal (assuming a quorum is present):

| | | | | |

Proposal 1: Amendment to Certificate of Incorporation to increase authorized shares of Common Stock | The proposal will be approved if a majority of the voting power of the shares present in person or represented by proxy at the meeting vote in favor of the proposal. Abstentions will be treated as votes against the proposal and broker non-votes will have no effect on the outcome of the proposal. |

| |

Proposal 2: Amendment to Certificate of Incorporation to authorize “Blank Check” Preferred Stock | The proposal will be approved if a majority of the voting power of the shares present in person or represented by proxy at the meeting vote in favor of the proposal. Abstentions will be treated as votes against the proposal and broker non-votes will have no effect on the outcome of the proposal. |

How will voting on any other business be conducted?

Although we do not know of any business to be conducted at the Special Meeting other than the proposals described in this Proxy Statement, if any other business comes before the Special Meeting, your signed proxy card gives authority to the proxy holder(s) to vote on those matters at their discretion.

Can I dissent or exercise rights of appraisal?

Under Delaware law, shareholders are not entitled to dissenters’ rights in connection with any of the proposals to be presented at the Special Meeting or to demand appraisal of their shares as a result of the approval of any of the proposals.

Who will bear the costs of this solicitation?

The Company will bear the entire cost of solicitation of proxies, including the preparation, assembly, printing and mailing of the proxy materials. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of Common Stock beneficially owned by others to forward to the beneficial owners. We may reimburse persons representing beneficial owners of Common Stock for their reasonable out-of-pocket costs of forwarding solicitation materials to the beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, facsimile or personal solicitation by our directors, officers or other regular employees. These persons will receive no extra compensation for their services.

PROPOSAL NO. 1

APPROVAL OF AMENDMENT TO CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK.

Our Board has unanimously adopted a resolution (i) approving an amendment to our Certificate of Incorporation to increase the authorized number of shares of Common Stock from 20,000,000 shares to 100,000,000 shares, par value of $0.0001 per share (the “Increase in Authorized Shares”) and (ii) directing that the Increase in Authorized Shares be submitted to the stockholders for approval at the Special Meeting. Approval of the Increase in Authorized Shares will grant the Board the authority, without further action by the stockholders, to carry out the amendment to the Certificate of Incorporation after the date stockholder approval for the amendment is obtained.

As of the record date, [*] shares of our Common Stock were issued and outstanding and [*] shares of our Common Stock were subject to outstanding warrants and options (including options that are presently outstanding but subject to stockholder approval of our 2022 Equity Incentive Plan), thereby leaving [*] shares of Common Stock unassigned and authorized for potential issuance.

Rights of Additional Authorized Shares of Common Stock

The additional shares of Common Stock resulting from the Increase in Authorized Shares, if and when issued, would be part of the existing class of Common Stock and would have rights and privileges identical to our Common Stock currently outstanding.

Potential Advantages of the Increase in Authorized Shares

Our Board believes that the authorized number of shares of Common Stock should be increased to provide sufficient shares of Common Stock for such corporate purposes as may be determined by our Board to be necessary or desirable. We do not have any plans, arrangements, or understandings for the remaining portion of the authorized but unissued shares of Common Stock that will be available following the Increase in Authorized Shares. However, the Company expects to continue to need additional external financing to provide additional working capital.

Once authorized, the additional shares of Common Stock may be issued with approval of our Board but without further approval of our stockholders, unless applicable law, rule or regulation requires stockholder approval.

Potential Disadvantages of the Increase in Authorized Shares

Future issuances of Common Stock or securities convertible into Common Stock could have a dilutive effect on the earnings per share, book value per share, voting power and percentage interest of holdings of current shareholders. In addition, the availability of additional shares of Common Stock for issuance could, under certain circumstances, discourage or make more difficult efforts to obtain control of the Company. The Board is not aware of any attempt, or contemplated attempt, to acquire control of the Company. This proposal is not being presented with the intent that it be used to prevent or discourage any acquisition attempt, but nothing would prevent the Board from taking any appropriate actions not inconsistent with its fiduciary duties.

Procedure for Effecting the Increase in Authorized Shares

If this proposal is approved by our stockholders, our Board will cause the Increase in Authorized Shares to be implemented by filing an amendment to our Certificate of Incorporation with the Secretary of State of the State of Delaware. The Increase in Authorized Shares will become effective on the date that it is filed.

Discretionary Authority of the Board to Abandon the Increase in Authorized Shares

The Board reserves the right to abandon the Increase in Authorized Shares without further action by our stockholders at any time before the effectiveness of the amendment to the Certificate of Incorporation, even if the Increase in Authorized Shares has been authorized by our stockholders at the Special Meeting. By voting in favor of the Increase in Authorized Shares, you are expressly also authorizing our Board to determine not to proceed with, and abandon, the Increase in Authorized Shares if it should so decide.

Appendix Relating to the Increase in Authorized Shares

The form of the amendment to our Certificate of Incorporation relating to this proposal, which we would file with the Secretary of State of the State of Delaware to effect the Increase in Authorized Shares, is attached to this proxy statement as Appendix A.

Anti-Takeover Effects

Although the Increase in Authorized Shares is not motivated by anti-takeover concerns and is not considered by our Board to be an anti-takeover measure, the availability of additional authorized shares of Common Stock could enable the Board to issue shares defensively in response to a takeover attempt or to make an attempt to gain control of our company more difficult or time-consuming. For example, shares of Common Stock could be issued to purchasers who might side with management in opposing a takeover bid that the Board determines is not in the best interests of our stockholders, thus diluting the ownership and voting rights of the person seeking to obtain control of our company. In certain circumstances, the issuance of Common Stock without further action by the stockholders may have the effect of delaying or preventing a change in control of the company, may discourage bids for our Common Stock at a premium over the prevailing market price and may adversely affect the market price of our Common Stock. As a result, increasing the authorized number of shares of our Common Stock could render more difficult and less likely a hostile takeover of our company by a third-party, or a tender offer or proxy contest, assumption of control by a holder of a large block of our stock, and the possible removal of our incumbent management. We are not aware of any proposed attempt to take over the company or of any present attempt to acquire a large block of our Common Stock.

Vote Required

The affirmative vote of stockholders that represent a majority of the voting power entitled to vote on the Increase in Authorized Shares is required to approve the Increase in Authorized Shares. Abstentions will be treated as votes against the proposal and broker non-votes will have no effect on the outcome of the proposal.

Board Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE INCREASE IN AUTHORIZED SHARES.

PROPOSAL NO. 2

APPROVAL OF AMENDMENT TO CERTIFICATE OF INCORPORATION TO AUTHORIZE 10,000,000 SHARES OF “BLANK CHECK” PREFERRED STOCK.

General

Our Board has unanimously adopted (i) a resolution approving an amendment to our Certificate of Incorporation to authorize 10,000,000 shares of “blank check” Preferred Stock, par value $0.0001 per share (the “Stock Authorization”) and (ii) directing that the Preferred Stock Authorization be submitted to the stockholders for approval at the Special Meeting.

If this proposal is approved, and the Preferred Stock is authorized, it may be issued, from time to time, as authorized by the Board in one or more series, in such numbers of shares, with such designations, powers, including voting powers, full or limited, or no voting powers, preferences, and relative, participating, optional, or other special rights, qualifications, limitations, and restrictions as the Board determines. The powers, preferences, and relative, participating, optional, or other special rights of each series of Preferred Stock, and any qualifications, limitations, or restrictions of a series may differ from those of any other series.

Our Board has determined that the Preferred Stock Authorization proposal is in the best interests of the Company and recommends approval by stockholders.

Potential Advantages of the Preferred Stock Authorization

Our Board has adopted the proposed amendment to provide maximum financial and strategic flexibility with respect to future financing transactions. Preferred Stock is commonly authorized by publicly traded companies and can be used as a preferred means of raising capital. In some circumstances, companies, including ours, have been required to issue senior classes of securities to raise capital, with the terms of those securities being negotiated and tailored to meet the needs of both investors and issuing companies.

Such senior securities often include liquidation preferences and dividend rights, conversion privileges and other rights not found in Common Stock.

If the proposal is approved, and our Certificate of Incorporation is amended, our Board would be able to issue the additional shares of authorized Preferred Stock with such designations, preferences and relative, participating, optional, conversion or other special rights (if any) of such series and the qualifications, limitations or restrictions (if any) thereof, as the Board may in the future establish by resolution or resolutions and by filing a certificate pursuant to the Delaware General Corporation Law (a “Preferred Stock Designation”), from time to time, providing for the issuance of such Preferred Stock. No vote of the holders of our Common Stock or Preferred Stock, unless otherwise expressly provided in the Certificate of Incorporation or in a Preferred Stock Designation creating any series of Preferred Stock or, to the extent the Company chooses to comply with any limiting rules of any securities exchange or quotation system on which shares of our common or Preferred Stock are then listed or traded, will be a prerequisite to the issuance of any series of Preferred Stock.

Approval of the proposed amendment will not alter or modify the rights, preferences, privileges or restrictions of outstanding shares of our Common Stock or Cumulative Preferred Stock, Series A.

Potential Disadvantages of the Preferred Stock Authorization

The authorized but unissued shares of Preferred Stock may generally be issued from time to time for such proper corporate purposes as may be determined by our Board or, as required by law or the rules of the Nasdaq Stock Market, with the approval and authorization of our stockholders. Our Board does not intend to solicit further stockholder approval prior to the issuance of shares of Preferred Stock, except as may be required by applicable law or by the rules of the Nasdaq Stock Market.

The possible future issuance of shares of our Preferred Stock or securities convertible or exercisable into our Preferred Stock could affect our current stockholders in a number of ways. The issuance of new shares of Preferred Stock could cause immediate dilution of the ownership interests and the voting power of our existing stockholders. New issuances of Preferred Stock may also affect the number of dividends, if any, paid to such stockholders and may reduce the share of the proceeds that they would receive upon the future liquidation, if any, of the company.

In addition, the future issuance of shares of our Preferred Stock or securities convertible or exercisable into shares of our Preferred Stock could:

•dilute the market price of our Common Stock, to the extent that the shares of Common Stock are issued and sold at prices below current trading prices, or, if the issuance consists of securities convertible or exercisable into Common Stock, to the extent that the securities provide for the conversion or exercise into Common Stock at prices that could be below current trading prices of the Common Stock, which dilution, in each case, may increase the volatility and affect the market value of our trading securities;

•dilute the earnings per share, if any, and book value per share of the outstanding shares of our Common Stock ; and

•make the payment of dividends on Common Stock, if any, potentially more expensive.

No specific shares of Preferred Stock are being designated at this time, and we do not currently have any plans to issue shares of Preferred Stock.

Anti-Takeover Effects

Although the proposed amendment is not motivated by anti-takeover concerns and is not considered by the Board to be an anti-takeover measure, the availability of authorized shares of Preferred Stock could enable the Board to issue shares defensively in response to a takeover attempt or to make an attempt to gain control of the Company more difficult or time-consuming. For example, Preferred Stock could be issued to purchasers who might side with management in opposing a takeover bid which the Board determines is not in the best interests of the Company and its stockholders, thus diluting the ownership and voting rights of the person seeking to obtain control of the Company. In certain circumstances, issuing Preferred Stock without further action by the stockholders may delay or prevent a change of control of the Company, may discourage bids for the Company’s Common Stock or Preferred Stock at a premium over the market price of the Common Stock or Preferred Stock, and may adversely affect the market price of the Common Stock or Preferred Stock. Thus, increasing the authorized Preferred Stock could render more difficult and less likely a hostile merger, tender offer, or proxy contest, assumption of control by a holder of a large block of the Company’s stock, and the possible removal of the Company’s incumbent management. We are not aware of any proposed attempt to take over the Company or of any attempt to acquire a large block of our stock.

No Appraisal Rights

Under Delaware General Corporation Law, the Company’s stockholders are not entitled to appraisal rights with respect to the proposed amendment.

Procedure for Implementing the New Class of Preferred Stock

If this proposal is approved by our stockholders, our Board will cause the “Blank Check” Stock Authorization to be implemented by filing an amendment to our Certificate of Incorporation with the Secretary of State of the State of Delaware. The Preferred Stock Authorization will become effective on the date that it is filed.

Discretionary Authority of the Board to Abandon Preferred Stock Authorization

The Board reserves the right to abandon the Preferred Stock Authorization without further action by our stockholders at any time before the effectiveness of the amendment to the Certificate of Incorporation, even if the Authorization has been authorized by our stockholders at the Special Meeting. By voting in favor of the Authorization, you are expressly also authorizing our Board to determine not to proceed with, and abandon, the Preferred Stock Authorization if it should so decide.

Appendix Relating to the Preferred Stock Authorization

The text of the form of the articles of amendment relating to this proposal, which we would file with the Delaware Division of Corporations to effect the Preferred Stock Authorization, is attached to this proxy statement as Appendix A.

Required Vote

The affirmative vote of stockholders that represent a majority of the voting power entitled to vote on the Preferred Stock Authorization is required to approve the Preferred Stock Authorization. Abstentions will be treated as votes against the proposal and broker non-votes will have no effect on the outcome of the proposal.

Board Recommendation

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE PROPOSAL TO AUTHORIZE A NEW CLASS OF PREFERRED STOCK.

HOUSEHOLDING

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more shareholders sharing the same address by delivering a single set of these proxy materials addressed to those shareholders. This process, which is commonly referred to as “householding,” reduces duplicate mailings and saves printing costs and postage fees, as well as natural resources.

Accordingly, Shareholders who share an address may receive only one copy of this Proxy Statement unless contrary instructions are received. We will deliver promptly a separate copy of such proxy materials to any Shareholder who resides at a shared address and to which a single copy of the documents was delivered, if the Shareholder makes a request by contacting our Corporate Secretary at 2118 Walsh Avenue, Suite 210, Santa Clara, CA 95050, or by telephone at (408) 899-4443. If you wish to receive separate copies of proxy statements and annual reports in the future, or if you are receiving multiple copies and would like to receive a single copy for your household, you should contact your broker, bank or other agent if your shares are held in street name. Alternatively, if you are a record holder of our Common Stock, you may contact Broadridge Financial Solutions Inc. either by calling toll-free at 1-800-542-1061, or by writing Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MONDAY NOVEMBER 14, 2022:

The proxy statement for the Special Meeting is available at www.proxyvote.com.

OTHER MATTERS

We know of no other matters to be submitted for consideration by the Shareholders at the Special Meeting. If any other matters properly come before the Special Meeting, it is the intention of the persons named in the enclosed proxy card to vote the shares they represent as the Board may recommend. It is important that your shares be represented at the meeting, regardless of the number of shares which you hold. You are therefore urged to execute and return, at your earliest convenience, the accompanying proxy card in the postage-prepaid envelope enclosed. You may also submit your proxy over the Internet or by telephone. For specific instructions, please refer to the information provided with your proxy card.

| | |

| By order of the Board of Directors, |

|

| /s/ Branislav Vajdic |

| Branislav Vajdic |

| President and Chief Executive Officer |

APPENDIX A

CERTIFICATE OF AMENDMENT

TO THE

CERTIFICATE OF INCORPORATION OF

HEARTBEAM, INC.

HeartBeam, Inc., a corporation organized and existing under and by virtue of the provisions of the General Corporation Law of the State of Delaware (the “Corporation”), hereby certifies as follows:

1. The name of the Corporation is HeartBeam, Inc. The Corporation’s original Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on June 11, 2015.

2. Pursuant to Section 242 of the DGCL, this Certificate of Amendment to the Certificate of Incorporation further amends the provisions of the Corporation’s Certificate of Incorporation.

3. ARTICLE IV of the Certificate of Incorporation of the Corporation is hereby amended and restated to read in its entirety as follows:

Authorized Stock. The total number of shares of stock which the Company shall have authority to issue is 110,000,000, consisting of 100,000,000 shares of Common Stock, par value $0.0001 per share (the “Common Stock”), and 10,000,000 shares of Preferred Stock, par value $0.0001 per share (the “Preferred Stock”).

4. This Certificate of Amendment to the Corporation’s Certificate of Incorporation has been duly authorized and adopted by the Corporation’s Board of Directors in accordance with the provisions of Section 242 of the Delaware General Corporation Law.

5. That thereafter, pursuant to resolution of its Board of Directors, a Special Meeting of the stockholders of said corporation was duly called and held, upon notice in accordance with Section 222 of the General Corporation Law of the State of Delaware at which meeting the necessary number of shares as required by statute were voted in favor of the amendment.

6. This amendment shall become effective on the date filed with the State of Delaware.

IN WITNESS WHEREOF, HeartBeam, Inc. has caused this Certificate of Amendment to be signed by Branislav Vajdic, a duly authorized officer of the Corporation, on [*], 2022.

| | | | | |

| /s/ Branislav Vajdic |

| Branislav Vajdic |

| Chief Executive Officer |

| | |

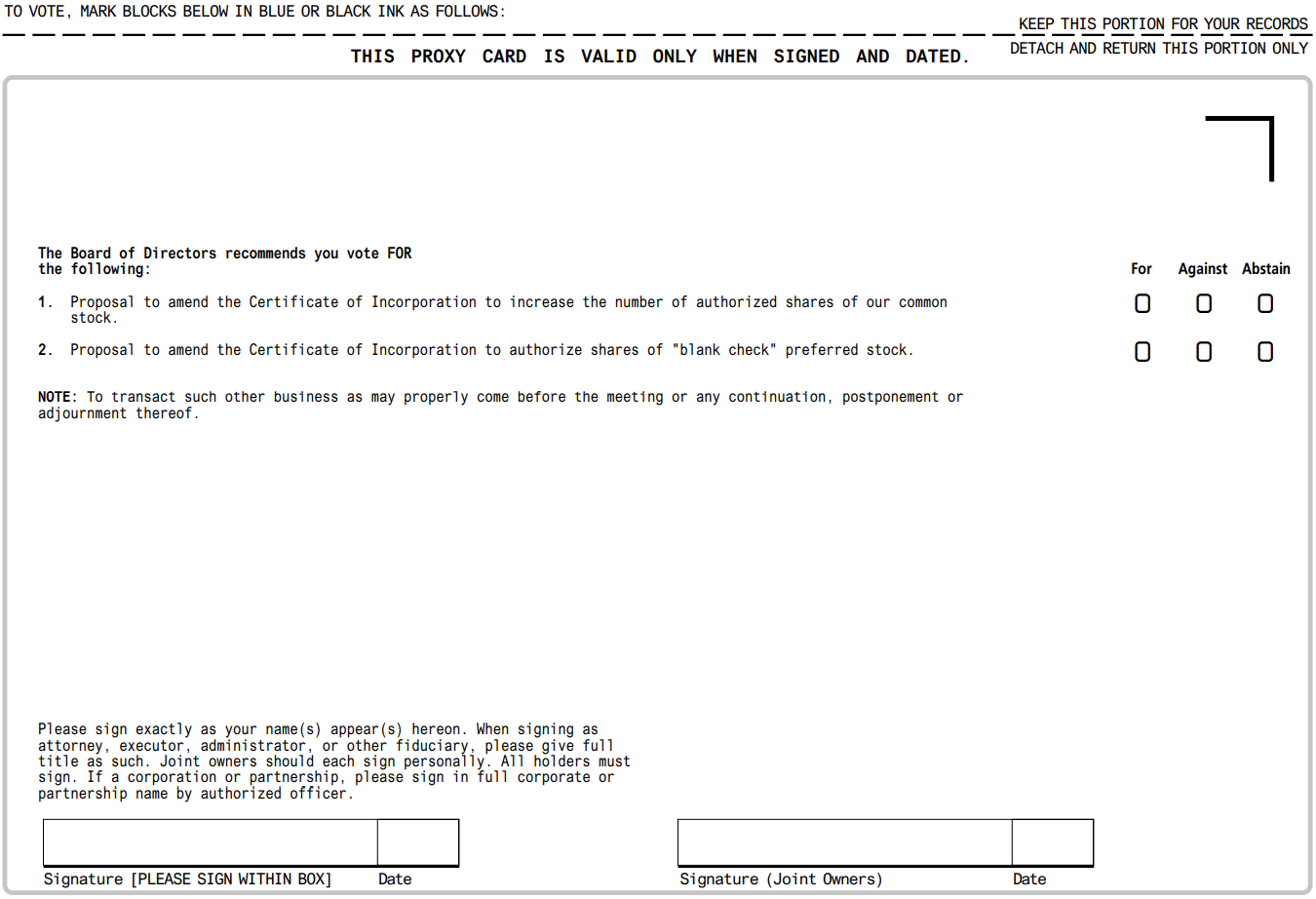

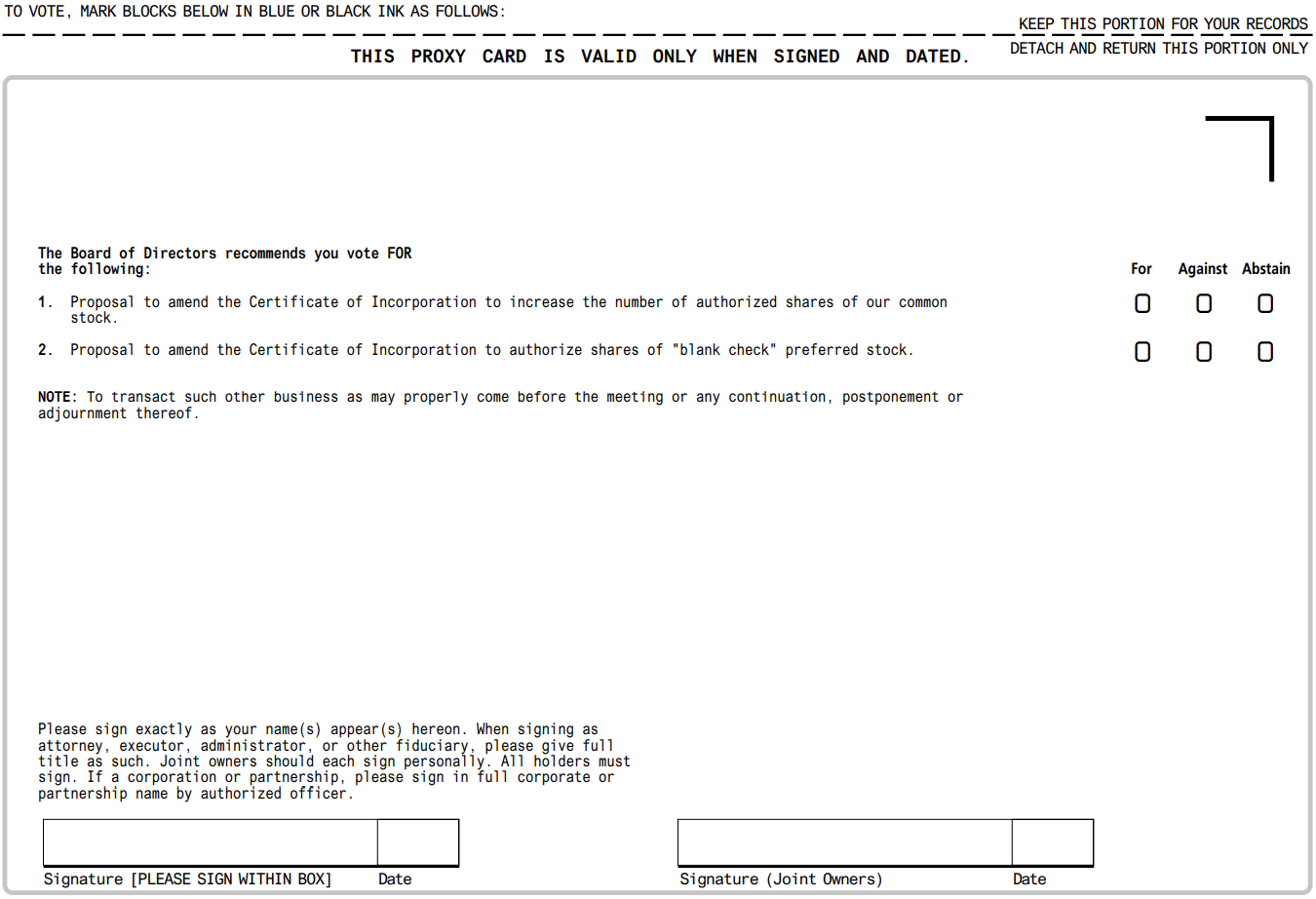

VOTE BY INTERNET - www.proxyvote.com |

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. |

|

ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS |

If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years. |

|

VOTE BY PHONE - 1-800-690-6903 |

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. |

|

VOTE BY MAIL |

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The Notice & Proxy Statement, Annual Report is/ are available at www.proxyvote.com