UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | |

| ☑ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under § 240.14a-12 |

HeartBeam, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the boxes that apply):

| | | | | |

| þ | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

PRELIMINARY COPY - SUBJECT TO COMPLETION

HEARTBEAM, INC.

2118 Walsh Avenue, Suite 210

Santa Clara, CA 95050

(408) 899-4443

Notice of 2023 Annual Meeting of Shareholders

Dear HeartBeam Shareholders:

It is our pleasure to invite you to attend HeartBeam, Inc.’s 2023 Annual Meeting of Shareholders (the “Annual Meeting”).

Date: July 7, 2023, (Friday)

Time: 1:00 p.m., Eastern Daylight Time

Virtual

Location: You can attend the Annual Meeting online, including to vote and/or submit questions, at

www.virtualshareholdermeeting.com/BEAT2023. See page 1 of the accompanying proxy statement for additional

information regarding participation in the virtual meeting.

Items of At the Annual Meeting, shareholders will be asked to vote:

Business:

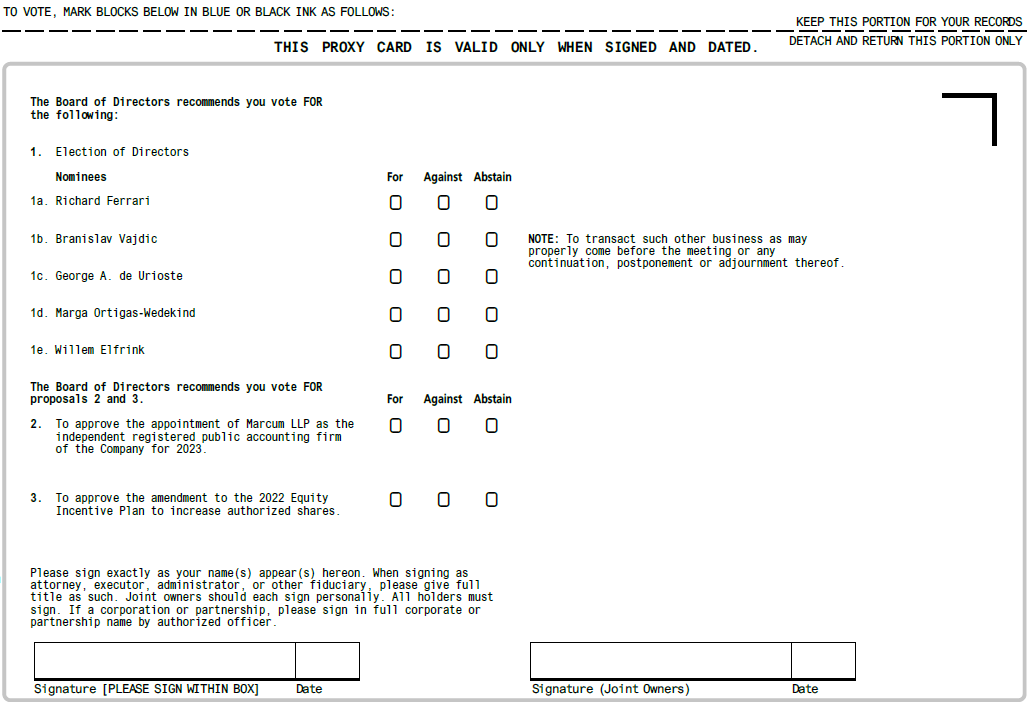

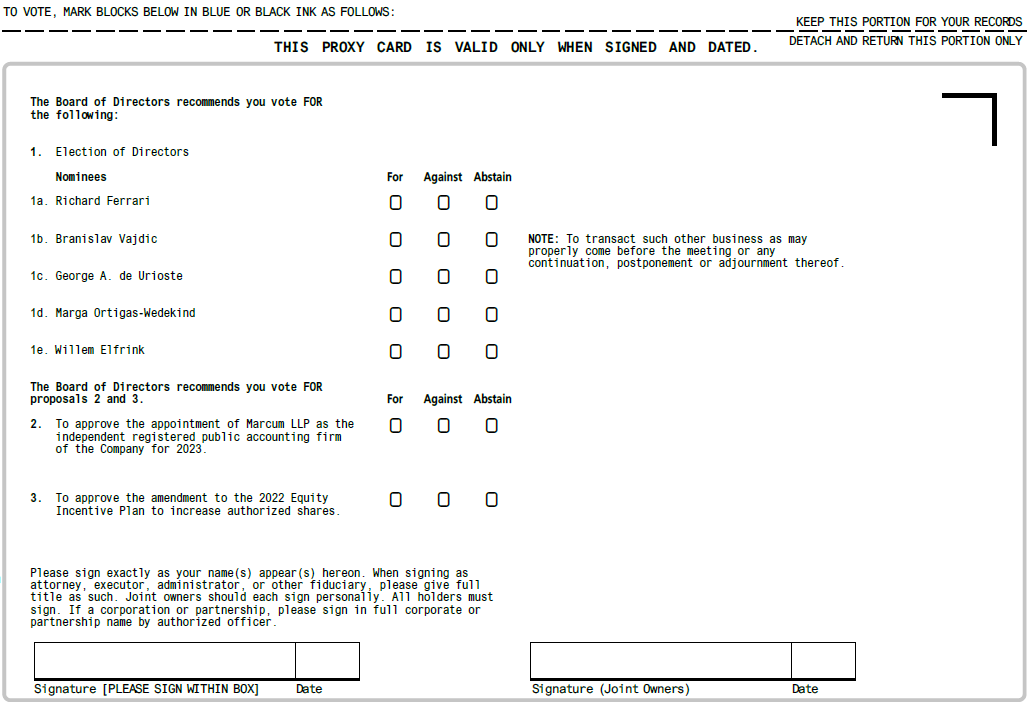

1.To elect the following five persons to serve as directors of the Company until the 2023 Annual Meeting of Shareholders and thereafter until their successors have been elected and qualified: Richard Ferrari, Branislav Vajdic, George A. de Urioste, Marga Ortigas-Wedekind, and Willem Elfrink;

2.To approve the appointment of Marcum LLP as the independent registered public accounting firm of the Company for 2023;

3.To amend the 2022 Equity Incentive Plan to increase authorized shares; and

4.To transact such other business as may properly come before the meeting or any continuation, postponement or adjournment thereof.

Record Date: You are entitled to notice of the Annual Meeting, and can participate and vote at the Annual Meeting if you were a

shareholder of record as of the close of business on May 10, 2023.

Voting: Your vote is very important to us. Whether or not you plan to attend the virtual Annual Meeting, please ensure your

shares are represented by voting promptly. For instructions on how to vote your shares, please refer to the

instructions included with this proxy statement or on your proxy card or voting instruction form.

| | |

| By order of the Board of Directors, |

|

| /s/ Branislav Vajdic |

| Branislav Vajdic |

| President and Chief Executive Officer |

| Santa Clara, California, [ ] |

| | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON FRIDAY JULY 7, 2023:

Our official Notice of Annual Meeting of Shareholders, Proxy Statement and 2022 Annual Report to Shareholders are available at: www.proxyvote.com |

TABLE OF CONTENTS

PRELIMINARY COPY - SUBJECT TO COMPLETION

HEARTBEAM, INC.

2118 Walsh Avenue, Suite 210

Santa Clara, CA 95050

(408) 899-4443

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JULY 7, 2023

GENERAL

This proxy statement (“Proxy Statement”) is being furnished to the shareholders (the “Shareholders”) of HeartBeam, Inc., a Delaware corporation (the “Company” or “HeartBeam”), in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board”) from the Shareholders for use at the 2023 Annual Meeting of Shareholders to be held at 1:00 p.m., Eastern Daylight Time, on Friday, July 7, 2023, and any continuations, postponements or adjournments thereof (the “Annual Meeting”). The Annual Meeting will be held virtually. To participate in the virtual meeting, click on www.virtualshareholdermeeting.com/BEAT2023. This Proxy Statement and the accompanying Notice and proxy card are first being mailed to Shareholders on or about May 26, 2023.

INFORMATION ABOUT THE ANNUAL MEETING

When and where is the Annual Meeting?

The Annual Meeting will be held at 1:00 p.m., Eastern Daylight Time, on Friday, July 7, 2023. To participate in the virtual meeting, click on www.virtualshareholdermeeting.com/BEAT2023.

Why did I receive these materials?

Our Board has provided these proxy materials to you, in connection with our Board’s solicitation of proxies for use at the Annual Meeting. As a Shareholder, you are invited to attend the Annual Meeting virtually and vote per the virtual meeting instructions or you may vote by proxy on the proposals described in this Proxy Statement.

What is included in the proxy materials?

The proxy materials include:

•this Proxy Statement;

•the proxy card or voting instruction form; and

•our Annual Report on Form 10-K for the year ended December 31, 2022 (the “Annual Report”).

What is being considered at the Annual Meeting?

At the Annual Meeting, our Shareholders will be acting on the following proposals:

1.To elect the following five persons to serve as directors of the Company until the 2023 Annual Meeting of Shareholders and thereafter until their successors have been elected and qualified: Richard Ferrari, Branislav Vajdic, George A. de Urioste, Marga Ortigas-Wedekind, and Willem Elfrink;

2.To approve the appointment of Marcum LLP as the independent registered public accounting firm of the Company for 2023;

3.To amend the 2022 Equity Incentive Plan to increase authorized ; and

4.To transact such other business as may properly come before the meeting or any continuation, postponement or adjournment thereof.

In addition, our management will report on our progress and respond to your questions.

Who is entitled to vote at the Annual Meeting?

You may vote at the Annual Meeting if you owned shares of the Company's Common Stock (the “Common Stock”) as of the close of business on the record date, which was May 10, 2023 (the “Record Date”). You are entitled to one vote for each share of Common Stock that you held as of the record date.

How many shares are eligible to be voted at the Annual Meeting?

There were 25,901,240 shares of Common Stock issued and outstanding as of the Record Date, each of which entitles the holder thereof to one vote at the Annual Meeting.

How do I vote?

You can vote in the following ways:

•by attending the virtual Annual Meeting and voting per the virtual meeting instructions;

•over the Internet or by telephone using the instructions on the enclosed proxy card;

•by completing, signing, dating and returning the enclosed proxy card (applicable only to Shareholders of record); or

•by following the instructions on the voting instruction form (applicable only to beneficial holders of shares of Common Stock held in “street name”).

What if I return my proxy card but do not include voting instructions?

Proxies that are signed and returned but do not include voting instructions will be voted in accordance with the Board’s recommendations, which are as follows:

•FOR the election of the five director nominees (Proposal 1);

•FOR the ratification of the appointment of Marcum LLP as the independent registered public accounting firm of the Company for 2023 (Proposal 2);

•FOR the approval of the Amendment to the 2022 Equity Incentive Plan to increase authorized shares (Proposal 3).

How do I vote if I hold shares registered in “street name”?

If, on the Record Date, your shares were not held in your name, but rather were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and the proxy materials were forwarded to you by that organization. The organization holding your account is considered to be the Shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares held in your account. You will receive a voting instruction form from your broker or other agent asking you how your shares should be voted. Please complete the form and return it as provided in the instructions.

You are also invited to attend the virtual Annual Meeting. However, since you are not the Shareholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy from your broker or other agent. If you want to attend the virtual Annual Meeting, you must provide proof of beneficial ownership as of the Record Date, such as your voting instruction card with your control number provided by your broker or other agent, or other similar evidence of ownership. Whether or not you plan to attend the virtual Annual Meeting, we urge you to provide voting instructions to your broker or other agent in advance of the Annual Meeting to ensure your vote is counted. Your broker or other agent will furnish you with additional information regarding the submission of such voting instructions.

Will my shares be voted if I do not provide my proxy?

If you hold your shares directly in your own name, they will not be voted if you do not provide a proxy or attend the Annual Meeting and vote in accordance with the virtual meeting instructions.

If, however, you hold your shares in street name, your shares may be voted under certain circumstances. Brokers and other agents generally have the authority to vote customers’ un-voted shares on certain “routine” matters. The ratification of Marcum LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023 (Proposal 2) is the only proposal at the Annual Meeting that we believe is routine. Accordingly, brokers and other agents that do not receive voting instructions from beneficial owners may vote on this proposal in their discretion. A “broker non-vote” occurs when the broker or other agent is unable to vote on a proposal because the proposal is non-routine and the beneficial owner does not provide instructions.

Can I change my mind after I return my proxy?

Yes. You may change your vote or revoke your proxy at any time before your proxy is voted at the Annual Meeting. If you are a Shareholder of record, you can do this by giving written notice to the corporate secretary, by submitting another proxy with a later date, or by attending the Annual Meeting and voting in accordance with the virtual meeting instructions. If you hold your shares in street name, you should consult with your broker or other agent regarding the procedures for changing your voting instructions.

How many votes must be present to hold the Annual Meeting?

Your shares are counted as present at the Annual Meeting if you attend the meeting and vote in accordance with the virtual meeting instructions or if you properly return a proxy by mail or the other methods described in these materials. In order for us to conduct business at the Annual Meeting, a majority of the shares of Common Stock entitled to vote as of the Record Date must be present in person or by proxy at the Annual Meeting. This is referred to as a quorum. In order to ensure that there is a quorum, it may be necessary for certain directors, officers, regular employees and other representatives of the Company to solicit proxies by telephone, facsimile or in person. These persons will receive no extra compensation for their services.

If a quorum is not present, then either the Chairman of the Annual Meeting or the Shareholders may adjourn the meeting until a later time. Abstentions and broker non-votes are counted as present or represented for purposes of determining the presence or absence of a quorum.

What vote is required to approve each item of business to be considered at the Annual Meeting?

The following table describes the voting requirement for each proposal (assuming a quorum is present):

| | | | | |

| Proposal 1: Election of Directors | Election of a director requires the affirmative vote of the holders of a plurality of the shares for which votes are cast. The five persons receiving the greatest number of votes will be elected as directors. Since only affirmative votes count for this purpose, a properly executed proxy marked “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. Broker non-votes will not be treated as votes cast, and therefore will have no effect on the outcome of the proposal. Shareholders may not cumulate votes in the election of directors. |

| Proposal 2: Ratification of Independent Registered Public Accounting Firm | The proposal will be approved if a majority of the votes cast are voted in favor of the proposal. Abstentions and broker non-votes will not be treated as votes cast for or against the proposal, and therefore will have no effect on the outcome of the proposal. |

| Proposal 3: Approval of the Amendment to the 2022 Equity Incentive Plan to increase authorized shares | The proposal will be approved if a majority of the votes cast are voted in favor of the proposal. Abstentions and broker non-votes will not be treated as votes cast for or against the proposal, and therefore will have no effect on the outcome of the proposal. |

How will voting on any other business be conducted?

Although we do not know of any business to be conducted at the Annual Meeting other than the proposals described in this Proxy Statement, if any other business comes before the Annual Meeting, your signed proxy card gives authority to the proxy holder(s) to vote on those matters at their discretion.

Can I dissent or exercise rights of appraisal?

Under Delaware law, shareholders are not entitled to dissenters’ rights in connection with any of the proposals to be presented at the Annual Meeting or to demand appraisal of their shares as a result of the approval of any of the proposals.

Who will bear the costs of this solicitation?

The Company will bear the entire cost of solicitation of proxies, including the preparation, assembly, printing and mailing of the proxy materials. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of Common Stock beneficially owned by others to forward to the beneficial owners. We may reimburse persons representing beneficial owners of Common Stock for their reasonable out-of-pocket costs of forwarding solicitation materials to the beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, facsimile or personal solicitation by our directors, officers or other regular employees. These persons will receive no extra compensation for their services.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Nominees for Election at the 2023 Annual Meeting of Shareholders

The Board has nominated directors Richard Ferrari, Branislav Vajdic, George A. de Urioste, Marga Ortigas-Wedekind, and Willem Elfrink for election as directors to serve until the next Annual Meeting of Shareholders and until their successors are duly elected and qualified. If elected, each of the directors will hold office as a director until our 2024 Annual Meeting of Shareholders.

If you sign your proxy or voting instruction card but do not give instructions with respect to the voting of directors, your shares will be voted for the nominees recommended by our Board. If you wish to give specific instructions with respect to the voting of directors, you may do so by indicating your instructions on your proxy or voting instruction card. The Board expects that the nominees will be available to serve as directors. If any nominee becomes unavailable, however, the proxy holders intend to vote for any nominee designated by the Board, unless the Board chooses to reduce the number of directors serving on the Board. If additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner as to assure the election of directors Richard Ferrari, Branislav Vajdic, George A. de Urioste, Marga Ortigas-Wedekind, and Willem Elfrink.

Vote Required

Election of a director requires the affirmative vote of the holders of a plurality of the shares for which votes are cast at a meeting at which a quorum is present. The five persons receiving the greatest number of votes will be elected as directors. Since only affirmative votes count for this purpose, a properly executed proxy marked “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. Broker non-votes will not be treated as votes cast, and therefore will have no effect on the outcome of the proposal. Shareholders may not cumulate votes in the election of directors.

Board Recommendation

The Board recommends that shareholders vote FOR the election of each of directors Richard Ferrari, Branislav Vajdic, George A. de Urioste, Marga Ortigas-Wedekind, and Willem Elfrink as directors of the Company.

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors, Director Nominees and Executive Officers

The following table sets forth certain information with respect to the current directors, director nominees and executive officers of our Company:

| | | | | | | | | | | | | | |

NAME | | AGE AS OF ANNUAL MEETING | | POSITION |

Richard Ferrari | | 69 | | Executive Chairman of the Board of Directors |

Branislav Vajdic, PhD | | 69 | | Chief Executive Officer, Director |

George A. de Urioste | | 67 | | Director |

Marga Ortigas-Wedekind | | 61 | | Director |

Willem Elfrink | | 71 | | Director |

Richard Ferrari - Executive Chairman of the Board of Directors

Mr. Ferrari, 69, joined our Board in 2019 and was appointed Executive Director of the Board of Directors in June 2021. Mr. Ferrari combines over 40 years of experience in Medical Device Start-ups as CEO, and entrepreneur. Also Mr. Ferrari is co-founder of De Novo Ventures which has $650M under management and has been Managing Director since 2000. Mr. Ferrari has also co-founded 6 more companies, two of which have been successful IPO’s and subsequent acquisitions, CTS one of the companies he co-founded was the fastest start-up to an IPO in the last 22 years in the medical device industry. Mr. Ferrari most recently from 2018 to 2021 was Chairman and CEO of PQ Bypass which was recently acquired by Endologix. Mr. Ferrari sits on the board of Pulmonx, a public company and is the Chairman of the Compensation Committee. Additionally, Mr. Ferrari is Executive Chairman of Tenon Medical,

Vice-Chairman of ABS Interventional, Executive Chairman of Medlumics, and holds board positions with several other medical device start-ups. Mr. Ferrari has an undergraduate degree from Ashland University and an MBA from University of South Florida.

We believe that Mr. Ferrari is qualified to serve on our board of directors because of his experience in leadership and management roles in the field of medicine, as well as his experience as a member in the healthcare industry.

Branislav Vajdic, PhD - Chief Executive Officer and Director

Dr. Vajdic, 69, Chief Executive Officer and Founder of HeartBeam, Inc, combines over 30 years of experience in technology development and senior management positions. Dr. Vajdic has been deeply involved with the development of HeartBeam’s technology to fit his vision for the Company. Prior to HeartBeam from 2007 to 2010, Dr. Vajdic was CEO and Founder of NewCardio, a publicly traded company in the cardiovascular devices space, from 1984 to 2007, Dr. Vajdic was at Intel, where he held various senior management positions. At Intel, Dr. Vajdic was the designer of first Flash memory and two key inventions that enabled Flash as a product and led engineering groups responsible for Pentium 1 through Pentium 4 designs. Dr. Vajdic was awarded two Intel Achievement Awards, the highest level of award for outstanding contributions to Intel. Dr. Vajdic is author of numerous patents and publications in the fields of cardiovascular devices as well as chip design. Dr. Vajdic holds a PhD degree in Electrical Engineering from the University of Minnesota.

We believe that Dr. Vajdic is qualified to serve on our board of directors because of his experience in leadership and management roles in the field of medicine, as well as his experience as a member in the healthcare industry.

George A. de Urioste - Director

Mr. de Urioste, 67, combines over 30 years of experience in high technology industry senior management. Previously, Mr. de Urioste has been involved in over 10 companies, holding positions including Board Director, Chief Operating Officer and Chief Financial Officer. Mr. de Urioste was Chief Financial Officer of Remedy Corporation (software) from 1992 to 1998, Chief Executive Officer of Aeroprise, Inc., from 2000 to 2003 (software), from 2004 to 2006 he was Chief Operating Officer and Chief Financial Officer for Chordiant Software, Inc. (software), interim Chief Operating Officer and Chief Financial Officer for Marvell Technology, Inc. (semiconductors) during 2008, Chief Financial Officer for Pluribus Networks, Inc. (software) 2014 to 2018, Chief Financial Officer for 4iQ, Inc. (software) 2019 to 2020 and interim Chief Financial Officer for Mozilla, Inc. (software). Mr. de Urioste’s Board Director experience includes Audit Committee chairman roles for the following companies: Rainmaker Systems, Inc. (business outsourcing), from 2003 to 2005, Saba Software, Inc. (software) from 2008 to 2010, GCT, Inc. (semiconductors), from 2009 to 2011 Villa Montalvo (performing arts center), from 2011 to 2013, Bridgelux, Inc., from 2011 to 2016 (LED lighting), and Vendavo, Inc., from 2013 to 2014 (software). Mr. de Urioste was also chairman of the Board of Directors for Aeroprise, Inc. from 2000 to 2005 (software). Mr. de Urioste is currently a Board Director at Silicon Valley Directors Exchange, (a not-for-profit for Board education events). Mr. de Urioste has an undergraduate degree from University of Southern California and an MBA from University of California at Berkeley. Mr. de Urioste is also a Certified Public Accountant (inactive) in the State of California and is a member of the Latino Corporate Directors Association.

We believe that Mr. de Urioste is qualified to serve on our board of directors because of his experience in leadership and management roles in high technology industries, as well as his experience as a board member including Audit Committee Chairman roles.

Marga Ortigas-Wedekind - Director

Ms. Ortigas-Wedekind, 61, Board member, has over 30 years of experience in health technology senior management. Ms. Ortigas-Wedekind has been Chief Commercial Strategy Officer of Fogarty Innovation, a non-profit educational incubator for early stage medtech companies since December 2019, Executive Vice President of Marketing and Payer Relations for iRhythm Technologies Inc., a publicly-traded digital healthcare company from July 2015 through July 2019, Executive Vice President, Global Marketing and Product Development of Omnicell Inc., a publicly-traded developer of automated medication dispensing and analytics systems where she led the Marketing, International and Engineering departments from 2009 to 2015, Senior Vice President, Marketing, Development, and Clinical Affairs at Xoft, Inc, a developer of disruptive technology to deliver radiation therapy with capital equipment and high-end disposables from 2002 to December 2008. She started her medtech career at Guidant Vascular, now Abbott Vascular. Ms. Ortigas-Wedekind was on the board of Itamar Medical (NASDAQ: ITMR), which provides digitally-enabled systems for sleep apnea management until its sale to Zoll Medical in December 2021, Total Flow Cannula, an early stage company developing a mechanism to improve safety during on-pump open heart surgery and, the Bay Area Cancer Coalition, a non-profit organization that supports those affected by breast or ovarian cancer. Ms. Ortigas-Wedekind is a limited partner and advisory board member for Launchpad Digital Health, a venture fund focused on digital heath technologies and is also an angel investor with Health Tech Capital. Ms. Ortigas-Wedekind has an undergraduate degree from Wellesley College and an MBA from the Stanford Graduate School of Business.

We believe that Ms. Ortigas-Wedekind is qualified to serve on our board of directors because of her experience in leadership and management roles in the field of medicine, as well as her experience as a member in the healthcare industry.

Willem Elfrink - Director

Mr. Elfrink, 71, was Chairman of the Board since our founding and in June 2021 stepped down from this position but remains a Board member. Mr. Elfrink has over 40 years of experience in bringing new technologies to the market. Mr. Elfrink actively contributes to portfolio companies via board participation, strategic marketing, governance and capital structure. Mr. Elfrink is also the Founder and President of WPE Ventures Digitized Solutions, a security and digitization solutions investment firm. Mr. Elfrink joined Cisco in 1997 and was Cisco’s Executive Vice President of Industry Solutions and Chief Globalization Officer from 2000 to 2006 and 2007 to 2015 respectively, where Mr. Elfrink made and contributed to key strategic and operational decisions of the Company. Widely recognized as Cisco’s Corporate Entrepreneur in residence, his global charter was to identify significant technology opportunities. Mr. Elfrink also led an industry initiative — called the Internet of Things World Forum. Before joining Cisco, Mr. Elfrink held management and senior management positions at Olivetti, Xerox, HP, Digital Equipment Corporation and Philips. Mr. Elfrink earned a Bachelor of Engineering degree from the Institute of Technology in Rotterdam, the Netherlands.

We believe that Mr. Elfrink is qualified to serve on our board of directors because of his experience in leadership and management roles in bringing new technologies to the market, as well as his globalization experience.

There are no agreements or understandings for any of our executive officers or directors to resign at the request of another person and no officer or director is acting on behalf of nor will any of them act at the direction of any other person.

Directors are elected to serve until their successors are duly elected and qualified.

Board Diversity

The table below provides information relating to certain voluntary self-identified characteristics of our directors. Each of the categories listed in the table below has the meaning as set forth in NASDAQ Rule 5605(f).

| | | | | | | | | | | | | | |

| Board Diversity Matrix (As of March 31, 2023) |

| Total Number of Directors | 5 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity |

| Directors | 1 | 4 | 0 | 0 |

| Part II: Demographic Background |

| African American or Black | | | | |

| Alaskan Native or Native American | | | | |

| Asian | | | | |

| Hispanic or Latinx | | 1 | | |

| Native Hawaiian or Pacific Islander | | | | |

| White | | 3 | | |

| Two or More Races or Ethnicities | 1 | | | |

| LGBTQ | |

| Did Not Disclose Demographic Background | |

Director Independence

The Board has affirmatively determined that four of the directors are “independent directors” under NASDAQ Listing Rule 5605(a)(2) and the related rules of the U.S. Securities and Exchange Commission (the “SEC”). In making this determination, our Board considered the current and prior relationships that each non-employee director has with the Company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director. The Company’s independent directors conduct executive sessions at regularly scheduled meetings as required by NASDAQ Listing Rule 5605(b)(2).

Family Relationships

There are no family relationships among any of our directors and executive officers.

Board Leadership Structure

The Board does not have an express policy regarding the separation of the roles of Chief Executive Officer (“CEO”) and Board Chairman, as the Board believes it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. Currently, Dr. Branislav Vajdic serves as the Company’s President and CEO and Richard Ferrari serves as the Chairman of the Board. The Board believes that its current leadership structure best serves the objectives of the Board’s oversight of management; the ability of the Board to carry out its roles and responsibilities on behalf of the shareholders; and the Company’s overall corporate governance. The Board also believes that the current separation of the Chairman and CEO roles allows the CEO to focus his time and energy on operating and managing the Company and leverages the experience and perspectives of the Chairman.

Board Oversight of Risk Management

The full Board has responsibility for general oversight of risks facing the Company. The Board is informed by senior management on areas of risk facing the Company and periodically conducts discussions regarding risk assessment and risk management. The Board believes that evaluating how the executive team manages the various risks confronting the Company is one of its most important areas of oversight. While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. For example, the Audit Committee reviews and assesses the Company’s processes to manage financial reporting risk and to manage investment, tax, and other financial risks; the Compensation Committee oversees risks relating to the compensation and incentives provided to our executive officers; and the Nominating and Governance Committee oversees risks associated with our overall compliance and corporate governance practices, as well as the independence and composition of our Board. Finally, management periodically reports to the Board or relevant committee, which provides guidance on risk assessment and mitigation.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, requires the Company’s directors and executive officers, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of securities ownership and changes in such ownership with the SEC.

Based solely upon a review of such forms filed electronically with the SEC or written representations that no Form 5s were required, the Company believes that all Section 16(a) filing requirements were timely met during the year ended December 31, 2022, except for: Mr. George de Urioste submitted one late Form 3 filing in regards to disclosing initial securities, Mr. Willem Elfrink submitted one late Form 4 filing in regards to disclosing the distribution of equity from his venture partnership to the respective non-affiliated partners and Mr. Kenneth Persen one late Form 4 filing disclosing his options award.

Code of Ethics

The Company has adopted a code of ethics policy in 2022 for its principal executive officer and senior financial officers and that is applicable to all directors, officers and employees, a copy of which is available online at www.Heartbeam.com. Shareholders may also request a free copy of this document from: HeartBeam, Inc., 2118 Walsh Avenue, Suite 210, Santa Clara, CA 95050, Attn: Corporate Secretary.

Director Meeting Attendance

During the year ended December 31, 2022, the Board held five meetings of the full Board, The Board also took action by written consent on eleven occasions. During the year ended December 31, 2022, each member of the Board attended at least 75% of the aggregate of all meetings of the Board and the meetings of the committees on which he or she served (during the periods for which he or she served).

The Company does not have a written policy requiring directors to attend the annual meeting.

Board Committees

Our board of directors has established an audit committee, a compensation committee and a nominating and governance committee. Our board of directors may establish other committees to facilitate the management of our business. The composition and functions of each committee are described below. Members serve on these committees until their resignation or until otherwise determined by our board of directors. The charter of each committee is available on our corporate website at https://ir.heartbeam.com/corporate-governance/governance-documents.

Committee Composition

The following description below outlines our current membership for each committee of our board of directors:

Audit Committee

The Audit Committee, among other things, will be responsible for:

•appointing; approving the compensation of; overseeing the work of; and assessing the independence, qualifications, and performance of the independent auditor;

•reviewing the internal audit function, including its independence, plans, and budget;

•approving, in advance, audit and any permissible non-audit services performed by our independent auditor;

•reviewing our internal controls with the independent auditor, the internal auditor, and management;

•reviewing the adequacy of our accounting and financial controls as reported by the independent auditor, the internal auditor, and management;

•overseeing our financial compliance system; and

•overseeing our major risk exposures regarding the Company’s accounting and financial reporting policies, the activities of our internal audit function, and information technology.

The Audit Committee will consist of Mr. de Urioste, Ms. Ortigas-Wedekind and Mr. Elfrink. Mr. de Urioste will chair the Audit Committee. We believe the Audit Committee will comply with the applicable requirements of the rules and regulations of the Nasdaq listing rules and the SEC.

Compensation Committee

The Compensation Committee will be responsible for:

•reviewing and making recommendations to the Board with respect to the compensation of our officers and directors, including the CEO;

•overseeing and administering the Company’s executive compensation plans, including equity-based awards;

•negotiating and overseeing employment agreements with officers and directors; and

•overseeing how the Company’s compensation policies and practices may affect the Company’s risk management practices and/or risk-taking incentives.

The Compensation Committee will consist of Mr. Ferrari, Mr. Elfrink and Mr. de Urioste. Mr. Ferrari will serve as chairman of the Compensation Committee. The board of directors has affirmatively determined that each member of the Compensation Committee meets the independence criteria applicable to compensation committee members under SEC rules and Nasdaq listing rules.

Nominating and Governance Committee

The Nominating and Corporate Governance Committee, among other things, will be responsible for:

•reviewing and assessing the development of the executive officers and considering and making recommendations to the Board regarding promotion and succession issues;

•evaluating and reporting to the Board on the performance and effectiveness of the directors, committees and the Board as a whole;

•working with the Board to determine the appropriate and desirable mix of characteristics, skills, expertise and experience, including diversity considerations, for the full Board and each committee;

•annually presenting to the Board a list of individuals recommended to be nominated for election to the Board;

•reviewing, evaluating, and recommending changes to the Company’s Corporate Governance Principles and Committee Charters;

•recommending to the Board individuals to be elected to fill vacancies and newly created directorships;

•overseeing the Company’s compliance program, including the Code of Conduct; and

•overseeing and evaluating how the Company’s corporate governance and legal and regulatory compliance policies and practices, including leadership, structure, and succession planning, may affect the Company’s major risk exposures.

The Nominating and Corporate Governance Committee will consist of Ms. Ortigas-Wedekind and Mr. Elfrink. Ms. Ortigas-Wedekind will serve as chairperson. The Company’s board of directors has determined that each member of the Nominating and Corporate Governance Committee is independent within the meaning of the independent director guidelines of Nasdaq listing rules.

Director Nominations

The Nominating and Governance Committee is responsible for identifying and screening potential candidates and recommending qualified candidates to the Board for nomination. The Nominating and Governance Committee seeks to ensure that the Board is composed of members whose particular experience, qualifications, attributes and skills, when taken together, will allow the Board to satisfy its oversight obligations effectively. The Nominating and Governance Committee typically solicits recommendations for nominees from the persons the committee believes are likely to be familiar with (i) the needs of the Company and (ii) qualified candidates. These persons may include members of the Board and management of the Company. The Nominating and Governance Committee may also engage a professional search firm to assist in identifying qualified candidates. In selecting Board candidates, the Nominating and Governance Committee’s goal is to identify persons who it believes have appropriate expertise and experience to contribute to the oversight of a company of the Company’s nature while also reviewing other appropriate factors, including those discussed below under “Qualifications of Director Nominees.”

Qualifications of Director Nominees

The Board and the Nominating and Governance Committee believe that each of the persons nominated for election at the Annual Meeting have the experience, qualifications, attributes and skills that, when taken as a whole, will enable the Board to satisfy its oversight responsibilities effectively. The Board and the Nominating and Governance Committee consider the following for each candidate, among other qualifications deemed appropriate, when evaluating the suitability of candidates for nomination as director: independence; integrity; personal and professional ethics; business judgment; ability and willingness to commit sufficient time to the Board; qualifications, attributes, skills and/or experience relevant to the Company’s business; educational and professional background; personal accomplishment; and national, gender, age, and ethnic diversity.

Shareholder Communications with the Board

Shareholders who wish to communicate with the Board of Directors or with a particular director may do so by sending a letter to the Corporate Secretary, HeartBeam, Inc., 2118 Walsh Avenue, Suite 210, Santa Clara, CA 95050. The Corporate Secretary will review all correspondence and regularly forward to the Board copies of all such correspondence that, in the opinion of the Corporate Secretary, deals with the functions of the Board or committees thereof or that the Corporate Secretary otherwise determines requires attention.

Hedging, Short Sales and Related Policies

Pursuant to the Company’s insider trading policy, all directors, officers and employees of the Company (collectively, “Team Members”), as well as their spouses, minor children, other persons living in their household and entities over which they exercise control, are prohibited from engaging in the following transactions in the Company’s securities unless advance unanimous approval is obtained from members of the compliance committee designated by the Board:

•Hedging. Team Members may not enter into hedging or monetization transactions or similar arrangements with respect to the Company’s securities.

•Short sales. Team Members may not sell the Company’s securities short;

•Options trading. Team Members may not buy or sell puts or calls or other derivative securities on the Company’s securities; and

•Trading on margin. Team Members may not hold the Company’s securities in a margin account or pledge the Company’s securities as collateral for a loan.

AUDIT COMMITTEE REPORT

The Audit Committee oversees the financial reporting process of our company on behalf of our Board. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed the audited financial statements in our Annual Report on Form 10-K for the year ended December 31, 2022 with management, including a discussion of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit Committee has discussed with Marcum LLP (“Marcum”), our independent registered public accounting firm that was responsible for expressing an opinion on the conformity of those audited financial statements with U.S. generally accepted accounting principles, its judgments about our accounting principles and the other matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (PCAOB) and the SEC. The Audit Committee has received from Marcum the written disclosures and the letter required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence, and the Audit Committee has discussed with Marcum their independence. The Audit Committee has considered the effect of non-audit fees on the independence of Marcum and has concluded that such non-audit services are compatible with the independence of Marcum.

The Audit Committee discussed with Marcum the overall scope and plans for its audits. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of its audits and quarterly reviews, its observations regarding our internal controls, and the overall quality of our financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board that our audited financial statements for the year ended December 31, 2021, be included in the Annual Report on Form 10-K for the year ended December 31, 2022 for filing with the SEC.

This report has been furnished by the members of the Audit Committee.

| | |

| Respectively submitted, |

| THE AUDIT COMMITTEE |

| Mr. de Urioste, (Chairman) |

| Ms. Ortigas-Wedekind |

| Mr. Elfrink |

COMPENSATION OVERVIEW

The purpose of this Compensation Overview section is to provide material information about the Company’s compensation philosophy, objectives and other relevant policies and to explain and put into context the material elements of the disclosure that follows in this Proxy Statement with respect to the compensation of our named executive officers (“NEOs”). For the year ended December 31, 2022, our NEOs were:

Branislav Vajdic, PhD, President and Chief Executive Officer

Richard Brounstein, Chief Financial Officer

Determining Executive Compensation

On an ongoing basis, the Compensation Committee reviews the performance and compensation of our President and CEO and the Company’s other executive officers.

Our President and CEO provides input to the Compensation Committee regarding the performance of the other NEOs and offers recommendations regarding their compensation packages in light of such performance. The Compensation Committee is ultimately responsible, however, for determining the compensation of the NEOs, including our President and CEO.

Compensation Philosophy and Objectives

The Compensation Committee and the Board believe that the Company’s executive compensation programs for its executive officers should reflect the Company’s performance and the value created for its shareholders. In addition, we believe our executive

compensation programs should support the goals and values of the Company and should reward individual contributions to the Company’s success. Specifically, the Company’s executive compensation program is intended to, among other things:

•attract and retain the highest caliber executive officers;

•drive achievement of business strategies and goals;

•motivate performance in an entrepreneurial, incentive-driven culture;

•closely align the interests of executive officers with the interests of the Company’s shareholders;

•promote and maintain high ethical standards and business practices; and

•reward results and the creation of shareholder value.

Factors Considered in Determining Compensation; Elements of Compensation

The Compensation Committee makes executive compensation decisions on the basis of total compensation, rather than on individual components of compensation. We attempt to create an integrated total compensation program structured to balance both short and long-term financial and strategic goals. Our compensation should be competitive enough to attract and retain the highest caliber executive officers. In this regard, we utilize a combination of between two to three of the following types of compensation to compensate our executive officers:

•base salary;

•annual cash performance bonuses; and

•long-term equity compensation, consisting of stock options, typically granted with a multiple year vesting schedule to promote long-term retention.

The Compensation Committee's philosophy regarding the mix of the three components of compensation is that equity awards should be emphasized over base salaries. The Compensation Committee believes this approach preserves the Company's cash and strongly aligns executive officer incentives with shareholder interests.

The Compensation Committee periodically reviews each executive officer’s base salary and makes appropriate recommendations to the Board. Base salaries are based on the following factors:

•the Company’s performance for the prior fiscal years and subjective evaluation of each executive’s contribution to that performance;

•the performance of the particular executive in relation to established goals or strategic plans;

•competitive levels of compensation for executive positions based on information drawn from informal internal benchmark analysis of base salaries for executive officers at similarly sized, public medical technology companies and other relevant information; and

•our obligations under the applicable executive officer’s employment agreement or offer letter (if any).

Performance bonuses and equity compensation are awarded based upon the recommendation of the Compensation Committee. These grants are made with a view to linking executives’ compensation to the long-term financial success of the Company and its shareholders.

Other Compensation Policies and Considerations; Tax Issues and Risk Management

As part of its role, the Compensation Committee reviews and considers the deductibility of executive compensation under the Code and historically, the intention of the Committee has been to compensate our NEOs in a manner that maximizes the Company’s ability to deduct compensation for federal income tax purposes (although no assurances have ever been made nor can be made or given with respect to our ability to deduct any compensatory payment to any of our executives).

Section 162(m) of the Code, as in effect for tax years beginning prior to December 31, 2017, provided that we could not deduct compensation of more than $1,000,000 paid in any year to the executives designated as “covered employees” under Section 162(m) of the Code, unless the compensation in excess of $1,000,000 qualified as “performance-based compensation” under Section 162(m) of the Code. Although the Compensation Committee historically considered the implications of Section 162(m) on its ability to deduct compensation, the Compensation Committee has always retained the discretion to award compensation that is not “performance-based compensation” under Section 162(m) of the Code if it determined that providing such compensation was

appropriate with respect to the achievement of our business objectives and in the best interests of the Company and its shareholders. The Tax Cuts and Jobs Act (the “Tax Act”), which was signed into law in December 2017, eliminated the exception for “performance-based compensation” with respect to 2018 and future years. As a result, we expect that, except to the extent that compensation is eligible for limited transition relief applicable to binding contracts in effect on November 2, 2017 and not materially modified thereafter, compensation that is paid or provided to our Section 162(m) “covered employees” that exceeds $1,000,000 per year will be nondeductible under Section 162(m).

The Compensation Committee continues to monitor the impact that the repeal of the “performance-based compensation” exception to Section 162(m) will have on the Company’s compensation plans, awards, and arrangements, including whether and to what extent our existing agreements and programs qualify for the transition relief described above.

Section 409A of the Code imposes an additional 20% federal income tax and penalties upon employees who receive “non-qualified deferred compensation” that does not comply with Section 409A. The Compensation Committee takes into account the impact of Section 409A in designing our executive compensation plans and programs that provide for “non-qualified deferred compensation” and, as a general rule, these plans and programs are designed either to comply with the requirements of Section 409A or to qualify for an applicable exception to Section 409A so as to avoid possible adverse tax consequences that may result from failure to comply with Section 409A. We cannot, however, guarantee that the compensation will comply with the requirements of Section 409A or an applicable exception thereto.

On an annual basis, the Compensation Committee evaluates the Company’s compensation policies and practices for its employees, including the NEOs, to assess whether such policies and practices create risks that are reasonably likely to have a material adverse effect on the Company. Based on its evaluation, the Compensation Committee has determined that the Company’s compensation policies and practices do not create such risks.

Hedging, Short Sales and Related Policies

See “Directors, Executive Officers and Corporate Governance-Hedging, Short Sales and Related Policies” for information regarding the Company’s policies relating to hedging, short sales and related matters.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information concerning all cash and non-cash compensation awarded to, earned by or paid to our NEOs for services rendered in all capacities during the noted periods. The fiscal years ended December 31, 2022 and December 31, 2021 are indicated below by “2022” and “2021,” respectively:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal

Position | | Year | | Salary

($) | | Bonus

($)(1,2) | | Stock

Awards

($)(3) | | Option

Awards

($)(3) | | All Other

Compensation

($) | | Total

($) |

Branislav Vajdic, PhD (2) | | 2022 | | $ | 428,000 | | | $ | 203,642 | | | $ | — | | | $ | 387,720 | | | $ | — | | | $ | 1,019,362 | |

Chief Executive Officer (1) | | 2021 | | $ | 135,166 | | | $ | 350,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | 485,166 | |

Richard Brounstein (2) | | 2022 | | $ | 250,000 | | | $ | 79,300 | | | $ | — | | | $ | 86,400 | | | $ | — | | | $ | 415,700 | |

Chief Financial Officer (1) | | 2021 | | $ | 82,434 | | | $ | 40,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | 122,434 | |

1.In 2021 the Company provided cash bonuses to its Chief Executive Officer and Chief Financial Officer based upon the Company’s achievement of certain financial and strategic objectives. The bonuses were not based on any specific performance criteria.

2.In 2022 the Board of Directors ratified the Compensation Committee approval of cash bonuses to its Chief Executive Officer and Chief Financial Officer based on the Company’s achievements of the performance metrics as defined in the bonus plan. The Bonuses will be paid in the second quarter of 2023.

3.Represents the full grant date fair value of the stock award or option grant, as applicable, calculated in accordance with FASB ASC Topic 718. Our policy and assumptions made in the valuation of share-based payments are contained in Note 6 to our December 31, 2022 financial statements. The value of stock awards presented in the Summary Compensation Table reflects the grant date fair value of the awards and does not correspond to the actual value that will be recognized by the named executive officers.

Employment Agreements

We have entered into employment agreements, each with Branislav Vajdic, the Company’s Chief Executive Officer, Richard Brounstein the Company’s Chief Financial Officer.

Branislav Vajdic Employment Agreement

On September 10, 2021 we entered into an employment agreement with Dr. Vajdic as its Chief Executive Officer and a member of the board of directors (“2021 Vajdic Agreement”), Dr. Vajdic will receive an annual salary of $325,000, commencing on September 15, 2021. During 2022 the Board of Directors approved an amendment to the 2021 Vajdic Agreement, whereby effective January 1, 2022 Dr. Vajdic’s annual salary increased to $428,000 and he was awarded 359,000 stock options. The stock option will vest as to 25% on the 1-year anniversary of the vesting commencement date, and the remainder will vest monthly thereafter on the same day of the month as the vesting commencement date until fully vested. Pursuant to the amended 2021 Vajdic Agreement, Dr. Vajdic will be eligible to receive an annual bonus up to 60% of his annual compensation, subject to adjustment on an annual basis, based on his performance and overall progress of the Company.

Richard Brounstein Employment Agreement

On September 10, 2021 we entered into an employment agreement with Mr. Brounstein as its Chief Financial Officer (“2021 Brounstein Agreement”), Mr. Brounstein will receive an annual salary of $187,000, commencing on September 15, 2021. During 2022 the Board of Directors approved an amendment to the 2021 Brounstein Agreement, whereby effective January 1, 2022 Mr. Brounstein’s annual salary increased to $250,000 and he was awarded 80,000 stock options. The stock option will vest as to 25% on the 1-year anniversary of the vesting commencement date, and the remainder will vest monthly thereafter on the same day of the month as the vesting commencement date until fully vested. Pursuant to the amended 2021 Brounstein Agreement, Mr. Brounstein will be eligible to receive an annual bonus up to 40% of his annual compensation, subject to adjustment on an annual basis, based upon his performance and overall progress of the Company.

2022 Outstanding Equity Awards at Fiscal Year-End

The following table sets forth information concerning outstanding equity awards held by the NEOs at December 31, 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Number of Securities Underlying Unexercised Options Exercisable (#) | | Number of Securities Underlying Unexercised Options Unexercisable (#) | | Option Exercise Price ($) | | Option Expiration Date | | Equity: Unearned Shares, Units or Other Rights That Have Not Vested (#) | | Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) |

| | | | | | | | | | | | |

| Branislav Vajdic | | — | | 359,000 | | $ | 1.3 | | | 06/14/2032 | | — | | $ | — | |

Richard Brounstein(2) | | — | | 80,000 | | $ | 1.3 | | | 06/14/2032 | | — | | $ | — | |

1.Dr. Vajdic was awarded 359,000 options on June 15, 2022, these options are scheduled to vest over 4 years with 25% vesting on January 1, 2023 and the remainder vesting and exercisable monthly thereafter.

2.Mr. Brounstein was awarded 80,000 options on June 15, 2022, these options are scheduled to vest over 4 years with 25% vesting on January 1, 2023 and the remainder vesting and exercisable monthly thereafter.

Options Exercised and Stock Vested

The Following table summarizes, with respect to our named executive officers, all options that were exercised or stock that was vested during fiscal 2022:

| | | | | | | | | | | | | | |

| Name | | Option Awards |

| Number of Shares Acquired on Vesting (#) | | Value Realized on Exercise ($) |

Branislav Vajdic, PhD | | — | | | $ | — | |

Richard Brounstein | | 9,092 | | | $ | 44,369 | |

DIRECTOR COMPENSATION

Directors who are also employees of the Company do not receive any separate compensation in connection with their Board service, and we pay cash fees to our non-employee directors. Prior to 2022, our non-employee directors received a non-qualified initial stock option award upon joining the Board, which vests monthly over a four-year period, beginning on the date of the director’s election to the Board.

Effective January 1, 2022 the Company adopted an Outside Director Compensation Plan covering annual cash and equity compensation covering Board and Board Committee service.

The following table presents the total compensation for each person who served as a non-employee member of our board of directors and received compensation for such service during the fiscal year ended December 31, 2022. Other than as set forth in the table and described more fully below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Fees Earned or Paid in Cash ($)(1) | | Stock Awards ($) (2) | | Option Awards($) | | Non-Equity Incentive Plan Compensation ($) | | All Other Compensation | | Total ($) |

Richard Ferrari | | $ | 135,000 | | | $ | 100,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | 235,000 | |

| George de Urioste | | $ | 85,000 | | | $ | 75,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | 160,000 | |

| Marga Ortigas-Wedekind | | $ | 65,000 | | | $ | 75,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | 140,000 | |

Willem Elfrink | | $ | 60,000 | | | $ | 75,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | 135,000 | |

1.Represents director fees paid to each of Messrs Ferrari, de Urioste, Elfrink and Mmes Ortigas-Wedekind.

2.The annual RSU grants to Messrs Ferrari, de Urioste, Elfrink and Mmes Ortigas-Wedekind occur at each Annual Shareholder Meeting, vesting in full at the following annual meeting. The dollars convert to shares based on the FMV at the date of grant.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the Company’s Common Stock, beneficially owned as of May 10, 2023 by:

•each person known to the Company to beneficially own more than 5% of its Common Stock,

•each named executive officer, director and director nominee

•all executive officers and directors as a group.

The Company calculated beneficial ownership according to Rule 13d-3 of the Securities Exchange Act of 1934, as amended as of that date. Shares of the Company’s Common Stock issuable upon exercise of options or warrants or conversion of notes that are exercisable or convertible within 60 days after May 10, 2023 are included as beneficially owned by the holder, but not deemed outstanding for computing the percentage of any other shareholder for Percentage of Common Stock Beneficially Owned. For each individual and group included in the table below, percentage ownership is calculated by dividing the number of shares beneficially owned by such person or group by the sum of the 25,901,240 shares of Common Stock outstanding at May 10, 2023, plus the number of shares of Common Stock that such person or group had the right to acquire on or within 60 days after May 10, 2023. Beneficial ownership generally includes voting and dispositive power with respect to securities. Unless otherwise indicated below, the persons and entities named in the table have sole voting and sole dispositive power with respect to all shares beneficially owned. Unless otherwise indicated, the address of each of the beneficial owners listed below is c/o HeartBeam, Inc., Chief Financial Officer, 2118 Walsh Avenue, Suite 210, Santa Clara, CA 95050.

| | | | | | | | | | | | | | |

| Name | | Shares Beneficially Owned | | Percentage of Shares

% |

Richard Ferrari(1) | | 184,667 | | 0.71 | % |

Branislav Vajdic. PhD(2) | | 1,081,015 | | 4.15 | % |

George A. de Urioste(3) | | 20,172 | | * |

Marga Ortigas-Wedekind(4) | | 58,663 | | * |

Willem Pieter Elfrink(5) | | 395,239 | | 1.52 | % |

Richard Brounstein(6) | | 157,108 | | * |

Kenneth Persen, (7) | | — | | — | % |

Robert Eno, (8) | | 37,093 | | * |

All directors and executive officers as a group (8 persons) | | 1,933,957 | | 7.32 | % |

| | | | |

Mark E. Strome (9) | | 3,150,000 | | 12.16 | % |

Andrew Schwartzberg | | 1,833,343 | | 7.08 | % |

____________

*Less than 1 percent ownership

(1)Includes (i) 65,653 shares acquired from the conversion of 2015 Convertible Notes and (ii) 119,014 options exercisable within 60 days after May 10, 2023. Does not include 82,500 unvested stock options and 73,529 unvested RSUs.

(2)Includes (i) 794,545 shares acquired as founders equity, (ii) 115,559 shares acquired from the conversion of 2015 Convertible Notes, (iii) 1,287 shares acquired from the exercise warrants, (iv) 134,624 options exercisable within 60 days after May 10, 2023, and (v) 35,000 BEATW exercisable warrants. Does not include 209,418 unvested stock options.

(3)Includes 20,172 options exercisable within 60 days after May 10, 2023. Does not include 21,994 unvested stock options and 55,147 unvested RSUs.

(4)Includes (i) 9,000 units of shares and warrants purchased November 11, 2021, (ii) 9,000 BEATW exercisable warrants, (iii) 7,824 shares acquired from the conversion of 2015 Convertible Notes, and (iii) 32,839 options exercisable within 60 days after May 10, 2023. Does not include 8,978 unvested stock options and 55,147 unvested RSUs.

(5)Includes (i) 101,818 shares acquired under the 2015 Incentive Plan (ii) 207,056 shares acquired from the conversion of 2015 Convertible Notes, (iii) 3,640 shares acquired from the exercise warrants, (iv) 22,725 options exercisable within 60 days after May 10, 2023 and (v) 60,000 BEATW exercisable warrants. Does not include 19,093 unvested stock options and 55,147 unvested RSUs.

(6)Includes (i) 72,725 shares acquired under the 2015 Incentive Plan, (ii) 5,000 shares and 5,000 BEATW warrants purchased November 11, 2021, (iii) 5,000 shares and 10,000 BEATW warrants acquired on the open market, (iv) 29,197 shares acquired from the conversion of 2015 Convertible Notes, (v) 30,002 options exercisable within 60 days after May 10, 2023, and (vi) 184 shares acquired from the exercise warrants. Does not include 46,664 unvested stock options

(7)Does not include 140,000 unvested stock options.

(8)Includes 37,093 options exercisable within 60 days after May 10, 2023. Does not include 246,378 unvested stock options

(9)The shares shown as beneficially owned by Mr. Strome include 2,900,000 shares of common stock held by Strome Mezzanine Fund II, LP, 100,000 share held by Mark E. Strome Living Trust and 150,000 share held by Strome Dynasty, LLC, all of which Mr. Strome is the beneficial owner and has the power to dispose and vote the shares beneficially owned.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company has established policies and other procedures regarding approval of transactions between the Company and any employee, officer, director, and certain of their family members and other related persons. These policies and procedures are generally not in writing but are evidenced by long standing principles adhered to by our Board. The disinterested members of the Board review, approve and ratify transactions that involve “related persons” and potential conflicts of interest. Related persons must disclose to the disinterested members of the Board any potential related person transactions and must disclose all material facts with respect to such transaction. All such transactions will be reviewed by the disinterested members of the Board and, in their discretion, approved or ratified. In determining whether to approve or ratify a related person transaction the disinterested members of the Board will consider the relevant facts and circumstances of the transaction, which may include factors such as the relationship of the related person with the Company, the materiality or significance of the transaction to the Company and the related person, the business

purpose and reasonableness of the transaction, whether the transaction is comparable to a transaction that could be available to the Company on an arms-length basis, and the impact of the transaction on the Company’s business and operations.

Since the beginning of fiscal year 2023, the Company did not have any transactions to which it has been a participant that involved amounts that exceeded or will exceed the lesser of (i) $120,000 or (ii) one percent of the average of the Company’s total assets at year-end for the last two completed fiscal years, and in which any of the Company’s directors, executive officers or any other “related person” as defined in Item 404(a) of Regulation S-K had or will have a direct or indirect material interest.

ANNUAL REPORT

A copy of our Annual Report is being furnished to Shareholders concurrently herewith. An additional copy of our Annual Report may be obtained from www.https://heartbeam.com, or will be furnished, without charge, to beneficial shareholders or shareholders of record as of the record date upon request in writing to HeartBeam, Inc., 2118 Walsh Avenue, Suite 210, Santa Clara, CA 95050 or by telephone to (408) 899-4443.

PROPOSAL NO. 2

TO RATIFY THE APPOINTMENT OF MARCUM LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR 2023

Based on its evaluation and the Audit Committee's determination that Marcum LLP is independent, our Audit Committee has retained the firm of Marcum LLP as our independent registered public accounting firm for fiscal year 2023, and we are asking shareholders to ratify that appointment. In the event the shareholders fail to ratify the appointment, the Audit Committee will reconsider this appointment but will not necessarily select another firm. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and our shareholders. Representatives of Marcum LLP will be present at the 2023 Annual Shareholders' Meeting and will have the opportunity to make a statement and be available to answer questions.

Fees to Independent Registered Public Accounting Firm.

The merger of Marcum and Friedman LLP (“Friedman”) was effective as September 1, 2022. The following table sets forth the fees that the Company was billed by Friedman and Marcum in 2022 and by Friedman in 2021, our independent registered public accountants for fiscal years 2022 and 2021:

| | | | | | | | | | | | | | |

| | 2022 | | 2021 |

Audit Fees (1) | | $ | 126,100 | | | $ | 137,100 | |

Audit Related Fees (2) | | $ | 12,700 | | | $ | 90,500 | |

| Tax Fees | | $ | — | | | $ | — | |

| Total | | $ | 138,800 | | | $ | 227,600 | |

1.Audit fees relate to professional services rendered in connection with the audit of the Company's annual financial statements, quarterly review of financial statements and audit services provided in connection with other statutory and regulatory filings.

2.Fees related to services provided for the S-1 registration statement during the fourth quarter of 2022 and initial public offering in November 2021.

Policy on Audit Committee Pre-Approval of Fees

The Audit Committee must pre-approve all services to be performed for us by our independent registered public accounting firm. Pre-approval is granted usually at regularly scheduled meetings of the Audit Committee. If unanticipated items arise between regularly scheduled meetings of the Audit Committee, the Audit Committee has delegated authority to the chairman of the Audit Committee to pre-approve services, in which case the chairman communicates such pre-approval to the full Audit Committee at its next meeting. The Audit Committee also may approve the additional unanticipated services by either convening a special meeting or acting by unanimous written consent. During the years ended December 31, 2022 and 2021, prior to the establishment of committees, all services billed by Friedman LLP were pre-approved by the Board of Directors.

Attendance at Annual Meeting

Representatives of Marcum LLP are expected to attend the Annual Meeting virtually. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Vote Required

The proposal will be approved if a majority of the votes cast are voted in favor of the proposal. Abstentions and broker non-votes will not be treated as votes cast for or against the proposal, and therefore will have no effect on the outcome of the proposal.

Board Recommendation

The Board recommends that shareholders vote FOR the ratification of the appointment of Marcum LLP as our independent registered public accounting firm for 2023.

PROPOSAL NO. 3

APPROVAL OF THE AMENDMENT TO THE 2022 EQUITY INCENTIVE PLAN

Our board of directors is recommending that our shareholders approve an amendment to our 2022 Equity Incentive Plan (“2022 Equity Plan”) to increase the number of shares of our common stock that are available for issuance under the 2022 Equity Plan by 4,000,000 shares. If the amendment is approved by shareholders, the maximum number of shares available for issuance under the 2022 Equity Plan would increase from 1,900,000 to 5,900,000 (which includes up to 946,259 shares previously reserved for issuance under our Equity Plan that may become available under the Equity Plan). Our board of directors approved the amendment on April 10, 2023 (the “Amendment”), subject to shareholder approval. Other than the increase in shares, the Amendment effects no other material changes to the 2022 Equity Plan.

As of May 10, 2023, the record date for our Annual Meeting of Shareholders, there were awards with respect to 246,470 shares of restricted stock and restricted stock units outstanding under the 2022 Equity Plan, assuming at-target achievement of outstanding performance-based awards and 2,394,640 options to purchase shares of our common stock were outstanding under the 2022 Equity Plan. As of May 10, 2023 the number of shares available for grant under the 2022 Equity Plan was 946,259 shares.

Our board of directors believes the proposed Amendment is necessary to the long-term health of our company in order to support the effectiveness of our compensation, including executive and director compensation programs. We provide long-term incentives to our executives, employees, advisors and directors in the form of equity compensation, which we believe aligns their interests with the interests of our shareholders and fosters an ownership mentality that drives optimal decision-making for the long-term health and profitability of our company. Equally important, equity compensation is critical to our continuing ability to attract, retain and motivate qualified service providers.

Having an adequate number of shares available for future grants is necessary to promote our long-term success and the creation of shareholder value by:

| | | | | |

| |

• | Enabling us to continue to attract and retain the services of key employees and other service providers who would be eligible to receive grants; |

• | Aligning participants' interests with shareholders' interests through incentives that are based upon the performance of our common stock; |

• | Motivating participants, through equity incentive awards, to achieve long-term growth in the company's business, in addition to short-term financial performance; and |

• | Providing a long-term equity incentive program that is competitive as compared to other companies with who we compete for talent. |

The proposed Amendment to increase the number of shares available for issuance under the 2022 Equity Plan by 4,000,000 shares is intended to provide us with a sufficient number of shares to satisfy our expected equity grant requirements, based on the anticipated structure and timing of annual grants of our equity incentive program. We intend following the Annual Meeting of Shareholders, to resume granting stock options to certain of our employees, including our executive officers, in addition to or in lieu of full value awards, as our compensation committee believes that stock options offer the best performance-based incentive at this time and stage of the company’s life. As we transition from full value awards to stock options, we anticipate that our share usage will increase in order to allow us to provide market competitive long-term incentive compensation. Currently, the shares available for issuance and number of awards outstanding as a percentage of the Company’s common stock outstanding as of May 10, 2023 is 4%. If this proposal is approved by our shareholders, the potential additional dilution to shareholders would increase by 15% to 19%.

The Amendment to the 2022 Equity Plan, as proposed, is attached as Appendix A to this proxy statement. Shareholders are urged to review it together with the following information, which is qualified in its entirety by reference to the complete text of the

2022 Equity Plan. If there is any inconsistency between the description of the 2022 Equity Plan included in this proxy statement and the terms of the 2022 Equity Plan, the terms of the 2022 Equity Plan shall govern.

Key Plan Provisions

1. The 2022 Equity Plan will continue until terminated by the Board or the Board’s compensation committee, but (i) no incentive stock options may be granted after ten (10) years from the Board approval of the 2022 Equity Plan and (ii) the 2022 Equity Plan’s automatic share reserve increase (as described below) will operate only until the tenth (10th) anniversary of the Board approval of the 2022 Equity Plan;

2. The 2022 Equity Plan provides for the grant of stock options, both incentive stock options and nonqualified stock options, stock appreciation rights, restricted stock, restricted stock units, and performance awards;

3. 5.9 million shares of Common Stock will be authorized for issuance pursuant to awards under the 2022 Equity Plan, plus up to 1,178,194 shares of Common Stock that may become available for issuance as a result of recycling of awards under the 2015 Plan, as described below;

4. The 2022 Equity Plan provides for an automatic share reserve increase feature, whereby the share reserve will automatically be increased on the first day of each fiscal year beginning with the 2023 fiscal year, in an amount equal to the least of (i) 3,800,000 shares, (ii) 5% of the total number of shares of all classes of Common Stock outstanding on the last day of the immediately preceding fiscal year, and (iii) a lesser number of shares as determined by the administrator.

5. The 2022 Equity Plan will be administered by the Board or, if designated by the Board, the Board’s compensation committee.

Summary of the 2022 Equity Plan

The following paragraphs provide a summary of the principal features of the 2022 Equity Plan and its operation. However, this summary is not a complete description of all of the provisions of the 2022 Equity Plan and is qualified in its entirety by the specific language of the 2022 Equity Plan. A copy of the Amendment to the 2022 Equity Plan is attached to this proxy statement as Appendix A.

Purposes of the 2022 Equity Plan

The purposes of the 2022 Equity Plan are to attract and retain personnel for positions with HeartBeam, any parent or subsidiary, and any entity that is in control of, is controlled by or is under common control with HeartBeam (such entities are referred to herein as, the company group); to provide additional incentive to employees, directors, and consultants; and to promote the success of our business. These incentives will be provided through the grant 2022 Equity Plan may determine.

Eligibility

The 2022 Equity Plan provides for the grant of incentive stock options, within the meaning of Section 422 of the Code, to HeartBeam’s employees and any parent and subsidiary corporations’ employees, and for the grant of nonstatutory stock options, restricted stock, restricted stock units, stock appreciation rights, performance units and performance shares to employees, directors and consultants of HeartBeam and the company group. As of May 10, 2023 HeartBeam had four non-employee directors and approximately ten employees (including our employee directors).

Authorized Shares